Reform in financial sector imperative for progress

Healthy financial institutions are a prerequisite for preventing a financial crisis, as central bank governor Zhou Xiaochuan rightly pointed out at this year's Lujiazui financial forum in Shanghai on Tuesday.

Zhou made the comment while encouraging broader and longer-term financial opening-up.

The country faces a variety of challenges in its financial sector, so the emphasis on greater government efforts to advance reforms is welcome, as in this way the country will be better able to preempt a crisis stemming from its financial risks.

In the Government Work Report he delivered to the 12th National People's Congress in March, Premier Li Keqiang issued a strongly worded statement cautioning that strict vigilance was needed to guard against the financial risks accumulated through nonperforming loans, bond defaults, shadow banking, internet-based financial services and other instruments.

The financial sector has made many attempts at financial innovation and reform in recent years, such as in the field of internet-based finance. But regrettably, some of the many internet-based financial platforms that rapidly appeared turned out to be "financial bloodsuckers" engaged in illegal fundraising.

Also in the wake of the stock market debacles since the summer of 2015, investigations have revealed the murky connections between officials from the regulatory commission and the staff of securities firms, who joined hands to manipulate stock prices to the benefit of a few insiders.

Another major challenge the country faces is its high level of corporate debt. Although some international agencies have warned that China suffers from dangerously high debt levels, the fact is that China's government debts remain affordable. What is worrying is the debt on the corporate side. However, as China is "deleveraging" its economy, hopefully the corporate debt risk will gradually be reduced - in the same way that China is resolving the problem of its local government debt.

All these issues are symptoms of the financial sector's ill health, and policymakers must make more efforts to clean up and strengthen management in financial sector to remedy the risks.

One of the major tasks facing the government at present is to accelerate innovation and reform to equip the country's financial institutions with modern corporate governance structures; likewise, the growing number of State-owned financial enterprises with a presence in global financial arena need more modern management to be competitive.

To ensure the resilience and well-being of the financial sector, reform and innovation should not stop, as Wang Zhaoxing, vice-chairman of the China Banking Regulatory Commission, emphasized at Tuesday's forum.

Today's Top News

- China expresses worry over Japan's military and security moves

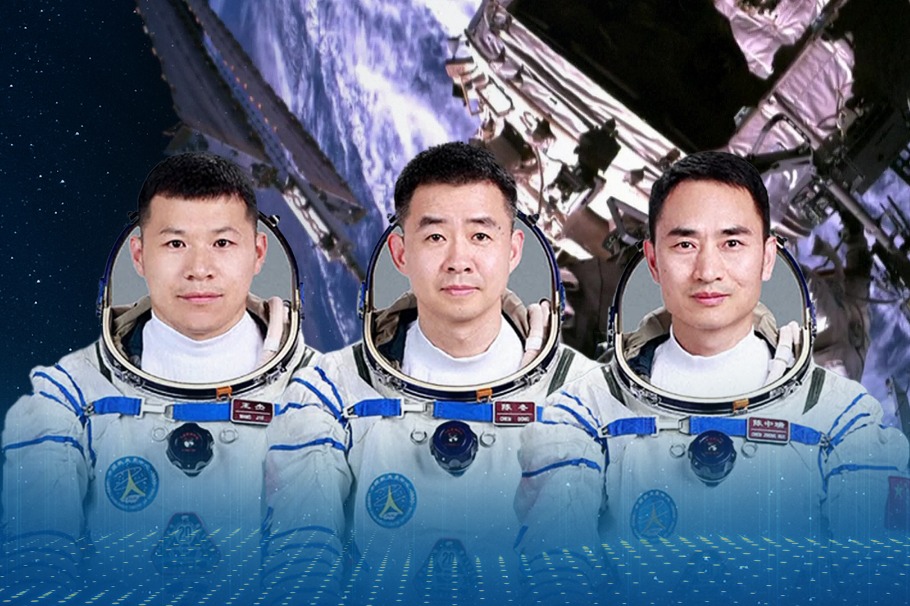

- Shenzhou XX mission crew returns after debris delays landing

- China warns Japan of 'heavy price' for any military interference in Taiwan

- Japan will only suffer a crushing defeat should it dare to take a risk: Defense spokesperson

- Tokyo must stop playing with fire: Editorial flash

- China's Shenzhou XX crew en route back to Earth