Getting ready for the next move

Challenges in west present Right time for China to focus on real, emerging and specific industries

The debt crisis in Europe and debt challenges in the US are likely to provide more overseas investment opportunities for China, even as its central bankers ponder long-term strategies for further investment of foreign exchange reserves.

Notwithstanding the risks, China is likely to continue buying the Treasury bills of other nations as they are guaranteed by the respective governments. But factors like falling currency value, rising inflation and the dire economic situation of target nations may, however, lead to lower T-bill investments.

In January, China Investment Corp (CIC), the nation's sovereign wealth fund, said it had purchased an 8.68 percent stake in Thames Water, a private utility in Britain responsible for public water supply and wastewater treatment. This deal marks a shift in the investment strategy of Chinese foreign exchange reserves from the US Treasury bills to tangible assets with value-added potential and relatively stable returns, such as infrastructure.

Chinese investment in overseas infrastructure has been seeing rapid growth in recent times. The total investment in overseas utilities, hydro and water supply has increased from $220 million (166 million euros) to $3.4 billion, a ten-fold increase between 2004 and 2010, with nearly 50 percent of the increment coming in the last three years. It is obvious that the 2008 financial crisis did not impede the process of Chinese investment in overseas infrastructure, but rather speeded up the process.

There is no doubt that China's investment in overseas infrastructure is primarily for its long-term gains. According to historical data, the investment horizon of most infrastructure projects is more than 15 years, and the average rate of return more than 10 percent. The characteristics of large capital demand, long investment period and relatively stable returns are highly appropriate for China Investment Corp's investment features and orientation. In addition, the large capital outflow to overseas infrastructure projects helps China to reduce the unsustainably high level of its foreign exchange reserves, and lower the yuan appreciation expectations and inflation pressure.

At the same time, such investments also satisfy the need of target countries. The woeful state of the European economy and reluctance of private investors to commit large amounts on infrastructure investment have brought about a change. Most of the European countries that are deeply involved in the debt crisis and probably already in a recession are tightening their budgets, while private investors are facing a liquidity crunch due to deleveraging and default risks.

Moreover, in the US and European countries, many infrastructure projects have long gestation periods of over half a century. Safety-accident potential due to prolonged disrepair urgently needs to be addressed while capital insufficiency and poor management have impeded the process.

Usually, investors bear greater risks when investing on infrastructure to be built or under construction, and gain greater benefits if it goes well. On the other hand, risks are smaller if they invest on existing projects such as CIC's deal because they can evaluate the benefits and costs comprehensively at the cost of lower returns and higher limits.

The above factors give China good opportunities to expand its overseas investment.

Capital from China's sovereign wealth fund is not the only source to finance the overseas investment. Private investors could also join the game by teaming up with foreign private equity or mutual funds that have rich experience and a strong profit orientation.

Chinese overseas investment is expected to focus largely on the real, emerging and specific industries that can create more job opportunities. The success of such overseas investment moves and long-term stable benefits will come from this win-win strategy.

The author is a researcher at the Information Department of the China Center for International Economic Exchanges.

(China Daily 02/17/2012 page7)

Today's Top News

- CPC holds symposium to commemorate 110th birth anniversary of Hu Yaobang

- Economy seen on steady track

- Trade-in program likely to continue next year

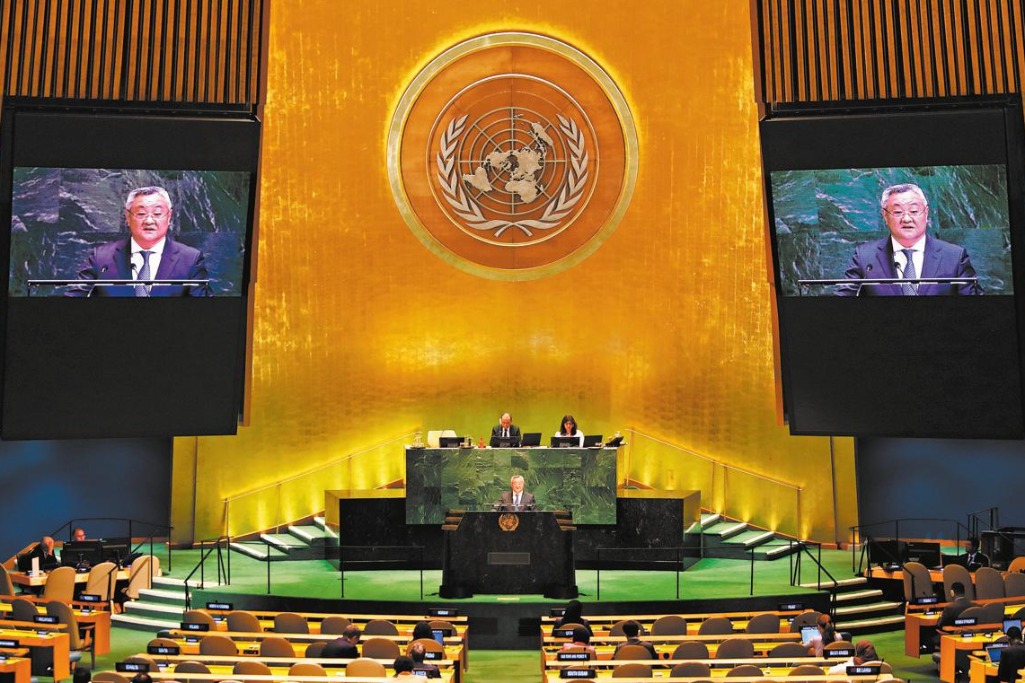

- Li: SCO can play bigger role in governance

- Huangyan Island protection lifeline for coral ecosystem

- Latin America urgently needs green credit