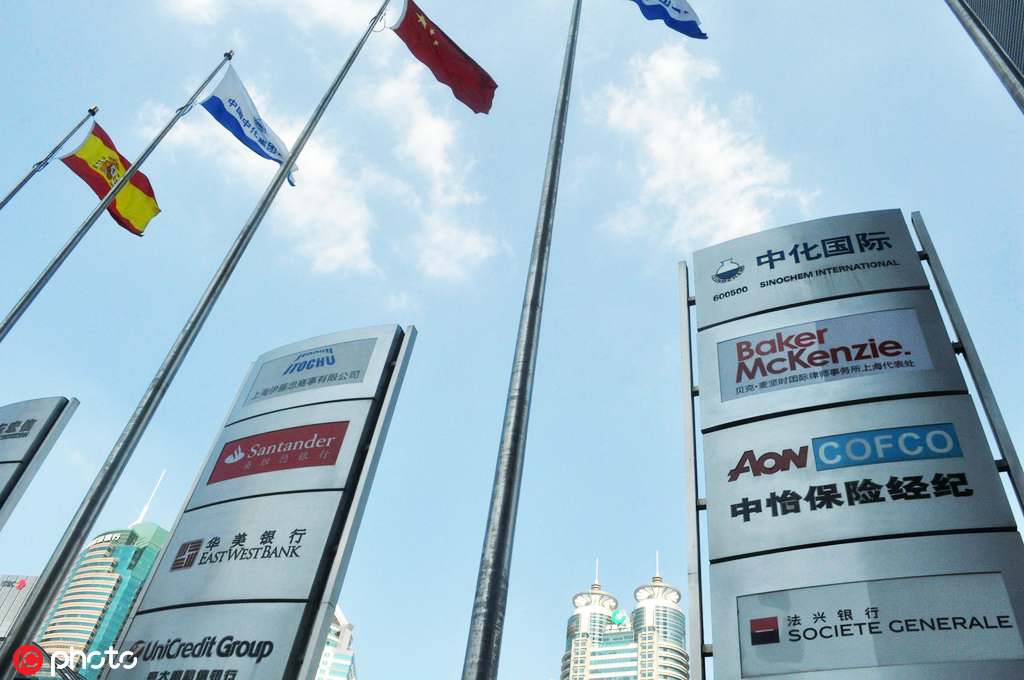

Greater market access to offset trade impact

Greater access to China's financial sector will encourage global investors and dispel the gloom clouding the global economy amid Beijing's trade tensions with Washington, according to senior officials and economists.

Chinese financial regulators are preparing a comprehensive opening-up, with more new measures in the pipeline. Foreign institutions with advanced performance in risk management, credit rating, consumer finance, endowments and health insurance are especially welcome, senior officials stressed over the weekend.

The opening measures will offset part of the negative impacts of trade friction on economic recovery, and enable China to reach its GDP growth target of above 6 percent this year, they said.

Under the trade pressure, the world's second-largest economy is accelerating restructuring reform and shifting from an export-dominated growth model to a more services-driven model, they added.

"The United States escalated trade tensions, but it cannot solve any problem. This causes volatility and sluggishness in global financial markets and hurts the global economy," said Guo Shuqing, the People's Bank of China's Party secretary and also head of the China Banking and Insurance Regulatory Commission. His keynote speech was delivered by a commission spokesman at a forum on Saturday.

Impact on the Chinese economy will be very limited, said Guo. "Chinese financial markets, although they were excessively affected by trade tensions last year, are unlikely to be hit more dramatically going forward, as financial resilience is strengthening."

The huge domestic consumer market in China will digest most of the unsalable exports, and many of China's exports will also shift to other foreign markets. The US will continue to purchase China-made goods if there are no substitutes, but US consumers will need to pay more, Guo said.

Research released by the International Monetary Fund on Friday showed that some of these tariffs have been passed on to US consumers, while others have been absorbed by importers leading to lower profit margins.

US restrictions on high-tech exports to China will push up Washington's trade deficit with China, and rising prices could also reverse the low inflation in the US. Meanwhile, any speculative trading on the Chinese currency amid its depreciation pressure will "inevitably suffer from a huge loss", Guo said in his speech.

To eliminate bad outcomes from trade tensions, further opening-up in China's services sector, together with high-tech development supported by artificial intelligence, will help lift Chinese economic growth from 6.3 percent to around 7 percent by 2035, said Zhu Min, a former deputy managing director at the IMF.

"Market-oriented reform and opening-up will improve productivity in the service sector, which is an important thing that China is focusing on to stabilize economic growth," Zhu said.

Chen Yulu, a vice-governor of the PBOC, also supported a "full-scale" opening of the financial sector. In the future, foreign investors are welcome to conduct all forms of financial business in China, excepting those being named on a negative list, and authorities are researching a new regulatory system, Chen said at the forum on Saturday.

Li Daokui, director of the Academic Center for Chinese Economic Practice and Thinking at Tsinghua University, said China "should be more confident" in accelerating opening-up of its financial sector, which will help global investors seize numerous opportunities in the Chinese market.

Domestic financial institutions are now capable of engaging in fiercer competition with global peers as their service abilities in many aspects, such as banking and insurance, have improved a lot over the past years, Li said.

Despite headwinds from the trade tensions, global investors are still optimistic about China's economic prospects, said Zhang Zhiwei, Deutsche Bank's chief China economist and head of China equity strategy.

Foreign investors believe that China has enough policy tools to offset short-term downside pressure, while the financial risks are under control as the country's debt level has shown signs of stabilizing, Zhang said.

China's overall debt-to-GDP ratio had dropped to 249.4 percent by the end of 2018, 1.5 percentage points lower than a year earlier, according to the PBOC.

If trade tensions escalate further, more opening-up policies in the sectors of medical care and education will help boost global investors' confidence in the Chinese economy, Zhang added.

Contact the writers at chenjia@chinadaily.com.cn