Trump's two miscalculations penalizing global prospects

In less than a week, President Trump made two great miscalculations. First, he undermined the trade talks in Shanghai. Then, the US Treasury called China a currency manipulator.

Both moves will prove costly not just in the US-Sino trade war but for global economic prospects.

Divisions at the White House and the Fed

On the eve of the recent trade talks in Shanghai, President Trump’s tweets undermined the meeting before it even began.

Afterwards in the Oval Office, President Trump overruled his advisers to ramp up tariffs on China. Reportedly, the decision ensued after a heated debate in which he insisted levies would force China to comply with US demands.

Except for Peter Navarro, Trump’s China-bashing trade adviser, Trump’s highest-level team adamantly objected to the tariffs, spurring an intense debate lasting nearly two hours.

Trump desperately needed to secure China’s purchasing boost of US agricultural exports - and he saw tariffs as the best bullying tactic. Eventually, Trump’s advisers gave in and the tweet announcing an extension of tariffs to essentially all Chinese imports was posted.

Soon thereafter, the US Treasury Department declared China a currency manipulator and threatened to “engage with the International Monetary Fund” to stop the Chinese yuan from gaining “unfair advantage” in trade. Rather than reflecting economic realities, it suggests a political desperation.

Neither the IMF - nor US Treasury - have expressed concerns about Chinese currency manipulation for a long while. The Chinese yuan joined the IMF’s international reserve currencies a few years ago, and more recently, China has joined vital global benchmark indices.

Conversely, political background forces in the US behind the recent Fed rate cut weakened the US dollar, giving rise to high-level concerns about the Fed's independence, as evidenced by the recent Wall Street Journal op-ed by former Fed chairs Paul Volcker, Ben Bernanke and Janet Yellen.

Trump’s tariffs undermine cheaper dollar and equities

The US administration does need a cheaper dollar. Yet tariff wars and global geopolitical ploys work against such goals.

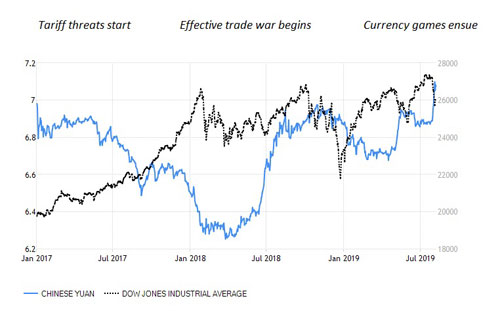

Before the summer, the White House lifted tariffs to 25% from 10% on $200 billion of Chinese goods, while targeting another $300 billion worth of Chinese imports for potential punitive tariffs. Unsurprisingly, the yuan depreciated from 6.7 to more than 6.9 against the US dollar following renewed trade tensions.

China retaliated by imposing duties on $60 billion of US goods, starting June 1. China could have retaliated harder, but opted for a mild response to keep the door open for trade talks.

Until tariff escalation, the Chinese yuan sat around 6.80 against the dollar. But that was predicated on the idea that cooler heads would prevail in the White House and a broad-scale trade war was avoidable.

When Trump opted for tariff escalation, markets reacted predictably. By the summer, the appreciation of Chinese yuan was reversed. Things were about to get tougher.

As the collateral damage of the US tariffs began to spread in the US economy in the summer, Trump largely ignored the economic impact of the trade friction. Naively, he thought the Fed’s rate cut - which he expected to result in new cuts over the fall - would accommodate his trade policy. Emboldened, he opted for a “more tariffs and still more tariffs” stance.

Over the past few days, the market response has been dramatic. Following the Shanghai talks and new tariff escalation, US stocks plunged envisioning a prolonged trade fight, and business groups warned about the impact on consumer spending.

Indeed, tariffs have paced the renminbi fluctuations ever since the start of his trade wars (see Figure).

How Trump’s tariffs reverberate in US equities and Chinese yuan

In light of the economic realities, the US Treasury’s claim that China is depreciating the Chinese yuan is simply flawed. In fact, depreciation is what China seeks to avoid. When exports shrink, a light depreciation of the currency is of no help. And if the yuan would depreciate significantly in a short period of time, it would foster worries about capital flight.

Paradoxically, the more the Trump administration escalates the trade war, the more likely it is that US dollar will push the yuan closer to 7 per US dollar or beyond it, as I discussed in China Daily last May. While that may impair market sentiment in China in the short-term, it is likely to cause collateral damage in the US stock market, as evidenced by recent market volatility.

The Trump administration’s yuan allegations are motivated by political objectives, not by economic realities. What President Trump needs for his domestic initiatives is a cheaper dollar and soaring equities. What his miscalculations have caused is precisely the reverse.

Dr. Dan Steinbock is the founder of Difference Group. He has served at India, China and America Institute (US), Shanghai Institutes for International Studies (China) and the EU Center (Singapore).

The opinions expressed here are those of the writer and do not represent the views of China Daily and China Daily website.