Cooling measures help curb property market speculation

|

| Visitors look at a model of a housing project at a real property exhibition in Beijing. [Photo provided to China Daily] |

Speculations in first-tier cities' real estate market have been effectively curbed as city-specific measures are gradually showing influence, according to a spokesman for National Bureau of Statistics.

In the first three quarters of the year, the real estate market has been playing a positive role in China's economic growth, while risks in the real estate market have also effectively dissolved, said Xing Zhihong, NBS spokesman.

The outlook for the real estate market is "stable", and efforts to decrease stocks in lower-tier cities are also achieving results, Xing said.

"Based on market data that we monitored, since August, new home prices in 15 first- and-second-tier key cities have been maintained unchanged, or been declining." And the growth of home prices "in Beijing, Shanghai, Guangzhou and Shenzhen has been slowing for 11 consecutive months," Xing said.

In second-tier cites, new home price growth has been declining for nine consecutive months, he said.

Efforts to destock the housing market in third-and-fourth-tier cities have been achieving positive results. By the end of September, the total space of home-to-sell dropped 12.2 percent to some 611 million square meters, which are mainly digested in lower-tier-cities thanks to city-specific measures, Xing said.

For first-tier cities, several measures have been taken to fill in the gap between supply and demand, such as increasing land supplies for housing projects.

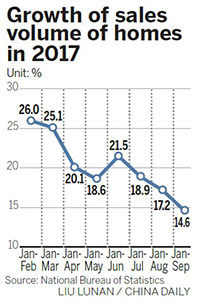

According to NBS data, the combined space of properties between January and September was 1.16 billion square-meters, a 10.3 percent year-on-year increase, with combined sales revenue of 9.19 trillion yuan ($1.39 trillion), a 14.6 percent year-on-year increase.

The index for real estate investment sentiment in China was 101.44 by the end of September, 0.02 higher than that in August, according to NBS, showing that the market is still growing in a steady and stable manner, analysts said.

"Active transactions in lower-tier cities are encouraging developers to tap on areas outside top-tier cities," said Yang Hongxu, an analyst with E-house China, a real estate services provider.

Real estate investments are more diversified, and developers have been exploring new models, according to a research note by Founder Securities.