Time for economies to build bulwarks

China should be making itself well prepared for the impacts and risks that might be brought by another global financial crisis

Financial crisis broke out in the world in 1998 and 2008, and so, if we calculate based on this, the next one is likely to break out in 2018. The elements that might trigger financial crisis in these two years are not clear yet, and perhaps are being postponed, so it is important for the world's economies to take advantage of the time window to become much stronger.

At the National Financial Work Conference, held in Beijing on July 14 and 15, financial risk control and deleveraging were put forward and will set the key tone of China's macroeconomic policies for the next five years. China should be well prepared for various kinds of impacts and risks that might affect the global economy.

Global debt increase is a fact but, apart from this, there are also other reasons that will make a global crisis likely.

First, the uncertainties of the appreciation of currencies will result in shocks in the global market. The US Federal Reserve is almost certain to reduce its balance sheet, and the central bank of the UK, the Bank of England, is about to appreciate its currency. The European Central Bank might quit its quantitative easing plan, so the European and US bonds' yields will have difficulties going upward.

Second, global debt is now almost reaching the ceiling. US public debt has almost reached a historic peak, its automobile loan default rate is climbing and its student loan debt has hit $1.4 trillion (1.4 trillion euros; £1.2 trillion).

Moreover, the eurozone hasn't fully recovered from economic crisis. The long-term low interest rates make it difficult for banks to get rid of bad debt on their accounting books. Refugee crises, security problems and the European debt crisis have been consistently bothering the eurozone.

Another factor is the property bubble. International experiences tell us that all financial crises in the past three decades have been related to the real estate industry. In the United States, property prices in San Francisco are now twice the level of 2008, and in China, real estate companies also have a over big debt scale. In 2016, China's per capita housing area was about 40.8 square meters, and there is already a surplus in China's real estate industry. There are also other factors - whether US president Donald Trump's position is stable, and whether his policies of reducing taxes will trigger another round of recession.

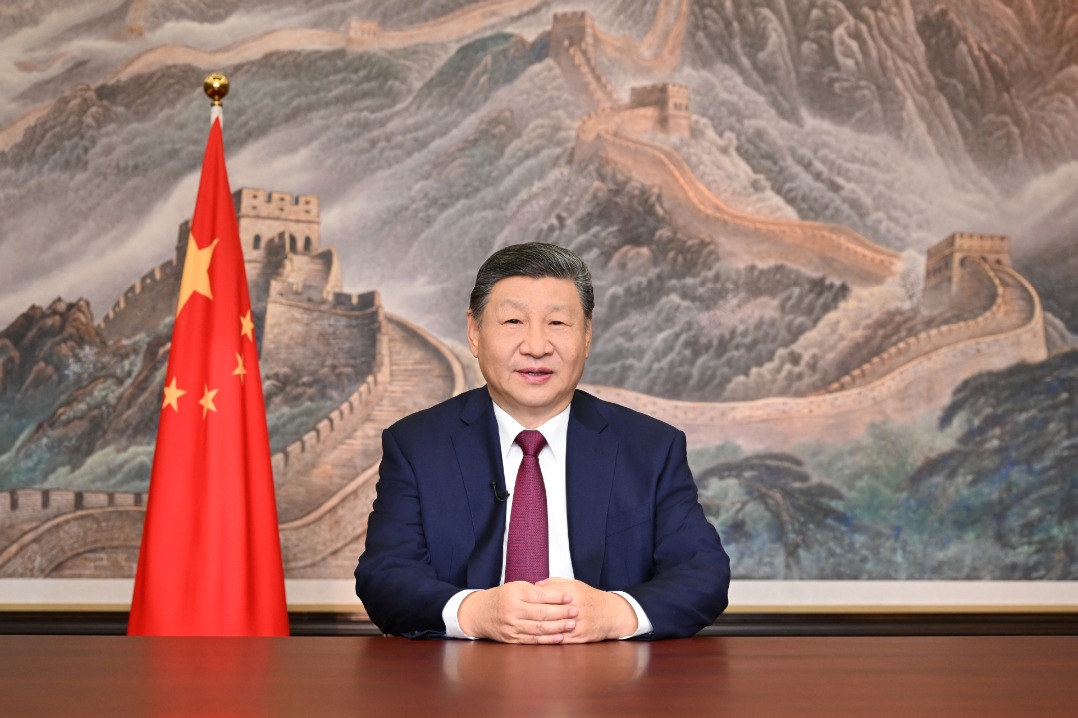

For China, preventing systemic financial crisis is the eternal subject of financial work. President Xi Jinping said during this year's National Financial Work Conference that China will set up the Financial Stability and Development Committee under the State Council. The establishment of the committee will help strengthen oversight of the financial system to contain risks.

At present, urgent steps are needed in several of China's sectors to prevent financial risks.

First, while global liquidity is tightening, it is important for China to be stricter with capital flight. Capital flight is the forewarning of financial crisis. Japan's economic recession was due to its large amount of capital outflow, which ended in the sluggish development of domestic industries. Before the Asia financial crisis occurred in 1997, Asian countries started largely holding US dollar assets, and there appeared an outflow of US dollar assets. In the first quarter of 2015, before China's stock market crash, China's international balance sheet showed signs of capital flight. So China should use big data and cross-border payment systems to monitor the latest trends of capital flight, and also combat activities, such as buying overseas real estate, football clubs and movie industries under the name of overseas investment led by the Belt and Road Initiative.

Second, reduce the bubbles in the property industry. The high leverage of the real estate industry means systematic risks. If owners sell domestic properties and send capital overseas, it will put big pressure on the stability of the renminbi exchange rate and also on China's foreign exchange reserves.

At present, China should make better infrastructure development for the third-and fourth-tier cities, including transportation and healthcare, to attract people to buy the currently unsold homes in these cities. Moreover, it should provide more vocational training to migrant workers so they can settle down in cities and realize China's urbanization. Moreover, there can be adjustments in terms of industries, for example making other infrastructure industries more integrated with property industries, so they can better push forward the infrastructure investment in countries involved in the Belt and Road Initiative.

The monitoring of financial innovations should also be strengthened. In the past few years, China's financial risks have occurred in different sectors, such as stock market, bonds, real estate, foreign currency and digital finance. It is important to have strong regulations and monitoring in these sectors through big data so they can perform well and innovate while containing risks.

China should also stabilize the renminbi exchange rate. The key for the internationalization of the renminbi is that it should stay relatively stable. It is only in this way that those overseas will have confidence in the renminbi. In the past, the reason that US dollars could replace the pound was because its exchange rate is relatively more stable. It is the same with other safe haven currencies, such as Japanese yen and Swiss franc.

Ding Jianping is director of the Research Center for Modern Finance at Shanghai University of Finance and Economics, and an academic committee member at the International Monetary Institute of Renmin University of China. Yang Jie is a PhD student at the university. The views do not necessarily reflect those of China Daily.

(China Daily European Weekly 07/28/2017 page12)

Today's Top News

- New Year's address inspiring for all

- Xi congratulates Science and Technology Daily on its 40th anniversary

- Xi congratulates Guy Parmelin on assuming Swiss presidency

- China Daily launches 'China Bound'

- Manufacturing rebounds in December

- PLA wraps up military drills around Taiwan