Investors taking stock as fortunes start to improve

Market rally unleashes bullish optimism as further gains expected, Xie Yu reports in Shanghai.

A recent rally in the Chinese stock market has fueled passions across the board, from individual investors to large institutions.

On Feb 6, days before the start of the Chinese New Year holiday, the normally bustling streets of Shanghai, China's financial center, appeared deserted.

However, the empty streets were in sharp contrast to the hive of activity at a small trading station in the offices of Guotai Junan Securities Co in the central district of Huangpu. Young and old, male and female, stared intently at the screens, their heart rates rising and falling along with the fluctuating red and green figures on display.

On Feb 1, the benchmark Shanghai Composite Index exceeded 2,400 points for the first time in nine months, after rising for five consecutive days.

The index has risen by about 23 percent from early December, when it hit a four-year intraday low of 1,949 points. In January, it rose by an average 4.76 percent on signs that economic growth is accelerating.

"You just can't miss this opportunity. It (the index) has rallied for more than a month. That's rarely happened before," said 57-year-old Zhu Liyong.

As an unofficial guru in the trading station, Zhu, who has plenty of followers and people asking for instruction and advice, said that in the course of his 15 years' trading experience, he has made enough money to buy "several apartments".

But times have often been frustrating, too. Zhu said he'd suffered losses during the past three years as the bear market lingered. Several blue chip stocks he held declined sharply and his investments shrank sevenfold or even more.

Zhu wasn't alone. The bear run hit many investors hard and China Securities Journal estimated that each investor lost an average 76,800 yuan ($12,325) in 2012.

"I always quarreled with my wife. She tends to be cautious and was always pushing me to offload the shares, even though prices were low. But I insisted that the market would rebound," said retired accountant Zhu.

Unlike Zhu, self-employed shop owner Lin Hong, 29, is new to the investment game. "My friends told me the bull market is here, so I want to get in early and make some money," he said, adding that he was concerned about inflation eroding his savings.

Lin's stock market "tutor" is his friend Chen Jiong, now in his early 50s. "I used to work for a former State-run enterprise, but the pay was bad and I had to find some way to support my wife and kid," said Chen, who lost his job during a period of restructuring in the 1990s.

Modern equity investment in China began in 1990, when the Shanghai exchange, originally founded in 1891, was re-established after decades in abeyance. Two years later, a second exchange opened in Shenzhen, Guangdong province, the site of China's first Special Economic Zone, initiated by former leader Deng Xiaoping during the period of reform and opening-up.

In the 1990s, millions of workers were laid off by enterprises that had formerly been run by the State. In response, many, like Chen, gravitated to the stock market as they looked for new ways to earn money.

"As long as you had the time, followed the market closely and remained sensible rather than greedy, it was not hard to make money," said Chen, whose investments not only supported his daughter through college, but won him an army of fans who trusted his judgment and allowed him to run their portfolios.

An investment frenzy in 2006 saw the market gain by 130 percent and by the middle of the following year, market turnover exceeded that those of the UK and Japanese markets combined.

However, the concerns expressed by many investors about overheating turned out to be anything but hot air. During the last three years, the bear run became protracted and China's stock market has constantly been in the dumps. As usual in these circumstances, small investors paid the highest price in losses.

"I couldn't believe that several blue chips I held also performed pathetically. I have lost at least 300,000 yuan since 2008. As far as I know, only a small number of people have made money in the last two or three years," said Chen.

The bleak outlook almost forced him to stop investing in late 2010 and he stopped following the market. "It hurt me when I looked at the money shrinking every day. I just assumed it was all gone," he said.

But since the January rally in Shanghai, many observers, from small-time investors to analysts and economists, have come to the conclusion that the market has simply rebounded after hitting rock bottom. That perception has restored Chen's confidence: "At least it looks as though I can minimize my losses."

And it's not just small investors looking to catch the moneymaking tide. Reports from Hong Kong in November suggested that qualified foreign institutional investors were quietly rebuilding their mainland stock portfolios. However, the news stories barely caused a ripple until analysts, investment gurus and market commentators began latching onto them as a signal of the turning point they'd been hoping for.

The bullish sentiment that dispelled the dark clouds overhanging the moribund stock market has been boosted by a flurry of encouraging macroeconomic data that have assuaged fears of a possible hard landing for the economy.

For example, the preliminary HSBC China manufacturing purchasing managers index or PMI, an important gauge of manufacturing activity, hit a 24-month high in January, rising to 51.9 from the December reading of 51.5. A figure above the midpoint 50 level indicates expansion.

- Investors taking stock as fortunes start to improve

- Geely posts sales and stock surge

- Chinese stocks close higher on Friday

- Govt policies support biopharmaceutical stocks

- Favorable policies support biopharmaceutical stocks

- Chinese stocks close lower on Thursday

- The rich tend to invest in housing, stocks

- Top political advisor stresses opposition to 'Taiwan independence'

- Chongqing builds China's largest instant coffee factory

- Twins go viral online as straight 'A' students

- Snow village, a farm turns fairy tale world in Heilongjiang

- China to introduce national smoking ban in public places

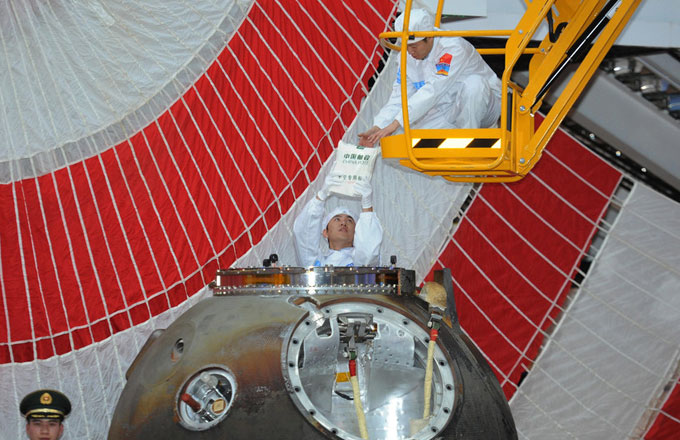

![An investor at a securities company in Shanghai during the stock market rebound. Shanghai's benchmark index has risen by 23 percent since early December when it hit a four-year low of 1,949. [AP PHOTO] Investors taking stock as fortunes start to improve](../../attachement/jpg/site1/20130218/00221917dead128bc39519.jpg)