Lack of investment channels means fewer choices for seeking wealth, reports Jiang Xueqing in Beijing.

Having closely monitored the performance of a financial management company for more than four years, Hou Yanjie finally decided to buy a trust product recommended by an account manager she's familiar with. The product requires investment of at least 1 million yuan ($163,000), and the expected annual rate of return is around 9.5 percent.

|

|

|

Wang Xiaoying/China Daily |

The 30-year-old Beijing-based newspaper editor also invested in a number of funds and bought paper gold - certificates that equate to the physical metal - and paper silver. She sold the paper silver in early April but is holding on to the paper gold, which is worth about 30,000 yuan. The price of physical gold slid from $1,561 to $1,482 an ounce on April 12 and $1,348 on April 15, and whether it will rise or fall over the long term remains a mystery to her.

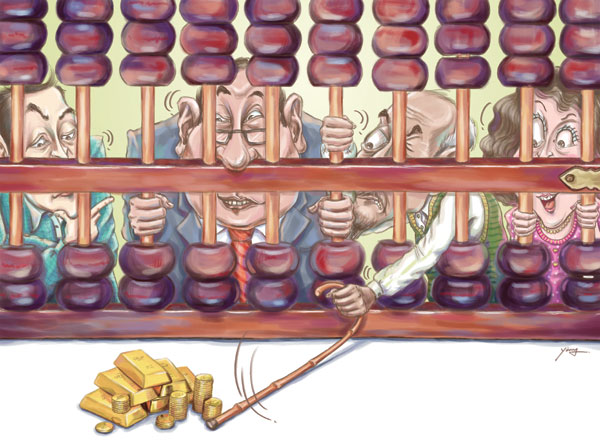

"Regular people cannot play the real estate market because the investment threshold is too high. Besides, it's too late to enter that market because prices have skyrocketed in recent years. Now, with the slump in the price of gold, it can only be used as a hedge against inflation rather than an investment. Plus, the stock market is rather depressed. We don't have any channels to make a promising investment with a good return," she said.

The lack of investment channels for Chinese investors became especially evident as the price of gold fell in April. Working class investors, most of whom are middle-aged housewives, rushed to buy gold as though it were cheap cabbage.

During the week of April 15 to 21, sales at Caishikou Department Store, Beijing's largest gold jewelry retailer, reached at least 100 million yuan a day, and its sales of gold investment products more than doubled compared with the same week a year before.

Zhang Wen, a 36-year-old financial advisor in Beijing, said she was lucky to have bought gold bars when the price of bullion dipped to 267 yuan per gram, the preferred unit of measurement for Chinese gold merchants. For every 10 people who inquired about gold as an investment before the price declined, three or four actually made a purchase. The number rose to six or seven once the price began to slide, said Xie Qingpeng, an analyst of gold market and investment at Guotai Junan Securities Co Ltd.

He attributed the growth of gold investors to the gloomy stock market and the scarcity of other investment channels.

"The financial products provided by banks do not offer high yields. Many of them are actually nonperforming assets that have been stripped off from banks and sold to investors. People rarely find sound investment options that can make a good profit. In this case, Chinese investors became very enthusiastic about gold. Compared with paper currency, gold is a tangible asset that will retain its value," he said.

However, he warned investors to be prepared to hold their gold for the long term because the price is likely to decline slowly, amid a widespread weakness in precious metals, and it will take time to rebound.

The decline in the price of gold came about mainly because of market speculation that the US Federal Reserve is considering major changes to its quantitative easing program. So far, there has been no clear sign that the price will rise to precollapse levels, which means it's not safe for individual investors to enter the market at this time, according to Zhou Wenhuan, a futures analyst at Beijing CIFCO Futures Co Ltd.

With a decline in gold and a depressed stock market, investors with a low appetite for risk are turning to more secure and stable forms of investment.

A typical family can save 20 percent of its disposable income in the bank, invest 50 percent in financial products and bonds, and allocate the rest to other investment options, said Guo Tianyong, director of the research center of the Chinese banking industry at the Central University of Finance and Economics.

Related:

Profit and loss

Chinese investors look overseas

|

|

|

|

|

|

|

|