Broader horizons

|

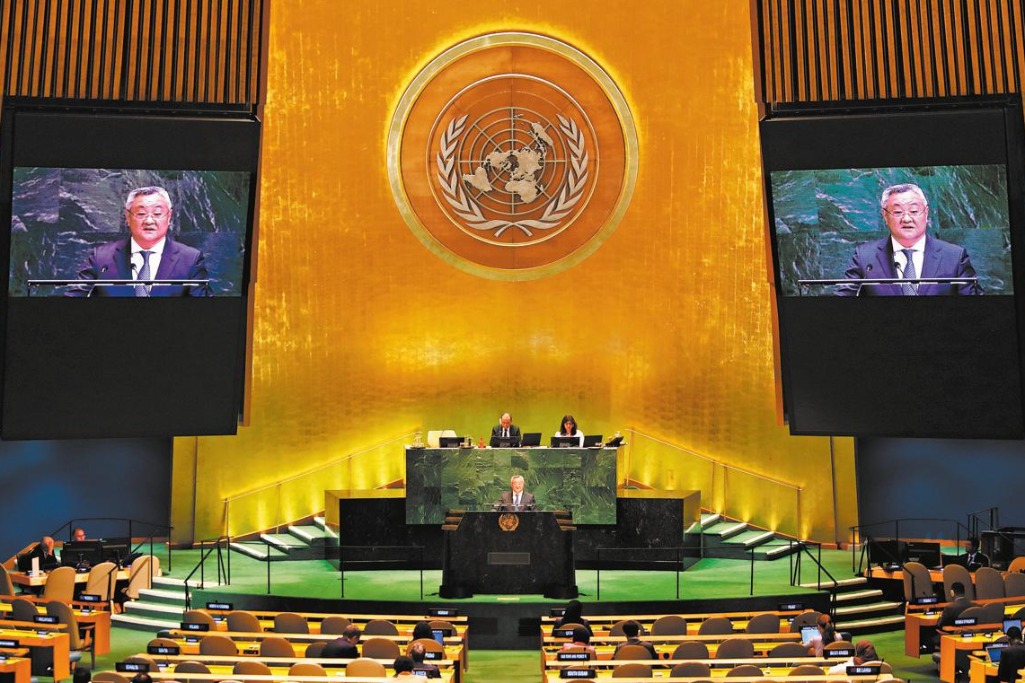

Paul Cheng, chairman of Hong Kong-based private equity concern China High Growth. Edmond Tang / China Daily |

"Nominal ODI has actually increased 10 times over the same period, but it doesn't mean there is 10 times more activity since China's GDP has quadrupled. This is a very significant increase, however, and shows how international China is becoming."

What of the significance of ODI becoming bigger than FDI? Most economists agree that it has very little real macroeconomic significance.

However, if there was a major imbalance between the two, there could be issues for capital inflows and outflows that could be destabilizing.

ODI does, nonetheless, provide an alternative for China to pare down its foreign currency reserves, which hit a record $3.82 trillion in January, without the usual recourse to buying US Treasury bonds, which typically does not generate very high returns.

Klaus Meyer, professor of strategy and international business at the China Europe International Business School, says the equalization target itself has little real relevance.

"I think it is largely of symbolic value reflecting that China is now an outward player and not an inward player. The government likes to set symbolic targets to motivate people. It catalyzes effort and gets people moving."

There could be cases in which increased ODI would be adverse for the Chinese economy.

"The worst-case scenario is that some companies take their money out of the country as in capital flight, which would not be good for China. There is a not insignificant part of Chinese overseas investment that goes to such places as the Bahamas and British Virgins Islands, although some of that comes back."

Paul Cheng, chairman of Hong Kong-based private equity concern China High Growth and a former member of the Hong Kong Legislative Council, says Chinese companies may move away from resources investment in the developing world simply because assets are now cheap in Europe and the United States as a result of the financial crisis.

"I expect to see a lot more investments over the next five to 10 years. It is an opportunity for Chinese companies to acquire technology instead of relying on their own home-cooked research and development," he says.

"They can also acquire consumer brands. Very few Chinese companies have global brands, and even their names are a no-go as far as Western consumers are concerned."

Pelham Smithers, managing director and founder of Pelham Smithers Associates, a London-based research firm that focuses on technology issues, says it is important not to get carried away by hype when discussing Chinese ODI.

"It does strike me that compared with Japan in the 1980s, China is still surprisingly reticent. I think partly the reason for this was that Japan developed a bad relationship with Washington 25 years ago and there is a sense that this could happen very quickly with China if they were to step up activity."

He says those who think that Lenovo buying IBM's low-end server business for $2.3 billion in January is a trend forget that its purchase of the US company's PC business took place almost nine years ago.

"To say this is a trend in Lenovo's case is questionable given that they were such an early mover on this. The clue to the significance of this deal is in the term low-end. The US will remain very protective of the high-end technology that China purportedly requires."

While China's overall ODI may be increasing, China's FDI is also changing in character.

From the 1990s onwards much of the FDI in China was in low-cost manufacturing.

Today's Top News

- CPC holds symposium to commemorate 110th birth anniversary of Hu Yaobang

- Economy seen on steady track

- Trade-in program likely to continue next year

- Li: SCO can play bigger role in governance

- Huangyan Island protection lifeline for coral ecosystem

- Latin America urgently needs green credit