IMF gives China clean bill of health, but also has warnings

| Security guards patrol in front of a Bank of China outlet in Shanghai. The International Monetary Fund said the financial system in China is not failing, but urged China to further reform its system. Jing Wei / for China Daily |

The International Monetary Fund says China's financial system is not about to fall over, but expressed concern about growing risks to the global economy if the authorities do not tackle reform.

Although the financial system is robust overall, the IMF said, policymakers need to look at weak points and should speed up improvements on supervision and regulation.

They also need to upgrade banks' capacity for risk management, the IMF said.

Jonathan Fiechter, deputy director of the IMF's Monetary and Capital Markets Department, who headed the IMF team that conducted the Financial Sector Assessment Program, said China's existing financial mechanisms, which foster high savings and high levels of liquidity, increase the risk of misallocated capital and promote asset bubbles.

"The cost of such distortions will only rise over time, so the sooner these distortions are addressed the better," Fiechter said.

The IMF report gave the country a tick for its significant progress toward a more commercially oriented system. But the threats posed by informal credit markets, conglomerate structures and off-balance sheet activities are rising, it said.

This is the IMF's first formal evaluation of China's financial sector. Top Chinese officials started the appraisal work with the fund in August 2009 as a commitment to the Group of 20 summit in Washington three years ago.

"What the IMF said in the report is generally positive and objective, and China needs to continually improve the financial structure as well as enhance the oversight of financial institutions," said Ba Shusong, deputy head of the Institute of Financial Studies at the Development Research Center of the State Council.

According to the IMF report, "most of the banks appear to be resilient to isolated shocks", after jointly conducted stress tests of the largest 17 Chinese commercial banks, about 83 percent of the commercial banking system.

However, if several of the risks - including a sharp deterioration in asset quality, a correction in the real estate market, shifts in the yield curve and changes in the exchange rate - occur at the same time, the banking system could be hard hit, the IMF said.

Ba isn't worried about such systematic risks emerging simultaneously. The pace of growth in the world's second-largest economy is expected to remain healthy and play an important role in the global recovery, he said.

Lu Zhengwei, chief economist at Industrial Bank Co Ltd, said that the central bank is likely to ease its monetary policy, and liquidity may increase next year, helping to contain any risks.

The Financial Sector Assessment Program gives an in-depth analysis of a country's financial sector, rating the quality of bank, insurance and capital market supervision against accepted international standards.

The report said the government's administrative measures to control bank lending and the relatively inflexible macroeconomic policy framework "are leading to a build-up of contingent liabilities".

The IMF suggested overhauling the way interest rates are set and allowing the yuan to trade more freely.

China's central bank, the People's Bank of China, issued a statement on its website half an hour after the IMF report was published saying that "there are still several points of view that are not sufficiently comprehensive and objective".

"The government's sway over financial markets has already evolved from direct intervention to asserting influence through regulation of financial companies," the bank said.

The country needs to take a "flexible" approach to promote financial reform developing into a more commercially oriented system "based on its own conditions", it said.

Liu Mingkang, a former top banking regulator, said this month that even if the worst scenario arose, such as a big slump in real estate prices and dramatic defaults on local government loans, the system had built up sufficient capital to weather the storm.

However, some international financial players showed less confidence in China's banking system.

A day before the IMF report was issued, Bank of America Corp announced that it was selling a batch of China Construction Bank Corp shares valued at 10.4 billion yuan ($1.64 billion), reducing the holding to 5 percent from half of the CCB's shares.

CCB, the world's second-largest lender by market value, said on Tuesday that the US bank's decision is not likely to affect CCB's performance.

Goldman Sachs Group Inc made a similar move last week, reducing its holdings in Industrial & Commercial Bank of China Ltd, the world's biggest lender by market value, and raising $1.1 billion. It has cut its holding of ICBC shares three times.

The People's Bank of China said new yuan-denominated lending reached 586.8 billion yuan last month, a growth of 17.5 billion yuan from a year earlier. In September the figure was 470 billion yuan.

A senior economist with Standard Chartered Bank (Hong Kong) Ltd, Stephen Green, said monthly lending was expected to grow to more than 600 billion yuan in the final months of the year to support fixed-asset investments and inject money into manufacturing, ensuring steady economic growth.

Today's Top News

- Mainland increases entry points for Taiwan compatriots

- China notifies Japan of import ban on aquatic products

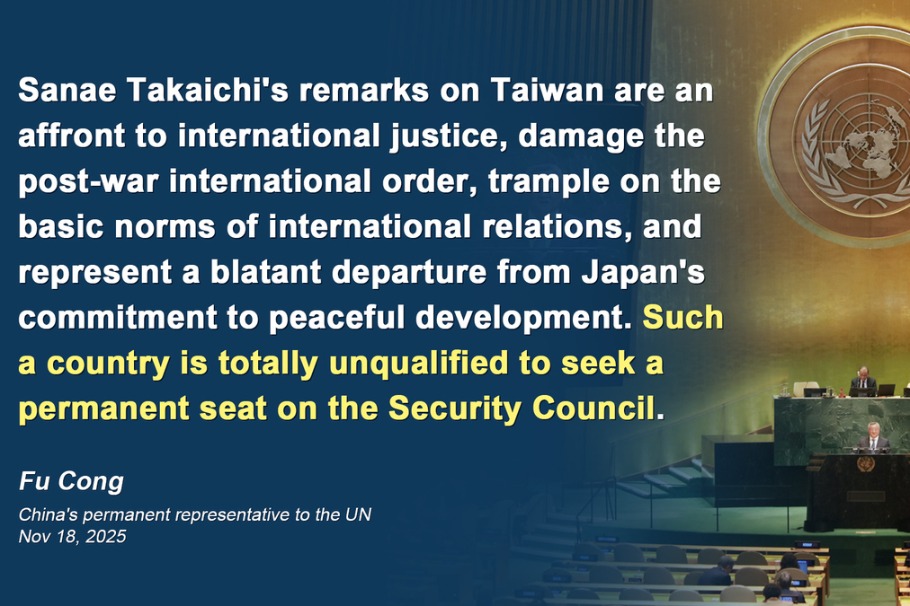

- Envoy: Japan not qualified to bid for UN seat

- Deforestation is climate action's blind spot

- Japan unqualified for UN Security Council: Chinese envoy

- China, Germany reach outcomes after discussions