Steering to a future of shared mobility

Interesting options emerge for consumers, along with opportunities for operators

Over the past few decades, China's economy has developed in a leapfrog manner, and urbanization is steadily progressing. More and more cities have a mixed transportation model, including private transport (walking, bicycles, private cars), public transport (taxis, subway, light rail, bus) and shared mobility (car rental, car sharing, chauffeur services, shared bikes). These have improved the quality of life for many.

However, in the process of urbanization, most cities - including those with relatively mature infrastructure - are suffering from traffic congestion, air pollution, insufficient supply at peak hours and other problems.

Shared mobility has been attracting the most attention and investment, with many phenomenal startups having been created in a short period of time, like Didi in chauffeur services, Evcard in car sharing and Mobike in bike sharing.

These are my thoughts on vehicle-related sharing services:

CAR SHARING

Since the launch of CCClub in China in 2013, the Chinese car sharing market has experienced quick growth in fleet size and subscribed members. According to Roland Berger's recent research, this market is expected to maintain its rapid growth over the next five years, with fleet size growing by 45 percent per year. The market is mainly driven by three major factors:

Favorable government policies

Mature customers' attitude toward the sharing concept

Needs unfulfilled by other solutions, such as public transportation and taxis).

For the past two or three years, newcomers have been entering the car sharing market - traditional vehicle manufacturers (Daimler, Chang'an, BMW, GM), third party providers backed by manufacturers (Global Sharing, Greengo) or third-party independent technology companies (Ezzy, CCClub).

Business models vary but three major ones exist:

The round trip, or A-A station model, such as car2share

The one-way trip, or A-B model, such as EVcard

The free-floating, or X-Y model, such as car2go.

Despite the fact that multiple players exist, few are reaching the break-even point. The major reason is low utilization, leading to insufficient revenue and a burdened cost structure. In the future, although mobility solutions like taxis, chauffeur-based vehicles and public transport are expected to be mainstream solutions, I believe that car sharing will occupy an important place because of its unique value proposition, echoing the boom in shared bicycles.

Moreover, from a manufacturer's perspective, with the development of technologies such as connected vehicles and autonomous driving, the market will be more helpful to their future strategy.

CHAUFFEUR MARKET

The chauffeur market has been booming for the last three years. A chauffeur service is like a taxi service but it leverages private cars and leisure drivers. It has been rapidly and widely accepted by Chinese customers because it helps solve the two major pain points arising from taxi services - lack of capacity and poor in-car conditions.

Benefiting from a huge population and enormous demand, many chauffeur services have emerged in China, among them Didi, Shenzhou, Shouqi and Caocao. Didi is the undisputed market leader, with more than 17 million customers per day on average last year.

In order to ensure healthy and sustainable growth of the chauffeur market, the Chinese government has released a series of regulations. Requirements for vehicles and drivers are strictly defined:

Expansion is controlled by plate restrictions in cities such as Beijing and Shanghai, but these restrictions do not apply to new-energy vehicles, which are therefore more favored by operators

Chauffeurs need to provide quality service with a high standard of drivers and vehicles; thus low-end chauffeurs are not encouraged

Mobility platforms need to improve operational efficiency during expansion, as most of those comprising private cars will increase their operating costs due to purchasing or renting vehicles. Therefore, I foresee three major trends in the China chauffeur market:

Using more new-energy vehicles for chauffeur services: New-energy vehicles will play an important role in the chauffeur market. They have an advantage in cities with plate restrictions. Chauffeur operators tend to purchase NEVs to ensure enough vehicle capacity in such cities, which are critical marketplaces.

Second, NEV manufacturers generally struggle to sell cars to private customers, even with attractive subsidies from the government. Therefore, they have a strong incentive to partner with chauffeur platforms for fleet sales. Because of this, chauffeur services are in a better position to purchase NEVs at favorable prices.

Finally, use of NEVs can lower operating costs. NEVs for chauffeur services can break even within around two years, much earlier for conventional cars.

Launching customized chauffeur services: To differentiate themselves from taxis and charge premium rates, mobility platforms are trying to provide customized chauffeur services.

For instance, Shenzhou has special services for pregnant women and Didi has launched an eldercare chauffeur service and a "five-star" chauffeur service (using Mercedes, BMW and Audi cars).

