Project report

Overseas infrastructure assets are increasingly drawing the attention of Chinese investors

Commuters on the Beijing subway, which has opened 11 of its 15 lines in the past five years, experience mostly trouble-free journeys every day. There are very rarely any delays and a journey is a clean and efficient 21st century experience.

Passengers on London's commuter trains coming in from the Home Counties often do not know to what century they belong. Some of the lines were constructed in the Victorian age and much of the tatty rolling stock often appears of a similar vintage.

|

||||

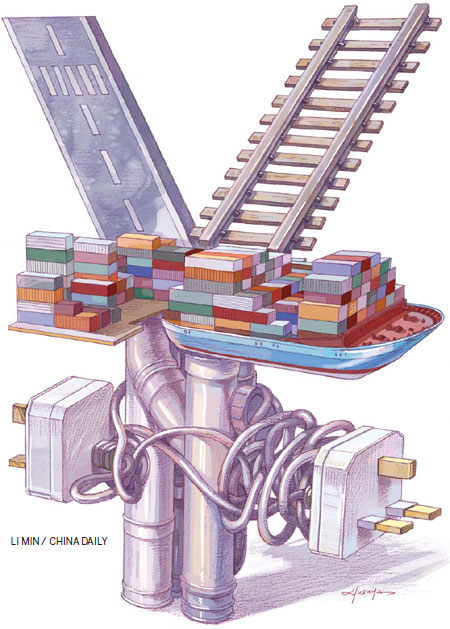

The UK, like other countries in Europe and the United States, needs investment not just in its rail and road network but also in other infrastructure assets, such as water utility and power generation companies.

With austerity measures being introduced across the world, money is tight for such projects - China, however, is showing an increasing appetite for investment in infrastructure assets.

Unlike investing in US Treasury bonds, such investments are unlikely to destabilize international currency markets and they are also assets that can deliver a steady income over a 30- or 40-year lifecycle.

Lou Jiwei, chairman and chief executive of China Investment Corporation (CIC), the $410 billion (310 billion euros) sovereign wealth fund, could not have been clearer of his intentions.

In an article in the Financial Times in November, he said investing in infrastructure was a "win-win" solution for China and those seeking funding.

"Infrastructure is under-invested in European countries and the US Infrastructure represents a suitable choice for sovereign wealth funds to invest directly or through fund managers, with the aim of seeking stable and sound financial returns," he argued.

Lou based his assessment on UK Treasury figures saying that it needed 200 billion pounds ($315 billion, 238 billion euros) of investment in energy, water, transport and other projects by 2015 and also those of the American Society of Engineers, which estimates the US needs to spend $2.2 trillion on its infrastructure.

Following Lou's article, UK Chancellor of the Exchequer George Osborne made a much-publicized visit to Beijing in January looking for Chinese investment in among other things, HS2, the planned high-speed rail link from London to the UK's second city Birmingham.

"We welcome further Chinese investment in UK infrastructure opportunities in the coming decade," Osborne said ahead of a meeting with Lou.

Within hours of Osborne's homeward bound plane leaving the tarmac, CIC announced on Jan 20 it was taking an 8.6 percent stake in Thames Water, the utility company that supplies London its water.

China's focus is not just the UK, however. On Feb 2, China's State Grid Corporation with Oman Oil, the Gulf-based oil company, bought a 40 percent stake in REN, Portugal's national grid operator, for 592 million euros ($778 million).

This followed the move in December by Three Gorges Corporation, a Chinese State-owned power company, to invest 2.7 billion euros in Energias de Portugal, the country's leading power company, making it its largest minority shareholder with a 21.35 percent stake.

Many believe China will soon turn its attention to the United States, which has been reluctant to accept foreign investment in major strategic infrastructure assets.

With the US still recovering from the financial crisis, such an isolated stance might soon begin to seem self-defeating.

China's financial help may be needed to build major infrastructure projects and, in particular, its nascent high speed rail network.

Roelof van Ark, chief executive officer of the California High-Speed Rail Authority, is one who says he is open to CIC taking a slice of the action.

China's infrastructure involvement may not prove to be just a financial investment or supplying labor in some developing countries - over the past 15 years, no country in the world has built more roads, railways, ports, power plants and other major installations.

Today's Top News

- 15th National Games embodiment of high-quality development

- Lawmakers' thousands of proposals receive responses

- China warns Japan against interference

- Nation's euro bond sale shows investors' confidence

- No soft landing for Tokyo's hard line

- Commerce minister urges US to increase areas of cooperation