Huge servings to be had in movable feast

| The headquarters of Alipay's mobile payment service at e-commerce giant Alibaba Group Holding Ltd in Hangzhou, Zhejiang province. Han Chuanhao / Xinhua |

As mobile devices change the way chinese live, the number of financial transactions done using new methods is skyrocketing

The number of non-cash financial transactions in China that went through the banking system and that were paid by mobile devices tripled last year compared with the year before, a central bank report says. Such payments accounted for 3 percent of all non-cash transactions, it says.

The number of mobile payments rose 213 percent to 1.67 billion, with a total value of 9.64 trillion yuan ($1.5 trillion; 1.18 trillion euros), more than 317 percent higher than the year before, says the annual review of the payments system issued by the People's Bank of China.

The number of non-cash payments, including debit and credit card payments, rose 21 percent to 50.16 billion over the year, with a total value of 1,607.56 trillion yuan, nearly 25 percent higher than the year before.

Growth for most non-cash payment instruments and methods, such as credit cards and online banking, was in the double digits.

The central bank figures on transactions do not include payments through the third-party mobile market, which when taken into account make the rise in the number of transactions and their value even more striking.

The consultancy iResearch Group says that over the year the value of transactions in China using third-party mobile payment methods, such as Alipay, the e-payment arm of Alibaba Group Holding Ltd, rose 707 percent to 1.2 trillion yuan.

The building of Internet infrastructure and the growing number of Chinese getting access to the Internet through their mobile phones are just two of the reasons behind the adoption of mobile payments in China, says Li Ye, an analyst with Analysys International, a Beijing Internet consultancy.

The main reason for the skyrocketing growth of the third-party mobile payment market is that many e-payment companies offer incentives to encourage people to transfer their money or make purchases using mobile devices, Li says.

"Many of the Internet giants such as Alibaba and Tencent Holdings Ltd have been trying to push users from PC-based payment solutions to mobile-based ones because they see a promising future in mobile Internet. Payments are a gateway to secure as many users as possible in the era of mobile Internet."

Banks are lagging behind in mobile payments compared with Internet companies, Li says. "Internet companies have built many contexts for people to pay though mobile devices. For example, there are apps for people to buy cinema tickets or book taxis though mobile phones.

"What banks offer right now are exactly the kind of services they offer on their websites," she says, adding that the only opportunities banks have in mobile payment lies in near-field communication technology, which allows customers to use a special mobile phone equipped with specific smartcard wave bands to enable payment by placing a phone near a reader module.

Early this month, Li Dongrong, deputy governor of the People's Bank of China, says in an interview that China established its first national mobile payment platform using near-field communication technology as part of an effort to boost a modern form of non-cash payment.

The platform, which began trial operations at the end of last year, has been connected to the mobile payment branches of seven organizations, including China Construction Bank Corp, China CITIC Bank Corp Ltd, China Everbright Bank Co Ltd, China UnionPay and telecom operator China Mobile Communications Corp.

Although the People's Bank of China has given strong support to develop near-field-communication-based mobile payments, Wang Weidong, an analyst with iResearch, says much more needs to be done before the technology can compete with the popular Internet-based mobile payment system.

Jiang Xueqing contributed to this story.

mengjing@chinadaily.com.cn

(China Daily Africa Weekly 02/21/2014 page22)

Today's Top News

- Japan's PM seen as playing to right wing

- Mainland increases entry points for Taiwan compatriots

- China notifies Japan of import ban on aquatic products

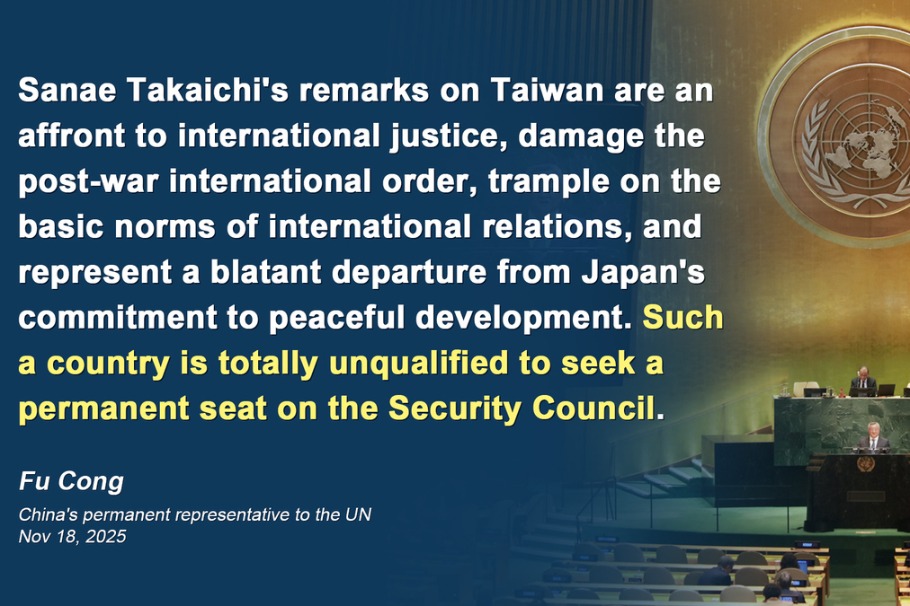

- Envoy: Japan not qualified to bid for UN seat

- Deforestation is climate action's blind spot

- Japan unqualified for UN Security Council: Chinese envoy