Chinese currency on the up and up

As leaders are keen for China's corporations to expand overseas, a strong yuan will make process easier

As the yuan approaches the psychologically sensitive line of 6:1 against the US dollar, debates are raging over whether the Chinese currency should continue appreciating.

Those against the appreciation say an increasing yuan would hurt China's industries, especially the manufacturing and export sectors.

But my sense is that the yuan will continue to climb against the greenback based on improved trade prospects and the government's support.

First of all, renminbi has room to appreciate as long as China continues to run a capital surplus. If China sustains continuous money inflows, mounting foreign-exchange purchases will increase the demand for the yuan, forcing it to rise in value.

China's status as a recipient of foreign capital is expected to be maintianed this year, with the situation of "dual surplus" to continue.

Its current account, which mainly records trade flows, will register a surplus, with exports continuing to surpass imports.

Although the country started to import more end products, China's trade structure has not fundamentally changed. It remains a manufacturing trader, which means that it mostly imports raw materials to process and then exports finished products. Under this mode, the value of Chinese exports will exceed imports, adding to the surplus on its current account. The surplus is even expected to increase this year, thanks to economic recovery in the United States and Europe, two major Chinese export destinations, and the tapering of the US monetary policy, a change that will help drag down the prices of Chinese imports of bulk commodities.

This trend emerged in January. China ran a trade surplus of $31.86 billion, up from $25.64 billion in December.

A surplus is also expected in the capital account, which mainly records investment activities, although China's outbound investment is increasing quickly. Last year, China's outbound investment trailed inbound investment by $27 billion. Based on last year's growth rate, a small surplus is expected this year on the capital account.

Combining current and capital accounts, China will surely see more money inflows than outflows. Since this broad picture will not change, there is no reason for the yuan to depreciate.

What's more, the new leadership seems to favor a stronger renminbi, which it may see as a tool to help push economic restructuring.

Former premier Wen Jiabao indicated in March 2012 that the value of the yuan has reached "an equilibrium". He kept his word. That year, the yuan only went up 1.03 percent against the US dollar, the slowest growth since the end of the 2008-09 financial crisis.

But the yuan picked up speed last year, after the new government was installed. It rose 3 percent, a remarkable increase considering the fact that the Chinese economy slowed down to a multiyear low and its trade surplus and capital inflows were not as huge as they used to be. This was a strong display of policymakers' willingness to leverage the appreciation of the currency to restructure the economy and propel reforms.

Policymakers also want the yuan's value to stay high because they are keen to promote Chinese investment overseas. Chinese officials have placed more emphasis on outbound investment than inbound investment in recent years, encouraging both state-owned and private companies to penetrate global markets.

A stronger yuan means higher purchase power in foreign currencies. This helps Chinese enterprises conduct mergers and acquisitions, source foreign products and slash production costs in overseas markets.

Another reason top policymakers favor an appreciating yuan is that China has to maintain the currency's growing momentum to promote its globalization. It is clear that the yuan's popularity in overseas markets stems mostly from its rising value instead of its convenience and international status, so strengthening it is the only option to push it onto the world stage.

The strongest opposition to the increasing yuan comes from fears about the competitiveness of exporters and manufacturers. In recent years, a rising yuan has helped eliminate some low-end manufacturing, but this came at a cost to employment. Concerns about employment might prompt policymakers to reconsider the pace of yuan appreciation.

In this sense, the direction of the yuan and how fast it moves will reflect which goal Chinese decision makers are leaning toward in the new year: a faster-appreciating yuan for proactive restructuring and internationalization or a slow-paced yuan to secure economic and industrial growth.

Either way, however, policymakers will not let the currency stop appreciating unless money flows reverse sharply this year, and that is unlikely.

Therefore, it seems just a matter of time until renminbi breaks the 6:1 line against the US dollar. If it continues to appreciate, even if only very slowly, this will happen sometime this year.

The author is a Shanghai-based financial analyst. The views do not necessarily reflect those of China Daily.

(China Daily Africa Weekly 02/21/2014 page11)

Today's Top News

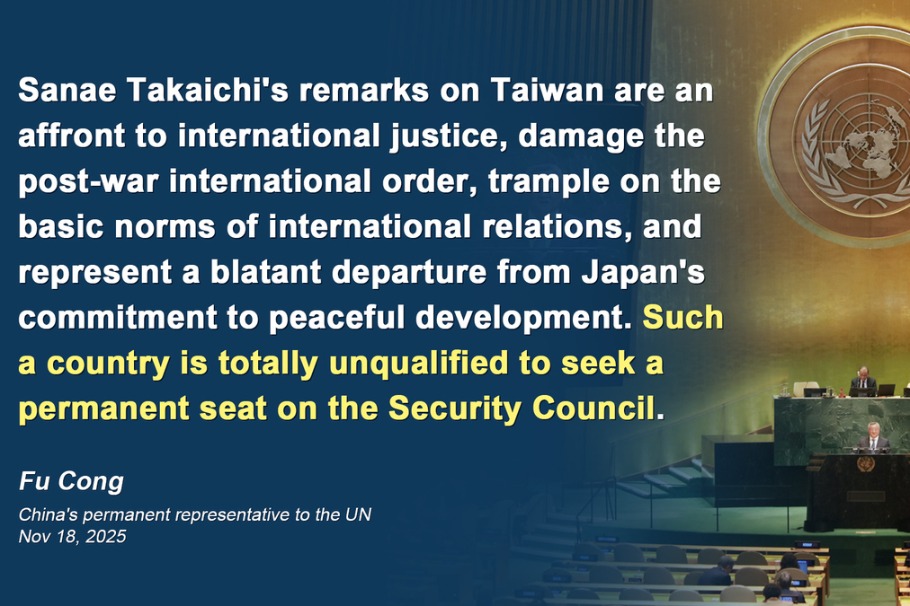

- Japan's PM seen as playing to right wing

- Mainland increases entry points for Taiwan compatriots

- China notifies Japan of import ban on aquatic products

- Envoy: Japan not qualified to bid for UN seat

- Deforestation is climate action's blind spot

- Japan unqualified for UN Security Council: Chinese envoy