Finding the economic sweet spot

Could you reverse the flow of the Mississippi River? Probably not - it's just too powerful. The Chinese government has decided that this tactic works when applied to economics, however, which is why China's high inflation isn't going away any time soon.

While the People's Bank of China, the central bank, has a variety of weapons in its arsenal, the tool which has been used the most aggressively to combat inflation has been the reserve requirement ratio. This ratio, which represents the percentage of available funds that must be kept on reserve at the central bank for loans, can be increased to a level that would prevent banks from lending.

The central bank has increased the reserve requirement ratio nine times since October 2010, when China's consumer price index, a main gauge of inflation, rose above 4 percent for the first time in two years, sterilizing 3.5 trillion yuan (380 billion euros) of funds. There are some that would hail this as a success, as the supply of funds was reduced and the growth in M2, the broad indicator for money supply, fell below the government's target of 16 percent.

There are a few problems with this view, however.

First, the central bank changed the accounting for loans and deposits, excluding entrusted business, which reduced the money supply by somewhere between 500 billion yuan and 1.2 trillion yuan, depending on how it's calculated. If added back into the money supply, M2 would be growing at between 16.6 percent and 17.6 percent. The central bank saying it has met its target for money supply is a bit like saying your diet is successful when you exclude dessert from your daily calorie count.

Second, and more importantly, the central bank's monetary policy actions have not actually addressed the cause of China's inflation. Economists generally cite excess liquidity that resulted from the 4 trillion yuan stimulus plan and the large amount of credit extended in 2009 as the root of inflation, as these funds, speculatively invested, contributed to an increase in both food and property rental prices, the two largest components of consumer price index. China's money supply is now 78 trillion yuan, 30 percent larger than that of the United States.

Increases to the reserve requirement ratio have not removed any existing liquidity, but have only frozen new liquidity that has been added to the system. Since just before the second US stimulus measure and when expectations of an interest rate increase in China were rising, foreign currency inflows into China increased materially. The central bank purchases these funds from the banking system on a monthly basis, printing local currency, or renminbi, with which to buy it. From October through June, the central bank printed 3.3 trillion yuan to buy foreign currency from the financial system, almost matching the amount of funds removed by the reserve requirement ratio.

If the government has not actually addressed what is said to be the cause of inflation, then how is consumer price index, which reached 6.4 percent in June, supposed to come down from its elevated level? In reality, officials think and hope that the numbers are in their favor. The largest contributor to inflation has been food prices, which increased by 14.4 percent in June from a year ago. Inflation spiked in November and December. If the growth of food prices begins to slow, the growth will appear much slower at the same time this year.

What we have is a central bank that is not addressing the root of the problem, while hoping that the numbers will look better by comparison in the future. If you gain 20 pounds one month but only 10 pounds the next, is your diet a success?

Over the course of the year, prices have continued to rise. Wheat prices, which were the largest contributor to the food component of consumer price index early in the year, have continued to rise, while pork prices rose 57 percent in June compared to a year earlier. When you add in the fact that property prices remain elevated and core inflation has increased to 3 percent in June from 1.6 percent in October, it seems likely that China's inflation will hang around longer than most people expect.

China could appreciate the yuan faster against the dollar, which would reduce the domestic cost of goods. It could also raise the amount of agricultural imports, ideally increasing the supply and bringing down prices faster. But in reality, it's probably easier to just wait and see what happens to food prices in November before doing anything too drastic.

The author is a financial analyst at London-based brokerage house North Square Blue Oak. The opinions expressed in the article do not necessarily reflect those of China Daily.

Today's Top News

- China expresses worry over Japan's military and security moves

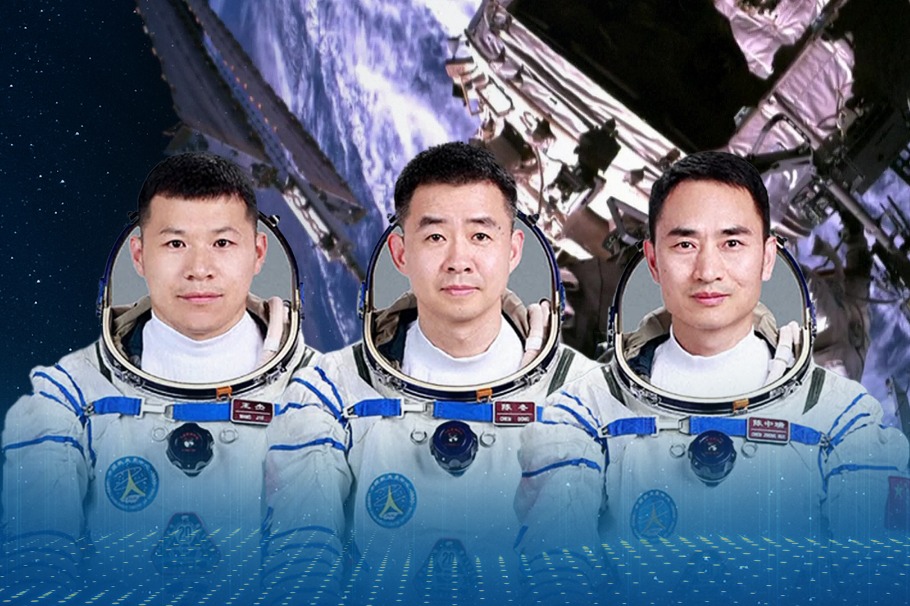

- Shenzhou XX mission crew returns after debris delays landing

- China warns Japan of 'heavy price' for any military interference in Taiwan

- Japan will only suffer a crushing defeat should it dare to take a risk: Defense spokesperson

- Tokyo must stop playing with fire: Editorial flash

- China's Shenzhou XX crew en route back to Earth