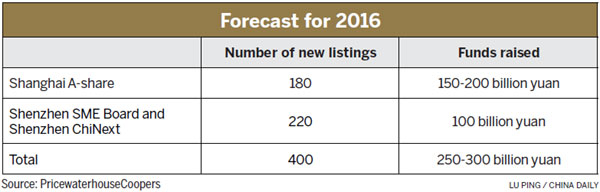

IPO fundraising set to top $38 billion

Fundraising by Chinese companies submitting new initial public offerings in 2016 is expected to make the A-share IPO market the biggest one globally, accounting firm PricewaterhouseCoopers said on Jan 4.

IPOs are expected to hit 250 billion yuan to 300 billion yuan ($38 billion to $46 billion; 35.5 billion to 42.6 billion euros) this year.

The number of new IPOs is expected to reach 400, fueled by the registration-based IPO system and the launch of the Strategic Emerging Industries Board, says Frank Lyn, PwC China and Hong Kong Markets leader.

"We believe such measures will positively influence IPO activities, and the acceleration of the registration system will further open up and enhance the A-share market," he says.

"Due to differences in estimated value in different capital markets, the trend of Chinese companies returning to A shares is expected to continue."

China will launch a registration-based initial public offering system in March to boost the role of the country's stock market and provide the necessary financing for companies.

"The core of registration systems is to enhance information disclosure to ensure issuers and intermediaries take responsibility," says Jean Sun, PwC China assurance partner. "Companies planning to list should pay attention to the quality and sufficiency of information disclosure."

PwC also surveyed emerging enterprises and potential IPO applicants and found 80 percent were planning to go public in the domestic capital market.

Key concerns of emerging enterprises pointed to ambiguous time frames required to verify applicants, nontransparency of initial public offering procedures, and financial conditions and profit requirements to qualify applicants.

The same companies surveyed expect both the new registration system with the Strategic Emerging Industrial Board can alleviate concerns to some extent, according PwC's findings.

Ernst & Young, another international accounting firm, predicted last week that the number of IPO deals is likely to surpass 350 this year.

There were 219 IPOs in 2015 on the Shanghai and Shenzhen stock markets, compared with 125 in 2014, PwC's statistics showed. Despite a listings suspension from July to November last year, fundraising reached 158.6 billion yuan, an increase from 78.6 billion in 2014.

Global capital markets fluctuated due to uncertainty in the global economy. However, the Hong Kong capital market remained relatively stable and strong. Total funds raised were 215.7 billion yuan, an increase of 12 percent compared with 2014.

Hong Kong surpassed the United States to become the largest capital market in 2015. Funds raised on the New York Stock Exchange and Nasdaq totaled 211.6 billion yuan to rank the second highest in the world.

huyuanyuan@chinadaily.com.cn

(China Daily European Weekly 01/08/2016 page25)

Today's Top News

- National Games an embodiment of China's strength, unity and progress: China Daily editorial

- Xi declares 15th National Games open

- Xi attends opening ceremony of 15th National Games

- Xi meets national honorees in sports

- Xi meets IOC president, honorary president

- China suspends part of control measures on dual-use items export to US