Chinese financier faces fraud charges

Benjamin Wey, a Chinese-born Wall Street financier, was indicted on Thursday for engineering so-called Chinese "reverse mergers" and then manipulating stock prices to earn millions of dollars in illegal profits.

The US Attorney's Office for the Southern District of New York charged Wey and his Swiss banker, Seref Dogan Erbek, with securities fraud, wire fraud, conspiracy and money laundering in an eight-count indictment unsealed in Manhattan federal court in New York City. The most serious securities fraud charge against the two men carries a top sentence of 25 years in prison.

"Mr Wey denies the charges against him and looks forward to clearing his name," said Wey's attorney David Siegel, according to Reuters.

The 43-year-old Wey, founder of New York Global Group, was in the news in June when he was found liable in an unrelated lawsuit claiming he sexually harassed a former employee, Swedish model, Hanna Bouveng, and then falsely smeared her as a prostitute and drug addict. A Manhattan jury in June awarded Bouveng $18 million.

Meanwhile, the US Securities and Exchange Commission (SEC) also filed a civil lawsuit against Erbek, Wey, his sister, his wife Michaela Wey, and two US attorneys for being part of the scheme.

The SEC alleges Wey and New York Global Group typically structured reverse mergers between clients and publicly-traded shell companies in such a way that he and other family members secretly obtained ownership interests of more than 5 percent of the newly listed companies.

To avoid detection and evade SEC reporting requirements as beneficial owners, they divided their shares among a vast network of foreign accounts and generated tens of millions of dollars in illegal profits as they sold the securities into artificially-inflated markets, according to the SEC lawsuit.

The alleged illicit profits eventually circled back to Wey and his wife, who used the money to finance a lavish lifestyle, according to prosecutors.

Wey offered to help Chinese companies seeking to raise US capital by arranging reverse mergers in which a closely-held firm buys a shell company already public on an exchange, allowing them to list shares without the scrutiny of a public offering, according to the SEC lawsuit.

Reuters and Bloomberg contributed to this story.

paulwelitzkin@chinadaily.com

(China Daily USA 09/11/2015 page2)

Today's Top News

- China expresses worry over Japan's military and security moves

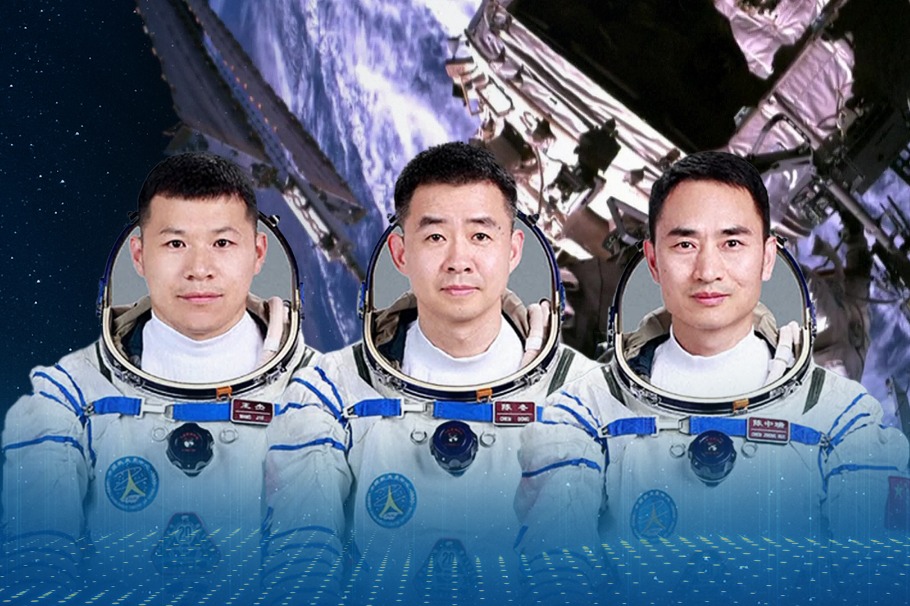

- Shenzhou XX mission crew returns after debris delays landing

- China warns Japan of 'heavy price' for any military interference in Taiwan

- Japan will only suffer a crushing defeat should it dare to take a risk: Defense spokesperson

- Tokyo must stop playing with fire: Editorial flash

- China's Shenzhou XX crew en route back to Earth