Loose monetary policy not enough to boost economy, say experts

Taking advantage of monetary easing and infrastructure investment may no longer be sustainable methods of supporting economic growth, political advisers said on Monday, as tackling the slowdown in economic growth requires new motivation from the service and consumption sectors.

Before Premier Li Keqiang delivers the annual Government Work Report, which is scheduled on Tuesday, members of the 13th National Committee of the Chinese People's Political Consultative Conference said that a lower GDP target is rational, down to 6-6.5 percent from "around 6.5 percent", given the weaker demand and the decreasing labor force in a long term.

China could maintain GDP growth at above 6 percent by 2020, but the current driving force - mainly through stimulating infrastructure investment - needs to be adjusted, the CPPCC National Committee members said.

The economic structure needs to be further optimized, said Liu Shijin, deputy head of the 13th CPPCC National Committee's economic committee and a member of the central bank's monetary policy committee.

To support infrastructure investment, the government has conducted a proactive fiscal policy and injected liquidity in the financial sector to fund State-led projects.

But further easing monetary policy should not be on the agenda, suggested Liu. "Even a looser monetary money could not solve the problem of slipping potential GDP growth".

The People's Bank of China, the central bank, has opted for accelerated growth of broad money supply, or M2, in January, which rose to 8.4 percent from 8.1 percent at the end of last year.

Although the current money supply growth pace and amount of liquidity can satisfy the demands of economic growth, the total amount of money is in excess of real GDP and the macroeconomic leveraging level is still high. That requires maintaining a prudent stance on monetary policy, even during a downturn in economic growth, said the central bank adviser.

Liquidity support from the central bank, mainly through the five cuts to the reserve requirement ratio since last year, has led to a decline in financing costs in the credit market, and targeted at encouraging the bond issuance of both the corporate and government sectors to support infrastructure projects. Banks' lending also surged to a new high last month.

Political advisers predicted that the local government bond quota, which will be proposed to the top legislature on Tuesday, will increase by a large margin from last year's figure.

The quota for special-purpose bonds, a type of local government bond issued for infrastructure projects, may expand by 800 billion yuan from the quota in 2018, said a research note from Morgan Stanley.

Hu Xiaolian, a CPPCC National Committee member and chairwoman of the Export-Import Bank of China, said that credit growth will not maintain such a high growth rate in the long term, and the first quarter of each year usually sees faster credit expansion.

"The most influential factor (for credit growth) is fixed-asset investment, especially depending on infrastructure and manufacturing investment," Hu said.

"But we should care about any cliff-style drop of credit in the future," or a sudden slowdown in credit growth, Hu explained, because large policy changes may lead to unstable expectations among investors.

- 'Book of Songs' from Chinese imperial tomb proves oldest complete copy ever found

- Exhibition highlighting the 'Two Airlines Incident' opens in Tianjin

- Average life expectancy in Beijing rises to 83.93 years

- Energy drink overdose sends delivery worker to hospital

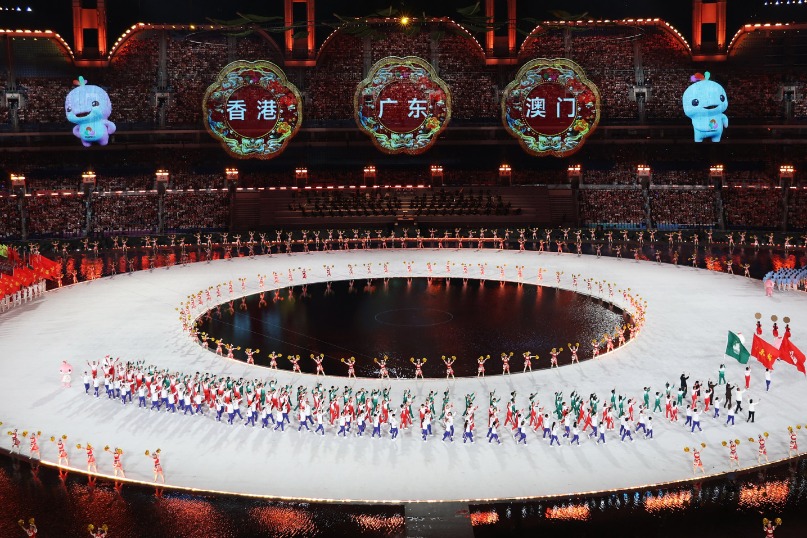

- GBA and Hainan deepening cooperation to boost innovation and sustainable growth

- Beijing mulls including the costs of embryo freezing and preservation in medical insurance