Online finance gaining share but facing challenges

The dramatic push into Internet finance this year has opened up a revolutionary means of financing other than resorting to the capital market or conventional banks. It heralds an era in which all market participants can borrow and lend directly on the Internet with few information barriers.

Booming Internet finance is closely associated with the development of so-called big data, which incorporates all sorts of information on a platform accessible to many people. The chance of a company defaulting on its loans can be more easily calculated by looking at the data of its past performance instead of just at its balance sheet.

Despite all the advantages in terms of convenience, high returns and easy access, Internet finance is full of uncertainties just like anything else that is new. The safety of the data, fierce competition and risks could dampen the profitability of Internet finance.

Last year has been called the first year of the Internet finance era. In fact the innovative form of finance entered China seven or eight years ago, but last year witnessed an exponential growth of various forms of Internet finance, including online credit, big data, Internet financial portals and third-party payments.

There are three main categories of Internet financial products.

The first is payment and settlement services, most of which used to be carried out by banks. Now bills such as for water, electricity and gas can be paid through third-party payment platforms.

Second is financing services, such as taking out loans through e-commerce platforms. Customers can seek capital on the Internet independent of bank loans. Many peer-to-peer platforms fall into this category.

The third category is the sale of financial products on the Internet, such as Yu'ebao, Bitcoin, a peer-to-peer payment network and digital currency, and ZhongAn Online P&C Insurance Co Ltd that sells insurance targeting e-commerce vendors.

Nevetheless, the scale of Internet finance is still small. For instance, third-party payment accounts for only 1 percent of total finance. Major settlements still take place among conventional banks.

Alibaba Group's Yu'ebao has become a highly successful example of Internet finance. Since it opened in June it has attracted more than 30 million users with 100 billion yuan ($16.5 billion) of deposits by mid-November. Yu'ebao distinguishes itself with a stable and high return as well as convenience. In 2012, time deposits of 100,000 yuan could generate 3,250 yuan in annual interest. The same amount in Yu'ebao could yield an extra 750 yuan in interest. The money in the account could be used for online-shopping, transfers, credit card payments, paying phone bills and other tasks.

Other Internet companies, such as Tencent Inc and Baidu Inc, have launched their own versions of monetary fund wealth management products. Major e-commerce operators such as Beijing Jingdong Technology Co Ltd and Suning Commerce Group Co Ltd are also trying their luck with Internet finance.

However, the competition that it poses to traditional banks is yet to be fully understood.

"If metal currency substituting for shell currency was the first financial revolution, followed by bank notes substituting for metal currency, Internet finance is the third revolution in finance," says Zhang Guoqing, vice-president of Zhongguancun Innovation Institute.

The first revolution made it possible to lend and borrow at a specific level of interest. The second revolution enriched financial products, introducing funds, securities, equity rights and other products. The third revolution that is taking place now is breaking the profitability of information asymmetry, expanding the means of knowing who has money and who needs it, Zhang says.

yangziman@chinadaily.com.cn

(China Daily Africa Weekly 01/31/2014 page23)

Today's Top News

- Japan's PM seen as playing to right wing

- Mainland increases entry points for Taiwan compatriots

- China notifies Japan of import ban on aquatic products

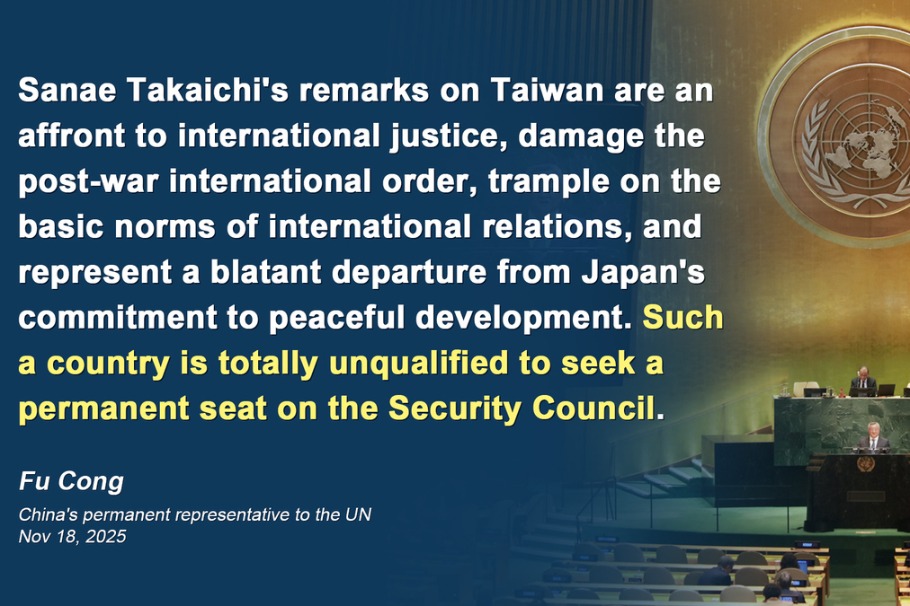

- Envoy: Japan not qualified to bid for UN seat

- Deforestation is climate action's blind spot

- Japan unqualified for UN Security Council: Chinese envoy