Banking sector opens to private players

With reform will also come consumer risks, analysts warn

Since China Minsheng Bank Corp became the first private bank in 1996, the government has not approved any others, although it has allowed a small amount of private capital to be invested in commercial banks. This will soon change as the government opens up the financial sector to private enterprises.

China now has five state-owned commercial banks, three policy banks, 12 joint-stock banks, 144 city commercial banks, 47 foreign capital banks and numerous banks in towns and rural areas. The introduction of private banks will introduce more competition to the industry to the benefit of private businesses strapped for capital.

Until now, the names of more than 40 private bank applicants have gained pre-approval from the State Administration for Industry and Commerce. However, the success of Minsheng, which was founded at a time when loans for small and medium-sized enterprises were relatively undeveloped, is unlikely to be repeated today given the many financial products fighting for customers' attention. Some private banks are bound to fail if they do not have a sound risk-control system.

With the opening-up of the banking industry to private capital after 14 years of hiatus. The biggest change in the policy is that private enterprises have seen their status elevated from "equity participator" to "initiator", according to the guidelines issued by the State Council in July that encourages more private capital to enter the financial industry.

Private banks that are filing for approval fall into two categories. First, there are enterprises or business associations that seek easier financing channels for the industry. For instance, Suning Commerce Group Co Ltd, a leading home appliance retailer, was the first listed company to announce its plans to apply for permission to launch a private bank. Other public corporations have also formed groups to create their own private banks.

The second category is more ambitious. This sector is the Internet companies that want to build a line of services on their own financial platforms, such as Tencent Technology (Shenzhen) Co Ltd.

Companies aiming to get a pieces of the pie in private banking cover a wide range of industries including e-commerce, real estate, food, garments, electrical equipment, technology and aviation.

Why does private banking look so enticing?

The Chinese banking industry has been enjoying lucrative profitability. According to the half-year profit statements of 2,467 A-share companies in 2013, the total net profits of the 16 listed banks amounted to 619.1 billion yuan ($102.1 billion; 75.6 billion euros), up 13.54 percent from the same period last year, accounting for 54.3 percent of total A-share profits. Although profit margins in banks have been decreasing in recent years, the large net profits still have a great appeal to private businesses.

Private banks can ease the difficulties in financing and acquiring loans by private enterprises. According to a study conducted by Qianzhan Industry Research, a Beijing-based research group, a mere 1.3 percent of small and medium-sized enterprises could conduct direct financing. Others accumulate capital through bank loans and private capitalization. However, because of their relatively low credibility, high management costs and banks' preferences for large-scale companies, only 10 percent of SMEs have access to bank credit. It is predicted that SMEs will need 17.5 trillion yuan in capitalization in 2014.

Severe competition in the banking sector stands in contrast with the private sector's enthusiasm. The profits in the banking industry are highly concentrated. Among the 16 listed banks, the profits of the top five state-owned banks made up 75.5 percent of the total profits in 2012. The total assets of city commercial banks accounted for a mere 9.4 percent of the total assets held by banking financial institutions.

Experts have been applauding the opening up of the banking sector to private capital. However, there are bound to be risks ahead.

Jin Liqun, chairman of the sovereign wealth fund, China Investment Corp, said some of the private banks are bound to go bankrupt.

State-owned banks are not going to go bust because customers are assured their deposits will be safely managed because the central Party and the government will not cheat their own people, Jin says. Private banks, on the other hand, face the risk of bankruptcy. But people don't have to be overly concerned because development comes with risks, he added.

"Deposit insurance needs to be put in place to protect customers' interests in case of bankruptcy," Jin says. "I heard of opposition from large banks that claim the insurance system is nothing but a burden because they are not going to go bankrupt. However, these banks have been given government protection to be exempt from bankruptcy, which attracts customers to put their money into their accounts. What is the cost of establishing an insurance system compared with their vested interests?"

Experts also warn that the current enthusiasm may not pay off.

"Private companies should remain cool-headed before they enter the industry," says Ba Shusong, deputy director-general of the Financial Research Institute of the State Council Development Research Center. He cited a case in Taiwan in which 16 private banks gained approval in 1992, but where only six remain.

Generally speaking, banks see no profits within the first three years after their establishment. Companies should wait until the industry has undergone consolidation before they try their luck.

yangziman@chinadaily.com.cn

| Farmers applying for an anti-drought loan of 5,000 yuan per household at a village bank in Linyi, Shandong province. Fang Dehua / for China Daily |

(China Daily Africa Weekly 01/31/2014 page23)

Today's Top News

- Mainland increases entry points for Taiwan compatriots

- China notifies Japan of import ban on aquatic products

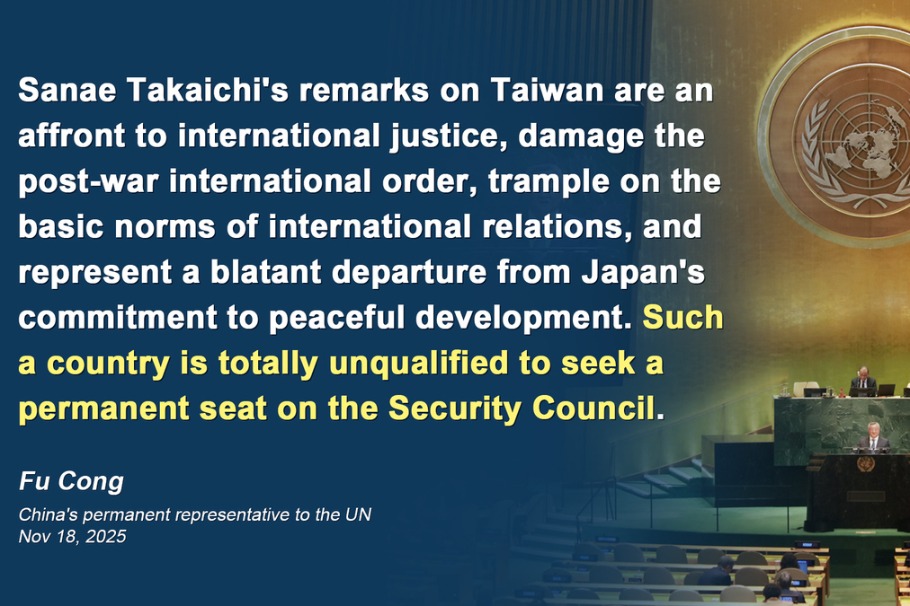

- Envoy: Japan not qualified to bid for UN seat

- Deforestation is climate action's blind spot

- Japan unqualified for UN Security Council: Chinese envoy

- China, Germany reach outcomes after discussions