De-risking China's online lending platforms

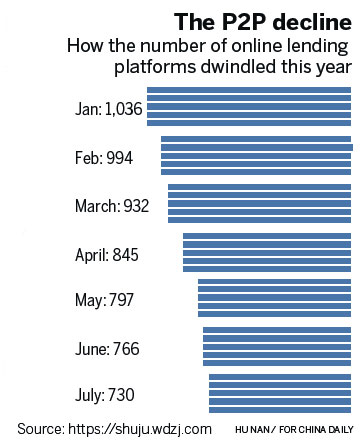

Delays and uncertainty in regulation have prompted many P2P lenders to reconsider their future in the P2P lending business. It also raised questions about the sustainability of the business model.

Some platforms began to see increasing loan defaults amid a slowing economy. Some are struggling to meet the heavy regulatory requirement and they have ceased to offer new products and some are preparing to liquidate their platforms.

Xue Hongyan, who researches internet finance at the Suning Institute of Finance, said that if other major players in the online lending business follow Lufax's suit and downsize their P2P business, it will further weaken investors' confidence in the sector.

Many P2P platforms are now seeking to transform their business model and looking at other areas, including wealth management and consumer lending. Some platforms are seeking partnerships with big financial institutions and hope to serve as "loan-assisting" agencies that help bridge small borrowers with big financial institutions, according to Dai.

"Some platforms are shifting attention from individual investors to financial institutions for source of capital. The 'loan-assisting' model is likely to be the main direction of business transformation for many P2P platforms," he said.

But, one challenge for the P2P platforms that are seeking to enter the consumer lending business is that some may lose their competitive advantage as an intermediary platform, Dai said. An intermediary platform usually does not require a strong capital position.

"In the consumer lending market, they will have to find new competitive advantage with the ability to target the right market and develop compatible risk management models," he said.

Chen Huan, chief risk management officer at Yiren Digital, formerly known as Yirendai, the P2P lending platform of financial technology firm CreditEase, believes that the online lending sector still holds promise as it serves as a crucial financing channel for small businesses and rural borrowers that are often overlooked by large financial institutions.

"Stricter regulation and some market liquidation will be beneficial to the healthy development of the overall sector. Leading and well-established players are going to win more opportunities," Chen said.

CreditEase has recently consolidated and upgraded its online lending business and has acquired a lending platform known as daokoudai.com, which offers loans and financial services for small and micro businesses.

"The industry needs to draw lessons from the past experience and to strengthen investor education and risk management capability," Chen said. "Online lenders will seek to diversify their capital sources from both individual investors and financial institutions. The prospect is still promising as the industry will continue to serve the financing needs of small business, rural residents and individual borrowers."

- Tencent to open online security platform to companies

- China micro-credit firms' outstanding loans at 924.1b yuan

- Private banks use high-tech to offer cost-effective services

- Chinese online brokerage Futu gets greenlight to clearing service in US

- Financial services to be improved for small, micro enterprises