Chauffeur services could also provide transport for children in the future. Zemcar, an American Uber-like platform, provides school and home pickups for kids 9 to 18 years old. It has background checks for drivers and realtime video monitoring to ensure security and build confidence among parents. In China, middle-class consumers look forward to this kind of service and are willing to pay more for it, a customer survey in Shanghai suggests.

Diving deeply into value chain for operational efficiency: China's chauffeur market has entered a new stage, having moved from wide-scale expansion to profit improvement. Therefore, operators need to focus on efficiency.

Car purchases are the first important brick in the value chain. Vehicle depreciation will contribute to more than 50 percent of total cost in the operating life cycle. There are multiple cost reduction options, among which discounts and customization of vehicles have proved effective. Manufacturers can provide fleet discounts.

Customized vehicles with lower specifications are another option for reducing costs. In Shanghai, special versions of the VW Touran and Santana are provided for the taxi market. Whether chauffeur players should apply vehicle customization depends on the operator's strategy.

Savings can also be made with specialized insurance strategies.

Repair and maintenance are critical to ensure vehicles stay in good condition and retain their value.

Supported by increasing customer demand and the upgrading of mobility services, I believe China's shared mobility market will continue to grow in the coming years. Citizens will be able to choose the most cost-effective and convenient mobility solution from public transportation, shared mobility, private vehicles, bike riding or a combination.

Looking even further into the future (later than 2025), when full autonomous driving arrives, the vehicle-related shared mobility market will see tremendous changes. Car sharing businesses could transform into "hub-based" robotic taxi services, while chauffeur services could become "floating" robotic taxi services. It is hard to determine now which robot-taxi model would win over another. Thus, I believe the current mobility service providers will all have a chance to redefine the future landscape of shared mobility.

The author is a Shanghai-based principal of Roland Berger. The views do not necessarily reflect those of China Daily.

(China Daily Africa Weekly 09/22/2017 page10)

Today's Top News

- China expresses worry over Japan's military and security moves

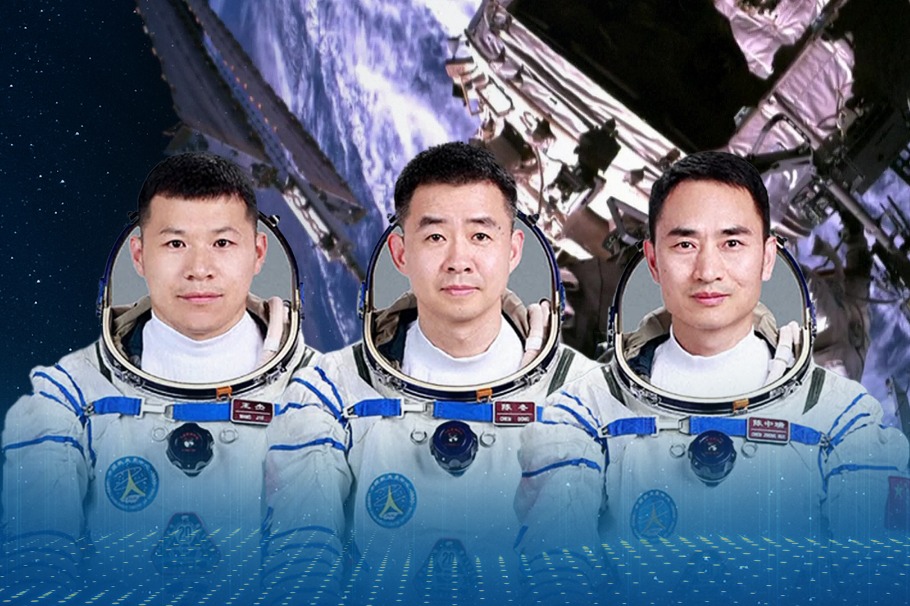

- Shenzhou XX mission crew returns after debris delays landing

- China warns Japan of 'heavy price' for any military interference in Taiwan

- Japan will only suffer a crushing defeat should it dare to take a risk: Defense spokesperson

- Tokyo must stop playing with fire: Editorial flash

- China's Shenzhou XX crew en route back to Earth