The China Opening

|

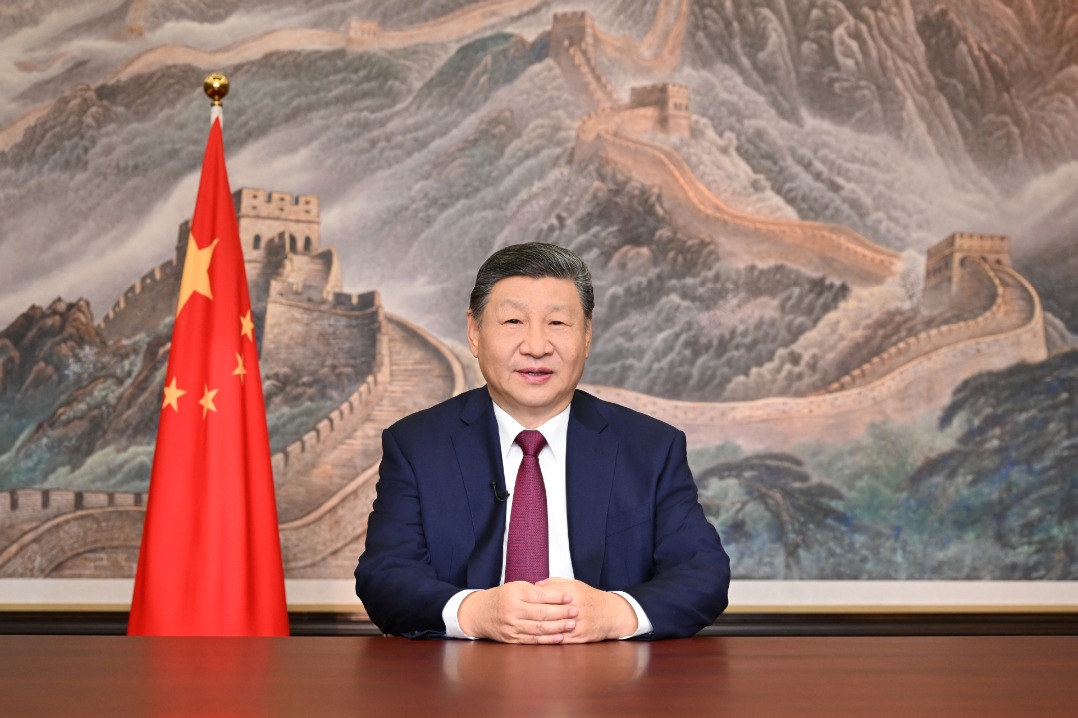

Left: David Chang, regional head for the Greater China region for Franklin Templeton Investments, says the QFII quota is relatively insufficient for foreign investors. Right: Aaron Boesky, chief executive officer of Marco Polo Pure Asset Management, believes China's stock markets could be open to foreign investors in just over three years. [Photos by Edmond Tang / China Daily]

|

He set up his Cayman Islands-registered hedge fund company with Chris Tang, a former PriceWaterhouseCoopers audit manager, to invest in China equities through the QFII scheme. Its China fund has produced annual returns of 30 percent and has $125 million (85 million euros) of assets under management.

|

|

Boesky believes between $500 million and $1 trillion would flood into the China markets in the two years after the withdrawal of the QFII, creating a bull market in which the Shanghai Composite Index would rise from its current level of about 2,700 to more than 10,000. This would shatter its previous peak of 6,124 in October 2007.

"This would not be out of place by Shanghai standards since we have seen four bull markets in the last 20 years each of which has averaged over 500 percent."

Such dramatic inflows are something the Chinese authorities are likely to be keen to avoid.

Since QFII was launched they have adopted a gradualist approach granting 109 licenses to foreign companies to buy shares in the China stock markets.

The total value of these quotas is around $20 billion, which still represents a tiny fraction of around 0.5 percent of the $4.5 trillion value of A-shares on the China bourses.

The capital market regulator, China Securities Regulatory Commission (CSRC) controls the scheme and also issues the QFII licenses.

The actual quotas involve a foreign exchange transaction and are controlled by the State Administration of Foreign Exchange (SAFE), which makes available the yuan, the local currency.

David Chang, regional head for the Greater China region for Franklin Templeton Investments, which received its QFII allocation in 2004, did not want to speculate about any gold rush that might follow after the current quota barriers are removed.

"That is a hypothetical question. It is not going to happen tomorrow, that is for sure," he says from his office in Chater House on Connaught Road.

"I think, however, there is a lot of enthusiasm from foreign investors wanting to get in to the market."

Franklin Templeton's QFII quota of $200 million is only a fraction of the $15 billion it has invested in China stocks. Its main access to China is still investing in those companies that have a Hong Kong listing.

Chang admits there is a sense of frustration among foreign financial institutions that the pace of opening up the markets is slow.

"I think the consensus from foreign investors is that the QFII quota is relatively insufficient at the moment. From our point of view we are hoping they will open the quota a bit more and a bit faster," he says.

David Weipers, head of China operations for Martin Currie Investment Management, based in Edinburgh, which was one of the first foreign companies to get a QFII license, cannot envisage any sudden opening up.

"It will remain very gradual and very controlled. I don't think anything big is going to happen in the short term, " he says.