Rebalancing of the economy is good

Behind the slowdown of the growth rate is the necessary shift to a new sustainable model

Once again, all eyes are on emerging markets. Long the darlings of the global growth sweepstakes, they are being battered in early 2014. Perceptions of resilience have given way to fears of vulnerability.

The US Federal Reserve's tapering of its unprecedented liquidity injections has been an obvious and important trigger. Emerging economies that are overly dependent on global capital flows - particularly India, Indonesia, Brazil, South Africa, and Turkey - are finding it tougher to finance economic growth. But handwringing over China looms equally large. Long-standing concerns about the Chinese economy's dreaded "hard landing" have intensified.

In the throes of crisis, generalization is the norm; in the end, however, it pays to differentiate. Unlike the deficit-prone emerging economies that are now in trouble - whose imbalances are strikingly reminiscent of those in the Asian economies that were hit by the late-1990s financial crisis - China runs a current-account surplus. As a result, there is no risk of portfolio outflows resulting from the Fed's tapering of its monthly asset purchases.

Yes, China's economy is now slowing; but the significance of this is not well understood. The downturn has nothing to do with problems in other emerging economies; in fact, it is a welcome development. It is neither desirable nor feasible for China to return to the trajectory of 10 percent annual growth that it achieved in the three decades after 1980.

Yet a superficial fixation on China's headline GDP growth persists, so that a 25 percent deceleration, to a 7 to 8 percent annual rate, is perceived as somehow heralding the end of the modern world's greatest development story. This knee-jerk reaction presumes that China's current slowdown is but a prelude to more growth disappointments to come - a presumption that reflects widespread and longstanding fears of a broad array of disaster scenarios, ranging from social unrest and environmental catastrophes to housing bubbles and shadow-banking blowups.

While these concerns should not be dismissed out of hand, none of them is the source of the current slowdown. Instead, lower growth rates are the natural result of the long-awaited rebalancing of the Chinese economy.

In other words, what we are witnessing is the effect of a major shift from hyper-growth led by exports and investment (thanks to a vibrant manufacturing sector) to a model that is much more reliant on the slower but steadier growth dynamic of consumer spending and services.

The problem, as I argue in my new book, Unbalanced: The Codependency of America and China, is not with China, but with the world - and the United States, in particular - which is not prepared for the slower growth that China's successful rebalancing implies.

The codependency construct is rooted in the psychopathology of human relationships whereby two partners, whether out of need or convenience, draw unhealthy support from each other. Ultimately, codependency leads to a loss of identity, serious friction, and often a nasty breakup - unless one or both of the partners becomes more self-reliant and strikes out on his or her own.

The economic analogue of codependency applies especially well to the US and China. China's export-led growth miracle would not have started in the 1980s without the American consumer. And China relied heavily on the US dollar to anchor its undervalued currency, allowing it to boost its export competitiveness.

The US, for its part, relied on cheap goods made in China to stretch hard-pressed consumers' purchasing power. It also became dependent on China's savings surplus to finance its own savings shortfall (the world's largest), and took advantage of China's voracious demand for US Treasury securities to help fund massive budget deficits and subsidize low domestic interest rates.

China's rebalancing will enable it to absorb its surplus savings, which will be put to work building a social safety net and boosting Chinese households' wherewithal. As a result, China will no longer be inclined to lend its capital to the US.

For a growth-starved US economy, the transformation of its codependent partner could well be a fork in the road. One path is quite risky: If the US remains stuck in its under-saving ways but finds itself without Chinese goods and capital, it will suffer higher inflation, rising interest rates, and a weaker dollar. The other path holds great opportunity: the US can adopt a new growth strategy - moving away from excess consumption toward a model based on saving and investing in people, infrastructure, and capacity. In doing so, the US could draw support from exports, especially to a rebalanced China.

Compared with other emerging economies, China is cut from a different cloth. China emerged from the late-1990s Asian financial crisis as the region's most resilient economy, and I suspect the same will be true this time. Differentiation matters - for China, Asia, and the rest of the global economy.

The author, a faculty member at Yale University and former chairman of Morgan Stanley Asia, is the author of Unbalanced: The Codependency of America and China. The views do not necessarily reflect those of China Daily.

(China Daily Africa Weekly 03/07/2014 page12)

Today's Top News

- Mainland increases entry points for Taiwan compatriots

- China notifies Japan of import ban on aquatic products

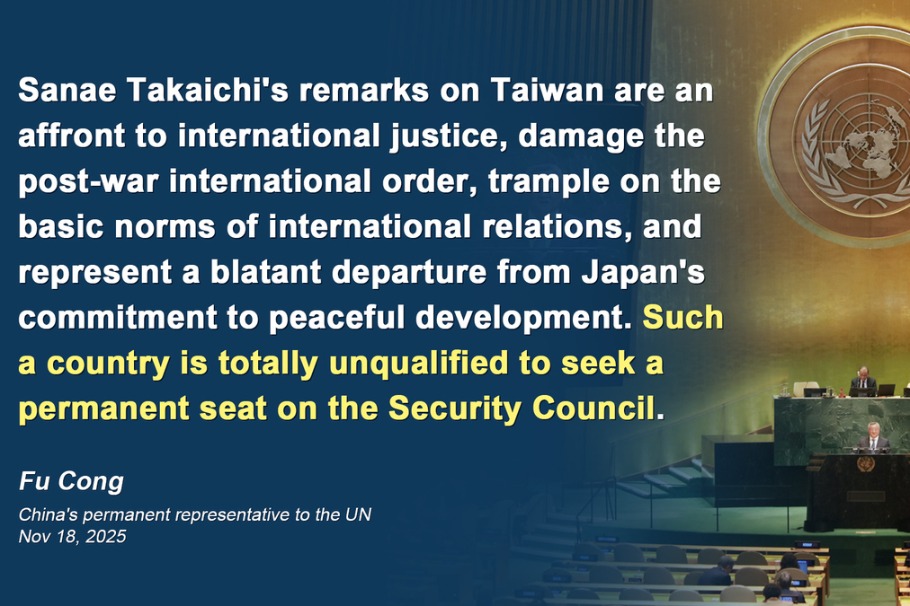

- Envoy: Japan not qualified to bid for UN seat

- Deforestation is climate action's blind spot

- Japan unqualified for UN Security Council: Chinese envoy

- China, Germany reach outcomes after discussions