Dealmaker 'queen' makes her mark

Securities house boss Pollyanna Chu says being HK's richest woman isn't everything to her. She tells Duan Ting she'll work even harder to repay society.

Sitting on a colossal personal fortune estimated at bigger than Donald Trump's is no small deal even to business bigwigs, let alone the ordinary folk. But, to Pollyanna Chu Li Yuet-wah, it still seems there's nothing much to trumpet about.

Chu - one of Hong Kong's most eminent dealmaking entrepreneurs - sticks to a rigorous philosophy in life, eschewing extravagance and ostentatiousness, adamant that life must go on and that she has yet to do more for progress and repay society.

The 59-year-old came to China Daily's interview, minus the prodigal, lavish dress-up one would expect of her, and exhibiting traces of the humbleness that characterizes a handful of Asia's political greats.

Hong Kong was uppermost in her mind as she kicked off the discussion. "To me, Hong Kong is a blessed place that has achieved prosperous development and, with our renowned resilience, we have ridden out the storms in the past 20 years."

Currently as chief executive officer and executive director of Kingston Financial Group Ltd, which she co-founded with her husband 24 years ago and named after their son, Chu was named by Forbes in January as Hong Kong's richest woman and the city's 14th wealthiest individual.

It was a burning sensation to take the plunge into the securities trade that prodded her to return to her homeland Hong Kong in 1992, after having lived and studied in the United States to which she emigrated when she was just 18. Her alma mater was Golden Gate University in San Francisco, which specializes in law, business, taxation and accounting - fields that would be the trump cards for her future brokerage business in Hong Kong.

To Chu, she had crossed the Rubicon in opting to pick dealmaking and securities trading as her principal line of business in deference to property - an area in which she had done remarkably well while in the US. The cost of running a real-estate business was high and Hong Kong, at that time, was already in the clutches of well-entrenched developers, she recalls. Thus, the securities industry was the obvious choice and Chu got the ball rolling with the inception of Kingston Securities in 1993.

Foreign and local brokerages had an equal share of the city's securities business in the 1990s, but the subsequent collapse of local giant Peregrine Investments Holdings Ltd and other key players at the height of the 1997 financial crisis reshuffled the market.

Due to sound risk management, says Chu, Kingston Financial Group's business not only survived but flourished, and this fueled her optimism that, one day, her group could stand up to the likes of behemoths Morgan Stanley of the US or Nomura of Japan.

Eye on the mainland

"In the wake of the global financial turmoil in 1997, I also realized that focusing just on the brokerage business may restrict a company's growth," she says. Since 1999, the group has brought investment banking into its orbit and begun tapping business opportunities on the Chinese mainland. It went a step further and started bringing into Hong Kong mainland private enterprises that might not appeal to foreign investment banks when it comes to a listing on the Hong Kong stock market.

"The Hong Kong market is relatively small and I guess most of the local companies had already gone public on the bourse in the past 20 years."

China's admission to the World Trade Organization in 2001 was another watershed as the country's rapid opening-up led to blistering business competition on the mainland, with Hong Kong gradually emerging as the key and only offshore fund raising center for mainland companies engaged in such diverse fields as banking, insurance or information technology, fed by the huge market potential and capital stimulus.

"Our 17 years' experience in engaging with mainland enterprises, plus field visits across the boundary, has taught me a lot, including Chinese culture and history," says Chu.

While Kingston was not the only company involved in the business, she believes their knowledge of and expertise in mergers and acquisitions, particularly when it comes to small and medium-sized companies, gave them the aces over other investment banks.

In 2006, Kingston Financial was bestowed with the accolade of being at the top in terms of share placement and underwriting in the Hong Kong market, with the number of deals sealed hitting 47, followed by Haitong Securities and Guotai Junan Securities, according to Bloomberg. As a financial adviser on mergers and acquisitions, Kingston Financial finished third with 22 deals - behind Gram Capital Ltd and Somerley Capital Holdings Ltd.

Chu applauds the company's setting up of an investment banking unit focusing on small and medium-sized mainland enterprises and the listing of Kingston Financial in 2012 as milestones in the group's development, allowing it to get in touch with various business institutions.

