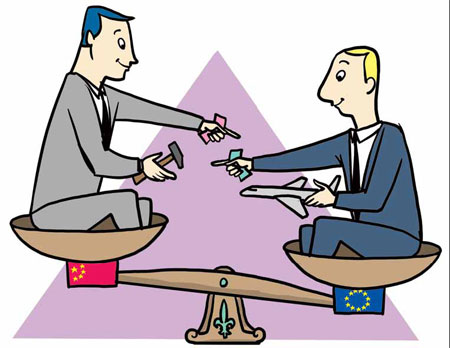

EU shouldn't forget strategic context

Trade deficit fueling concern in Europe, even if it is likely to subside for structural cyclical reasons

China's economic miracle over the last three decades owes a lot to the energy of the Chinese people - as well as to the long-term growth strategy worked out by the Chinese leadership. But wide access to the EU market and massive EU direct investment in China have also provided the indispensable ingredients for the country's performance. Today, although considered as irrelevant by economists, the trade deficit with China is fueling concern in Europe, even if it is likely to subside for structural and cyclical reasons.

Would China and Europe live in a mercantilist-free, a Smithian or Ricardian world, no debate about trade imbalances or even about dumping would ever arise. The European consumer would enjoy cheap labor-intensive manufactured goods from China, and his Chinese counterpart would buy luxury brand goods and technology-intensive equipment at bargain prices. But we are in an export-dominated universe where jobs and profits matter more than bargain prices for consumers.

Mercantilism was never far away, but the present crisis has brought it back to the forefront of the political economy of trade. All assumptions made about trade liberalization and net welfare gains indeed include the full employment of resources, starting with labor. This condition is not fulfilled anymore in Western economies, which have been hit by the consequences of the 2008 Wall Street collapse. We live in a "second best" world where the opportunity costs of unemployment make protectionism attractive again in sectors affected by Chinese imports.

Something has radically changed though: today, large firms operate according to a global value chain model and imports - of parts and components - make exports competitive. The opportunity cost of protectionist measures has increased drastically as a result. This provides an additional ratchet for preventing free trade from sliding back, a positive development for the trade liberalization camp.

Yet we cannot ignore this sea change as we reflect on the future of EU-China trade and investment relations. Exchanges are first and foremost determined by consumers and firms. What matters in this respect is the evolution of living standards: growth differentials normally translate into import penetration differentials as well. China should be importing more than the EU imports from China in the coming decade. Here growth strategies act as the main determinant for the play of market forces: the 12th Five-Year Plan (2011-15) will be decisive in this respect since it explicitly shifts the growth driver from exports to domestic consumption and environmental investment. This perspective should be borne in mind by EU institutions in dealing with the EU-China trade and investment issue.

Another development is also of significant importance: China's huge forex reserves put it in a position to buy European securities - from government bonds to shares - or to make greenfield investments in Europe. This in turn contributes to the alleviation of sovereign debt financing, to the recapitalization of EU banks, and to the growth of European firms or logistical infrastructures according to the strategic interests of Chinese investors. Cross FDI between the EU and China would not only fuel growth and create jobs in each others' markets but would also lead to the building-up of a strong pro-trade constituency on both sides, as evidenced by the importance of cross investment in the EU-US economic relationship.

Last but not least, China is gradually and experimentally trying out the internationalization of the yuan, a logical development in connection with the growing role of China in trade and finance. Internationalizing the yuan entails the gradual opening-up of the capital account and the improvement of financial structures within China. This means that markets will drive the allocation of savings more directly than today, with a two-pronged benefit for household revenues and therefore their consumption increase, and for the investment cost for both State-owned and privately-owned competitive firms.

Problems remain though: effective and fair access to the Chinese public procurement market for EU firms, in particular those which have settled in China, is a major stake in a State-dominated market economy. Fair access should lead the EU to bestow market economy status to China. This would prove a more interesting scenario for both partners than some form of retaliation from the EU through conditional access to its own public procurements. The respect of intellectual property rights is also an issue, in particular, counterfeiting. But cooperation among the EU and China, and the growing interest on behalf of Chinese firms to protect their own patents, should lead to significant headway in this sector.

All in all, trade irritants might rise along with the increase in bilateral trade between two major players, exactly as in the same way such litigation cases exist between the EU and the US. But the very dynamics of economic convergence should smooth the commercial relationship between the EU and China.

The main problem might today arise on the EU side with the euro crisis. The eurozone has long proved an impressive achievement and a very positive development for the future of the EU. But the viability of the euro has always been questioned by experts because of its weak governance and because of its vulnerability to asymmetrical shocks. Nobody seriously foresaw either the magnitude of economic policy divergence within the eurozone, or the financial instability arising from the European banking sector's exposure to the Wall Street collapse. Today the EU must remedy this twin fault-line of the eurozone, which threatens its integrity. A collapse of the eurozone would break up the unity of the single market which would trigger protectionist reactions.

The key priority for the EU is therefore to get the eurozone out of its dangerous predicament. Progress has been achieved in parallel toward more financial solidarity among eurozone members and more strict fiscal discipline. But more needs to be done. On the one hand, the eurozone leaders should find a way to rekindle growth so as to make possible the necessary fiscal and structural reforms. On the other hand, there is no way to avoid more political integration.

If the EU is successful in coping with this formidable challenge, then the conditions will be met for setting up a deep and strong strategic partnership with China. Trade and investment will always represent the main pillar of the relationship. Energy and natural resource management and access will also be a key collateral pillar of trade and FDI, especially because cooperation in the two areas will lead both to a consistency of strategies between the two partners and to the multiplication of innumerable commercial and industrial private and public partnerships.

Both China and Europe, but the US as well, should realize the full measure of the changes that are taking place at the world level and of the responsibilities it bestows on them. The US must tackle its "guns and butter" dilemma through taxes, since it cannot anymore rely on the dollar privilege. China must succeed in carrying out the ambitious and timely priorities of the 12th Five-Year Plan. The EU must go beyond the rhetoric of the Europe 2020 Strategy, and first must give the euro a strong political integration basis. When managing bilateral trade and investment between China and the EU, we should not forget this genuinely strategic context.

The author is executive director of the Madariaga-College of Europe Foundation. The views do not necessarily reflect those of China Daily.

Today's Top News

- Forum hailed for promoting Global South modernization

- AI-related skills prove to be hot commodity

- Premier in South Africa for G20 Summit

- Sports gala proves golden for GBA

- More efforts urged to tackle crime

- 15th National Games embodiment of high-quality development