Huarong speeds up Shanghai listing

|

| A man passes by the booth of China Huarong Asset Management Co at an international finance expo in Beijing, Oct 27, 2016. [Photo provided to China Daily] |

China Huarong Asset Management Co Ltd, the country's biggest distressed debt manager, is accelerating the process of listing on the A-share market, hoping to use the proceeds from the share offering to expand its core business, its chairman said on Thursday.

|

| Lai Xiaomin, chairman of China Huarong |

"We will use the funds raised from the A-share listing to expand our core business in distressed asset management, to better serve the real economy and to support projects under the Belt and Road Initiative," Lai Xiaomin, chairman of China Huarong, told a news conference.

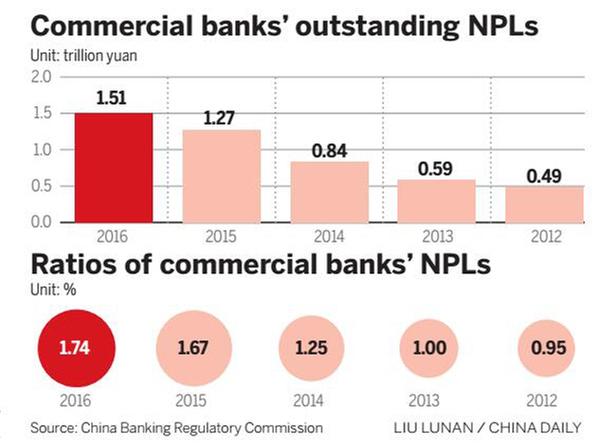

Lai said nonperforming loans of Chinese commercial banks would continue to increase in the next three to five years, adding however that the current amount of bad debts in the banking system was under control.

The chairman added that China Huarong would continue to consolidate its market-leading position to facilitate the exit of loss-making "zombie" companies and to support the debt-for-equity swaps of commercial banks.

With a total of 1.41 trillion yuan in assets under management, China Huarong reported a net profit of 23.1 billion yuan last year, surging 36.3 percent from the year earlier.

More than 30 local bad debt asset managers were established as the government stepped up efforts to address the rising bad loans and to contain the build-up of financial risk amid slowing economic growth.

Zeng Gang, director of banking research at the Institute of Finance and Banking in the Chinese Academy of Social Sciences, said the value of bad loans in the commercial banks will continue to rise, so there will continue to be strong demand for the bad asset management business.

"While some banks have seen reduced pressure on their balance sheets, the outstanding value of bad loans will still likely rise," Zeng said.