China's reforms 'hitting right note': expert

|

|

China has to go through a "very, very painful economic restructuring process" to rebalance the economy, but its reform efforts so far have been "hitting the right note", says a long-time hedge-fund manager.

Guo Shengbei, founder and CEO of hedge fund GSB Podium Advisors, said that he has always maintained a bearish outlook on the Chinese economy, which has relied on investment and export-driven policies. A strength of Chinese economic growth was its exports to other countries and using its foreign reserves as savings. Despite this approach, it totally stopped in 2008 after the financial crisis, but Guo said that China has done well in reforming its financial system ever since.

|

| Liu Xiaoguang, from the Ministry of Economic and Commercial Affairs of the Consulate General of the People's Republic of China in New York, giving remarks at the 2014 US-China Investment Forum held in New York on Wednesday. |

Guo, a former managing director of Deutsche Bank and former vice-president at Morgan Stanley, made his remarks on Wednesday in New York at a panel discussion on China's capital market. It was organized by the Chinese Business and Culture Development Center in North America.

"China will become a very important financial player, not measuring purely from the size of China's stock market. I'm talking about China's connection to the international market place," Guo said. "That is going to become a very, very important force in the future. I think the global financial system is decisively shifting into China's favor in the next couple of years."

|

| Jennifer Carpenter, associate director of the Stern Center for Global Economy and Business at New York University, giving keynote remarks at the 2014 US-China Investment Forum held in New York on Wednesday. |

Liu Xiaoguang, consul in charge of economic and commercial affairs at the Consulate of China in New York, offered similar comments, saying that China's economy has gotten off to stable start this year, with first-quarter GDP measuring 7.4 percent.

"Statistics show that urban employment continued to increase. Individual income, corporate profits and fiscal revenue registered steady growth," he said. "Consumer prices remain stable. Growth of electricity consumption started to rise and there were positive dynamics and also adjustments."

|

| Panelists at a discussion on the China capital market in New York on Wednesday. From left to right: Kevin Chen, founder and CIO of Anji Capital Management; Yi Du, a former associate principle scientist at the Merck Research Lab; CK Zheng, managing director at Credit Suisse; Jack Meola, partner of EisnerAmper; Guo Shengbei, founder and CEO of GSB Podium Advisors. |

Liu reiterated remarks made after the third plenum in November, saying that the government seeks to deepen reform and will let the market play a decisive role in the economy. China will seek to establish a stronger service sector — which Liu said was a "weak link" in the economy right now—and one of the ways of doing that is opening up its capital market, demonstrated by the establishment of the Shanghai-Hong Kong stock exchange connectivity, announced earlier in April.

"This will further promote two-way opening up and establish a healthy development of capital markets on the mainland and in Hong Kong," Liu said. "We will continue to raise the level and quality of opening up by showing a deeper integration with international markets."

China's outbound investment was around $4 billion last year, 2 and a half times greater than the year before, and has invested $1 billion in the US in this year's first quarter, according to Liu. The country is also no longer requiring that outbound investments of under $1 billion be subject to approval, Liu said, which will further open up China's capital market.

"We're happy to see businesses improving in the US, indicating the climbing up of its economy, and attracting more investors from China," he said. "Most of us believe that things are getting better. As all of us survived the crisis, this means more and more opportunities are emerging."

Jennifer Carpenter, a professor of finance at New York University, took a more measured stance and said that systemic risk in China's financial system is "great" and may be getting greater over time.

After the financial crisis, economists charted how much each country would need in case bailouts for another crisis were necessary, and China has jumped from needing the sixth largest amount in 2012 to switching with Japan in 2013 to needing the highest or second highest amount.

"China's now topping the charts for systemic risk by these measures," Carpenter said.

Today's Top News

- Control of precursor chemical exports tightened

- Xi greets Ouattara on reelection as Cote d'Ivoire president

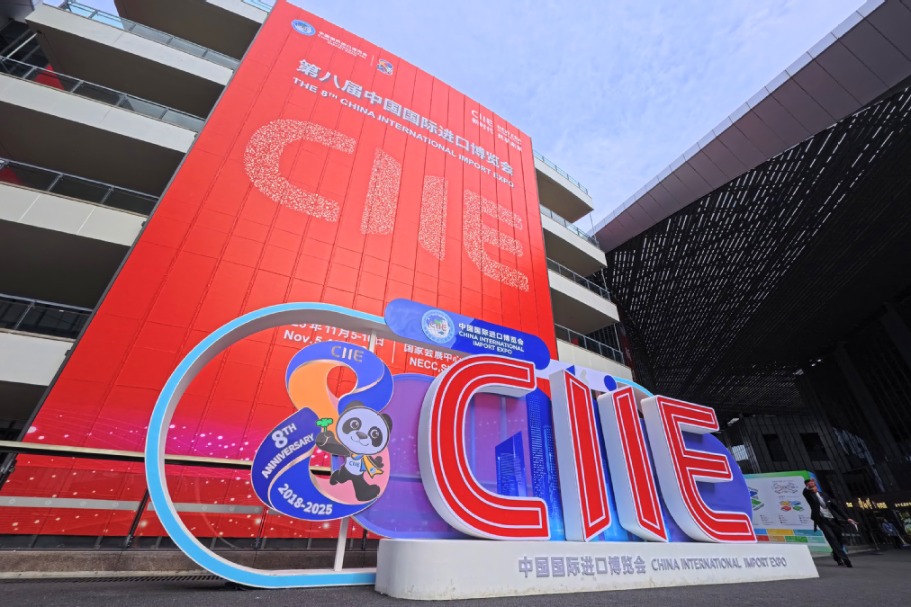

- CIIE displays innovation, global confidence in China

- Nation set to sharpen focus on key sectors

- Nation condemns Japan PM's remarks

- Spanish king on first state visit to China