Looking at the big picture through mini-QFII

It has been reported that the China Securities Regulatory Commission will be launching a mini qualified foreign institutional investor (QFII) program this year. The plan will allow Chinese brokers and funds to invest yuan directly in mainland stocks and bonds on behalf of foreign investors.

The initiative will allow overseas institutional investors to facilitate investments of offshore yuan deposits back into Chinese capital markets. This is different from the original QFII, which allows those same investors to convert foreign currencies into yuan to invest in China.

The launch of the mini-QFII program, in the short term, will not bring a greater revenue stream into the Chinese stock market. The program will help China as it tries to internationalize the yuan and launch an international stock exchange.

Indeed, while investment choices are still scarce, the sweep of yuan-denominated investments on offer already ranges from bonds and funds to certificates of deposit, currency swaps and insurance products.

Therefore, the launch of the mini-QFII program will help China's attempts to internationalize the yuan. We know that overseas investors have to hold enough yuan to invest in China's A-share market. So far, the amount of offshore yuan deposits has increased rapidly, with more yuan being used to settle transactions in transnational trades and in exchanges with other currencies. But there are not enough incentives for overseas investors to hold yuan and yuan-denominated assets because of a shortage in yuan-investment choices and China's capital control policies. The lack of incentives has become a major obstacle for the yuan's internationalization.

The mini-QFII will allow China to again supervise the yuan, which could then make it easier for the yuan to be used as a settlement currency.

It will also boost the chances for the yuan to become the currency of choice in dealing with settlements with other countries and regions. The yuan could become the unit of account, medium of exchange and storage of value beyond the issuing country's borders.

Second, the launch of the mini-QFII over the medium- and long-term will be beneficial to the growth of China's A-share market.

Some analysts believe that, at present, individual investors have dominated the mainland market and that has led to irrational market fluctuations. The gradual expansion of the mini-QFII program will to some extent stabilize or reduce abnormal fluctuations in the stock market, allowing the A-share market to keep up with international standards. But in the short term, the mini-QFII has not brought a great deal of funding for Chinese financial institutions with only small increases in stock prices. Over the long term, however, the launch of the mini-QFII will play a positive role in China's efforts to create an international board and the program will lift stock prices and balance prices in both the A-share market and the H-share market.

The launch of the mini-QFII at least provides a new investment channel and a positive influence on investors. Its launch will have a more significant impact on Chinese brokerage firms in Hong Kong, which will have more business opportunities. Since the mini-QFII will provide another channel for foreign capital, Chinese brokerage firms in Hong Kong can issue yuan-denominated investments products to attract customers in Hong Kong. That money will be invested back into the domestic market, which will boost funds in the A-share market.

The author is an opinion editor with Securities Daily.

Today's Top News

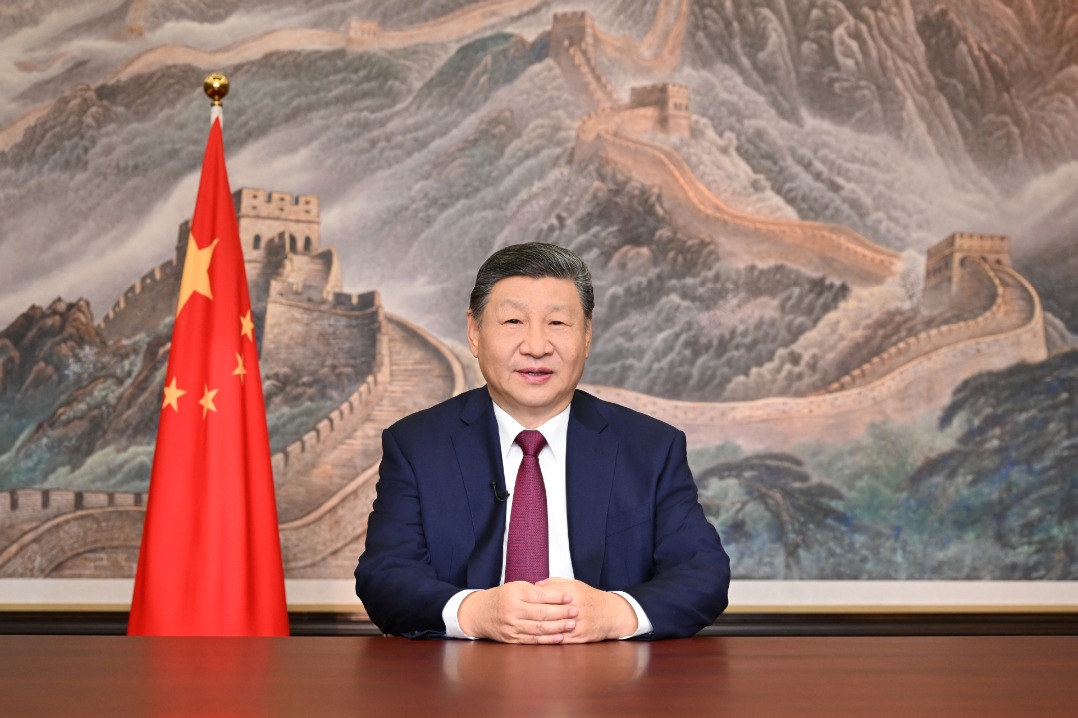

- New Year's address inspiring for all

- Xi congratulates Science and Technology Daily on its 40th anniversary

- Xi congratulates Guy Parmelin on assuming Swiss presidency

- China Daily launches 'China Bound'

- Manufacturing rebounds in December

- PLA wraps up military drills around Taiwan