An easy choice to make

If you're tired of concept stocks, you can always just pick any of the major airlines and relax in the comfort of knowing they will be supported by the ever expanding travel market on the Chinese mainland.

Lately, there's another reason to top up on mainland airline shares, some of which are listed in Hong Kong. Leading State-controlled airline companies will see their profits boosted by the exponential growth in overseas travel as more and more mainland people go overseas for business or leisure.

The average yield of long-haul international flights is significantly higher than that of domestic flights where heavy discounts are the norm.

Many stock analysts and investors believe the focus on developing international business will reshape the industry. Not surprisingly, there have been a number of reports of impending mega mergers among the big air carriers.

The regulatory authorities' denials of such reports, apparently, have not dampened investor interest in airline stocks. Share prices of major companies in the sector, including Air China, China Southern and China Eastern, have continued to surge.

The reasoning is simple. Merger is the most logical and practical way for competing airlines to maximize profits from international flights.

The number of overseas routes is determined by government-to-government bilateral agreements. Those routes are then split among the carriers. Mergers, therefore, would help airline companies better achieve economies of scale which is of particular importance to the industry that's known for high overhead costs and slim profit margins.

The authoritative Shanghai Securities News reported recently that Beijing-based Air China Ltd and Guangzhou-based China Southern Airlines Co Ltd were planning to merge, but this was denied by both airlines.

However, stock analysts and industry sources have been quoted as saying that a tie-up between these two airlines would make sense as it could ease infighting among State-controlled carriers for the coveted routes to destinations in the US, Europe and Australia - routes that are most favored by mainland travelers.

On the day Shanghai Securities News published the report, shares of both Air China and China Southern soared by the daily limit of 10 percent, while the stock price of China Eastern, which was not mentioned in the report, picked up more than 7 percent.

Investors seem convinced there'll be some form of restructuring of the mainland's airline industry that would benefit major carriers. If you're one of them, it should be an easy choice - just go for some of the biggest industry players.

Today's Top News

- China expresses worry over Japan's military and security moves

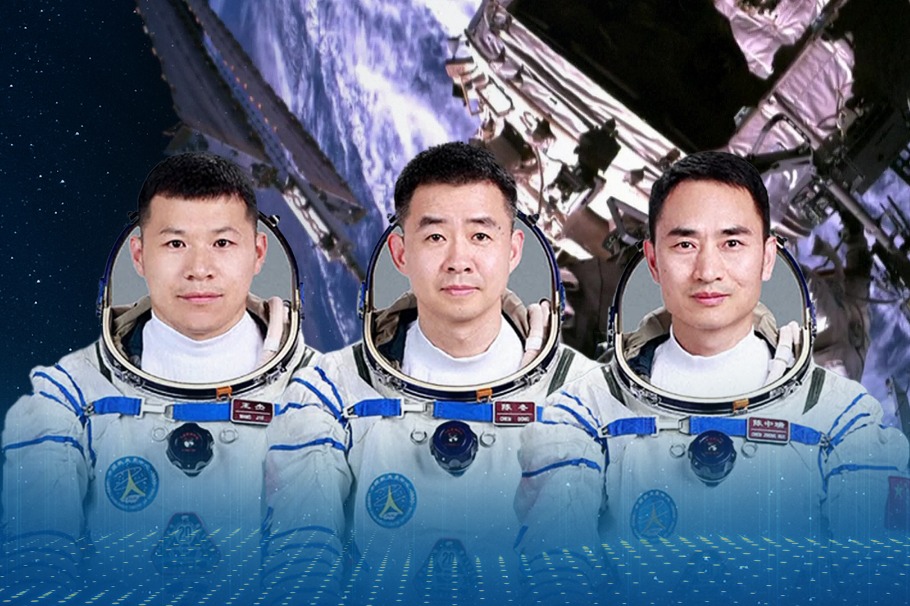

- Shenzhou XX mission crew returns after debris delays landing

- China warns Japan of 'heavy price' for any military interference in Taiwan

- Japan will only suffer a crushing defeat should it dare to take a risk: Defense spokesperson

- Tokyo must stop playing with fire: Editorial flash

- China's Shenzhou XX crew en route back to Earth