In her view, the biggest change seen in the market in past two decades has been the influx and proliferation of mainland securities houses in Hong Kong, which currently account for more than half of the number operating locally. Foreign and Hong Kong brokerages make up the remaining 30 percent and 20 percent, respectively.

Chu sees mainland enterprises playing a more critical role in Hong Kong business life and, in the next five years, Hong Kong should ride high on the back of the nation-led Belt and Road (B&R) Initiative and the Guangdong-Hong Kong-Macao Greater Bay Area plan.

In this respect, Kingston is resolved not to miss the boat, having already established a branch in Shenzhen's Qianhai Free Trade Zone, but laments that development progress there has been slow.

Walking the extra mile

On her visits to several Asian countries, including Vietnam, Indonesia, Malaysia and the Philippines, earlier this year, she found many mainland companies have begun plowing much of their resources into those places, particularly in areas like real estate and infrastructure.

She's hopeful that with the Greater Bay Area coming on stream in the next decade, Hong Kong's market potential is promising, suggesting that the new HKSAR Government walk the extra mile by organizing more tours for local businessmen to help them explore the opportunities in the countries and regions along the B&R.

Chu finds comfort in that regulations in the local market have markedly improved over the years, beefing up assurances that with stricter licensing criteria for brokerages, it wouldn't be easy for them to go to the wall or shrug off their responsibilities to shareholders and investors alike.

As a member of the National Committee of the Chinese People's Political Consultative Conference, she has called for deeper cooperation between the Hong Kong and mainland financial sectors with regard to the CEPA (Closer Economic Partnership Arrangement), as well as the B&R and Greater Bay Area projects. Of interest would be to encourage institutions, including securities houses, to get involved in the bond market on the heels of the recent launch of the much awaited Bond Connect, which allows Hong Kong and foreign investors to tap into the world's third-largest bond market.

One word of caution though - the brokerage business, Chu says, is being largely impacted by the advance of technology, their leading business model has evolved into being internet driven with a faster and broader spread of news.

Contact the writer at

tingduan@chinadailyhk.com

(HK Edition 07/14/2017 page9)

Today's Top News

- Massive response to latest bonds issue

- Control of precursor chemical exports tightened

- Xi greets Ouattara on reelection as Cote d'Ivoire president

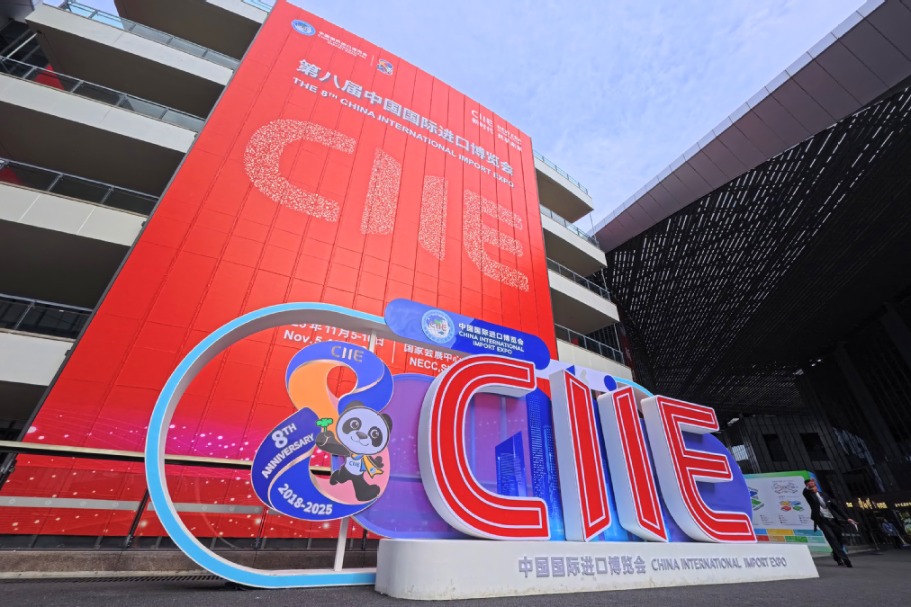

- CIIE displays innovation, global confidence in China

- Nation set to sharpen focus on key sectors

- Nation condemns Japan PM's remarks