More financial tightening

The latest interest rate hike that China's central bank announced on Wednesday should come as no surprise as the country's consumer inflation is widely expected to have accelerated significantly in June.

Though tentative signs of a slowdown have recently given rise to fears that more monetary tightening could hurt growth too much, Chinese policymakers still cannot afford a pause in their struggle to curb inflation which is proving more stubborn than predicted.

On Thursday, the People's Bank of China raised its benchmark deposit and lending rates by 25 basis points. Given that it is likely that inflation will exceed 6 percent in June, the latest move can hardly be deemed as a pre-emptive strike before another big jump in inflation is reported next week.

Instead, the third rate hike this year is a planned step to rein in rising consumer prices with gradual monetary tightening.

Citing surveys of China's manufacturing and services sectors which point to a clear slowdown in activity, some people have suggested that the Chinese government should become more cautious about further rate hikes to avoid a hard landing.

Such concerns over growth momentum are understandable, as a Chinese hard landing will not only worsen domestic economic problems but also derail the global recovery.

Yet, in absence of clear evidence that Beijing can declare victory in its battle against inflation, it is far too early to bring the ongoing cycle of rate rises to an end.

Analysts had long forecast that the country's inflation would probably pick up in June and remain high in July. But such expectations have failed to take into consideration short-term shocks like the surge in pork prices or the looming trend of double-digit wage increases that will feed into strong domestic demand in the long run.

Another reason some people have used to justify a little liquidity relief is that higher benchmark interest rates make it more difficult for local governments to repay the mountain of debt that they racked up to support economic growth in the wake of the 2008 global financial crisis.

The central government should certainly pay close attention to the provincial debt problem and explore ways to clean up local government finances. But by no means should local governments be allowed to inflate their way out of the debt problem. The overall impact that runaway inflation imposes on the national economy far outweighs the extra price local governments have to pay for tighter monetary policy.

With inflation hovering above the full-year target of about 4 percent, Chinese policymakers have no reason to slow their efforts to tame price pressures.

If half-year economic data to be released next week shows that the world's second-biggest economy is resilient enough to endure tighter monetary policy, Chinese policymakers should try harder to alleviate the worsening negative real interest rate for depositors.

Today's Top News

- China expresses worry over Japan's military and security moves

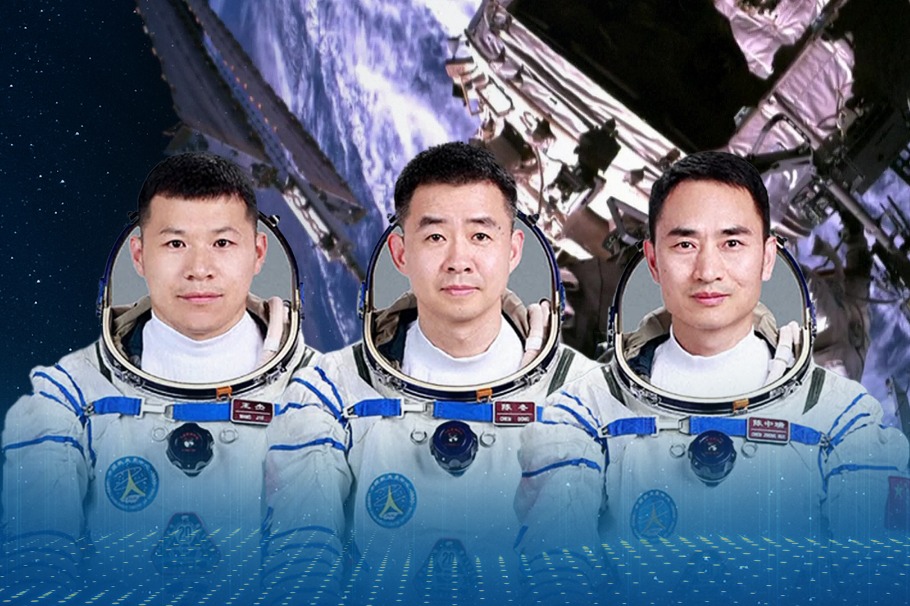

- Shenzhou XX mission crew returns after debris delays landing

- China warns Japan of 'heavy price' for any military interference in Taiwan

- Japan will only suffer a crushing defeat should it dare to take a risk: Defense spokesperson

- Tokyo must stop playing with fire: Editorial flash

- China's Shenzhou XX crew en route back to Earth