No worry behind the 8% mark

China's slowing economic growth rate is still on track - but direction needs checking

China's GDP growth rate fell to 7.8 percent in the first half of this year, breaking the important psychological barrier of 8 percent.

The second quarter saw the growth rate as low as 7.6 percent, the sixth consecutive quarter of slowing down - which has given rise to various alarming responses in the European and US media, and lots of worries in China.

A commentary piece in Die Frankfurter Zeitung newspaper titled Fear of China Crash on July 13 said that China is faced with a catastrophic economic crash which will lead to an enormous storm across the world. The Wall Street Journal the same day said that China will drag the world economy into "another recession".

In China, many worried about the prospect of a hard landing and appealed for all necessary policy actions to "defend" an 8 percent growth rate for the whole of 2012.

That is the "red line" of GDP growth rate for many. It was the target of the Chinese government in 1998 in the midst of the Asian financial crisis, and in 2009 during the world financial crisis. It is, however, no longer so during the 12th Five-Year Plan (2011-15), which envisaged an annual growth rate of 7 percent, and set the goal at 7.5 percent for 2012.

Assuming the growth of 7.6 percent in the second quarter remains unchanged, the whole year will hit 7.7 percent. If so, the average growth for 2013-15 will only need to be 6.4 percent to realize the annual 7 percent growth rate target for the 12th Five-Year Plan period. What is the worry?

An articulate examination of GDP growth during the first half of 2012 supports the judgment that a 7.8 percent growth rate is basically normal.

From January to June, fixed-asset investment grew 20.4 percent from a year ago, but 5.2 percentage points lower than the same period of last year. However, considering the receding inflation rate, it was still a high tempo.

The slowdown in growth is due to several factors. First, investment in real estate grew 16.6 percent in the first half of this year, much lower than the exceptionally high level of 32.9 percent in the first half of 2011. Home sales were down by 6.5 percent.

This has been caused by the strict control of the market, quenching the speculation bubbles, and it is certainly healthier than a year ago.

Second, after intense investment in high-speed railroad construction and transportation, the country needed to slow down railroad construction for the sake of safety and debt payment.

However, total industrial investment grew at 23.8 percent, showing investment in the real economy is still strong.

Meanwhile, consumption growth has been healthy too. Total retail sales hit 9.8 trillion yuan ($1.5 trillion, 1.25 trillion euros), 14.4 percent up from a year ago. Car sales increased by 9.1 percent in the first six months this year.

Growth in export and import figures dropped sharply. Foreign trade grew by only 8 percent year-on-year, compared to 25.8 percent in the first half of 2011. Exports grew by only 9.2 percent while imports rose by 6.7 percent. China's external trade has obviously felt the pain of the European debt crisis and an unsteady world economic recovery.

So China basically has had reasonable internal demand but poor external demand. As the former plays a dominant role in the whole economy, the overall situation is not a major problem, far less a "crash".

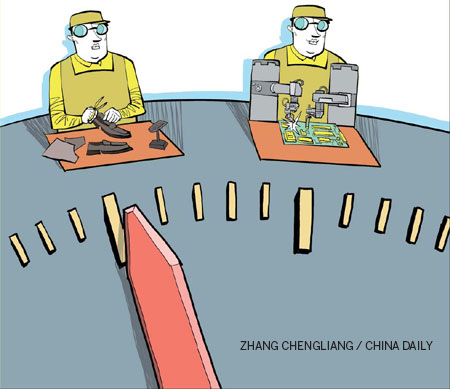

It is not the speed of growth, but the economic development model that China should be worried about.

The first half of 2012 did not see fundamental changes in the development model, as set by the central government. The country must shift from a low value-added economy to a higher value-added one, to structural upgrading with innovative, clean and competitive new emerging industries as the backbone.

Textiles, computers/telecom and non-metal minerals mining sectors had a growth rate higher than the industry total. But two of the three industries are traditional and low value-added.

On the contrary, the electrical equipment/materials sector, which represents more advanced manufacturing, registered only single-digit growth.

We have also seen a very worrying change in the sectors' investment growth pattern. Investment in the resources and energy consuming sector of mining accelerated hugely while that in the advanced sector, involving computers, telecom and electrical equipment and materials, was pulled back considerably.

The performances of alternative energy products, including hybrid cars, new materials, bio-chemicals and other sectors key to the new industrial revolution were not even factored in the growth figures.

The overview of the first half of the year's economic situation has no clear information on the change of the development mode, or the new emerging industries. The Chinese economy, although slowing, was still being driven to a large extent by low value-added resources and energy-consuming sectors' output and investment.

This is the real worry for the Chinese economy and future generations.

The Chinese government has recently announced a series of monetary and fiscal policies to stabilize economic growth and avoid further deceleration. The central bank lowered key interest rates and reserve rates twice within a month, releasing more money to the economy. A number of factors support a modest rebound of GDP growth.

Lower interest rates will reduce the cost and increase profit margins for business, leading to more investment, and large numbers of infrastructure projects, pushed by the government, are expected to start.

And, as the disposable income of urban households increased by 9.7 percent and rural ones by 12.4 percent in the first half of the year, more money will be available for consumption. The continuing subsidies for home appliances will add 200-300 billion yuan to that end, and the fall of the CPI rate to 2.2 percent in June means an ebb in inflation, encouraging more consumption.

However, the world economy will remain weak for the rest of the year.

The latest IMF World Economic Outlook slightly revised down the growth rate of the global economy in 2012 and 2013, to 3.5 percent and 3.9 percent, respectively. It estimated that the US economy will grow at a tepid pace of 2.0 percent in 2012 and 2.3 percent in 2013.

As a result, China's external trade growth will remain weak. Imports, on the other hand, will pick up.

The country's economic slowdown might hit bottom in the second or third quarter, but with the economic stimuli gradually taking effect, a rebound is certainly on the horizon.

The massive inputs for quantitative expansion in 2008-2009 are unlikely to be repeated, and with the weak world economy, the rebound will be modest. It is estimated GDP growth will rise back to about 8 percent in the third quarter and slightly higher in the fourth, leaving 2012 at about 8 percent overall.

Again, this is not the main concern. China should not repeat massive investment only for the sake of a GDP growth rate target, which will be harmful and unsustainable. Rather, the current economic difficulty should serve as a great chance to advance China's economy, improving the division of labor, and sustaining an innovative, competitive economic growth for the next decade.

The author is co-director of the China-US/EU Study Center, the China Association of International Trade.

(China Daily 07/20/2012 page7)

Today's Top News

- China, US hold maritime safety talks in Hawaii as Beijing reiterates warnings on sovereignty

- China sends letter to UN over Japanese PM's remarks on Taiwan

- Chinese, Uzbek FMs hold second strategic dialogue

- G20 an opportunity to strengthen Sino-EU ties

- China, Africa foster shared food security

- Japan urged to take practical steps to honor its commitments to China