Greenfield projects are the best bet

Chinese firms are establishing affiliates abroad at an accelerating pace. So far, however, Chinese foreign direct investment (FDI) in the United States has been negligible, although it is beginning to increase. This is not surprising, if anything is surprising, it is that there has not been more Chinese FDI in the US. This country is, after all, the world's single most important market and consequently also the most important host country: In 2010, the US attracted $228 billion in FDI flows, some one-fifth of global FDI outflows that year.

But the question arises: Is the US ready for FDI from China? We examined this question in the framework of a joint project between the US Chinese Services Group of Deloitte LLP and the Vale Columbia Center on Sustainable International Investment, with the results published by Edward Elgar in a volume entitled Investing in the US: Is the US Ready for FDI from China?

The short answer is: yes. The US has one of the most open FDI environments in the world, confirmed in June 2011 in a statement by President Barack Obama. The long answer is more complicated because there have been incidents in which Chinese investments in the US (China National Offshore Oil Corporation and Huawei, for example) were stymied or otherwise faced opposition.

These incidents reflect a certain amount of suspicion concerning Chinese FDI, fueled by the fact that China is seen as a strategic competitor, that Chinese firms are "new kids on the block", that they often choose mergers and acquisitions (M&As) as the form of market entry, and that many of the important Chinese investors are State-owned.

What does this mean more concretely for Chinese firms seeking to invest in the US? To begin with, Chinese firms need to consider carefully whether they should enter the US market via greenfield investments (which are generally welcome) or M&As.

There is no doubt that M&As have lots of advantages. But M&As can be highly visible, and they are often followed by layoffs, a particularly sensitive matter when unemployment is high. Moreover, M&As may be investigated by the Committee on Foreign Investment in the United States (CFIUS), whose terms of reference were strengthened recently to require it to investigate, in principle, all M&As by State-owned enterprises.

While most Chinese M&As in the US are not investigated, when they are, this can slow down transactions and introduce uncertainty. Moreover, even if CFIUS approves M&As, political opposition can cause Chinese firms to abandon their efforts.

Two implications follow from this situation. First, if there is a choice between entering the US market through greenfield projects or M&As, the former are more advisable. Second, if M&As are chosen, they need to be prepared carefully, not only from a commercial standpoint but also from political and public relations angles. Those navigating the corridors of power in Washington can often benefit from the advice of local intermediaries.

CFIUS is part of a highly sophisticated regulatory and institutional framework that involves scores of laws that are of direct relevance to foreign investors. Chinese firms need to be aware of them and obey them scrupulously.

But prospering in the US requires more than observing laws and commercial acumen. It also requires an active effort by Chinese foreign affiliates to show that they contribute to the local community through the creation of direct jobs and jobs with suppliers, through participation in various communal undertakings, through joining local business associations and so on.

In brief, Chinese affiliates have to show that they are good US corporate citizens.

Overcoming the "liability of foreignness" (foreigners operating in a foreign market) is not always easy, especially for firms that are newcomers in the world investment market and hence are relatively inexperienced. And this particular liability is accentuated in the case of Chinese firms by the "liability of the home country".

Overcoming these liabilities is certainly not an impossible task. It involves a learning process, it requires perseverance and it is ultimately helped by the interest of the US to benefit from Chinese FDI.

The author is executive director of the Vale Columbia Center on Sustainable International Investment, Columbia University, New York.

Today's Top News

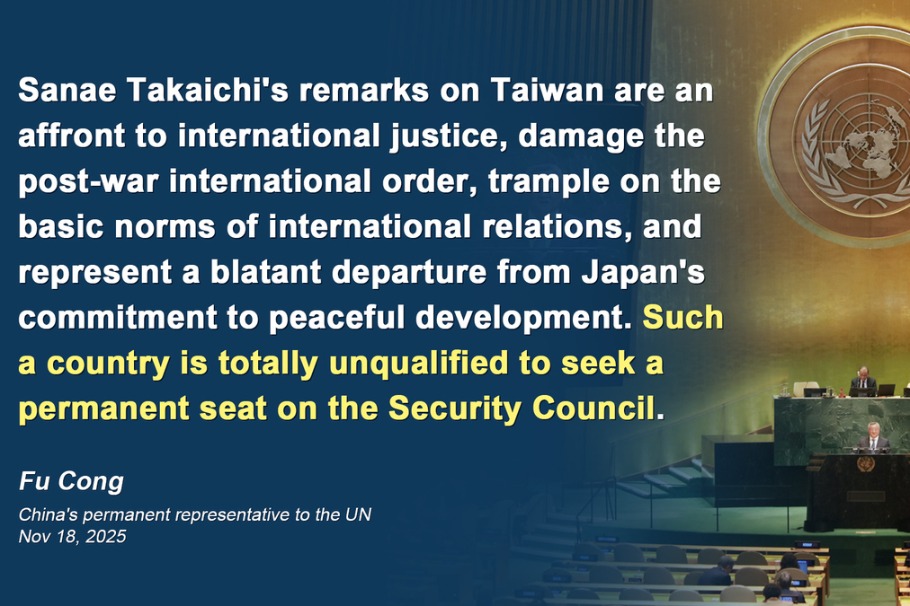

- Japan's PM seen as playing to right wing

- Mainland increases entry points for Taiwan compatriots

- China notifies Japan of import ban on aquatic products

- Envoy: Japan not qualified to bid for UN seat

- Deforestation is climate action's blind spot

- Japan unqualified for UN Security Council: Chinese envoy