Fed lowers rates, open to another cut

Divided FOMC votes to trim key interest rate to 1.75-2%; Trump wanted to see it go to 0%

The US Federal Reserve cut interest rates Wednesday by a quarter-point for the second time in two months to ease the disruption of the continuing US-China trade dispute and offset the weight of a global economic slowdown.

The Fed suggested that it is open to a third rate cut this year, possibly in October or December.

Seven of the 10 members of the Federal Open Market Committee voted to lower the short-term rate to 1.75-2 percent. Two committee members again voted to hold rates steady, and a third wanted a half-point cut.

"The quarter-point cut is already built into the financial markets and the real economy. It will make no difference to either," Gary Hufbauer, an analyst at the Washington-based Peterson Institute, told China Daily. "The cut will certainly not offset the disruption caused by the trade dispute."

Kamal Khan, chief US editor at Investing.com in New York, said Fed Chairman Jerome Powell had the difficult task of explaining the need for the rate cut when the Fed doesn't foresee a recession.

"The quarter-point cut won't be enough to derail a slowdown and more concerns about a US recession if trade relations between the US and China start to sour again," he told China Daily. "But it should help the economic data look even better in the near term."

President Donald Trump blasted the Fed's action, tweeting after it was announced: "Jay Powell and the Federal Reserve Fail Again. No 'guts,' no sense, no vision! A terrible communicator!" Last week, Trump tweeted that "The Federal Reserve should get our interest rates down to ZERO, or less, and we should then start to refinance our debt."

At a news conference Wednesday, Powell said the central bank is "fully committed to pursuing our goals of maximum employment and stable prices". He stressed that it will "act as appropriate to sustain the expansion" of the nation's economy.

The unemployment rate is 3.7 percent, near a 50-year low, but hiring has slowed, and low wage growth suggests employers have little difficulty finding workers. Inflation, excluding food and energy because of their volatility, is about 1.5 percent, below the Fed's 2 percent target.

The Fed's policy statement outlining the reasons for the rate cut differed little from its July statement. The FOMC again said the "implications of global developments for the economic outlook as well as muted inflation pressures" were the main reasons for the cut.

Assessing the nation's economy, the Fed noted that consumer spending is "rising at a strong pace", while business fixed investment and exports have weakened.

The Fed said disruptions from the US-China trade dispute have worsened since the July 30-31 FOMC meeting, and the global economic slowdown has not yet bottomed out. US manufacturing also has weakened.

Repeating language used in July, the Fed said "it will continue to monitor the implications of incoming information for the economic outlook and will act as appropriate to sustain the expansion".

"Economic and financial conditions have changed only modestly since the FOMC met in July, with growth remaining somewhat soft but wage and price measures looking a bit firmer," Jan Hatzius, an analyst at Goldman Sachs, said in a research report. "Beyond the September meeting, we continue to expect the FOMC to deliver a third and final (quarter-point) cut to 1.5-1.75 percent in October."

Fed: Also adds $75b in liquidity to system

The Fed pumped $75 billion into the financial system on Monday and Tuesday, the first such action in about 10 years, to alleviate a sudden shortage of cash. The move reflects a divergence between funding needs and cash available.

The Federal Reserve is charged with maintaining a stable monetary and financial system. Rate cuts are part of the Fed's effort to maintain a strong economy, full employment and stable prices.

In December 2008, as the economy sank, the Fed cut rates to 0.25 percent, the 10th cut in just over year, and didn't begin raising rates until December 2015. Prior to 2008, the lowest fed funds rates was 1 percent in 2003, to combat a recession that began in 2001.

The fed funds rate climbed to 20 percent in 1979 and 1980 to curb double-digit inflation. In 1971, President Richard Nixon took the dollar off the gold standard, and inflation soon rose to 9.6 percent from 3.9 percent.

In response, the Fed continued to hike rates. In 1979, Fed Chairman Paul Volcker held rates steady at a record high, all the way to 20 percent, leading to a recession that ended inflation.

The Dow Jones Industrial Average dropped 200 points, or 0.8 percent, within 30 minutes of the Fed's announcement on Wednesday, but rebounded to close at 27,147.08, up 36.28 points or 0.13 percent.

Today's Top News

- China expresses worry over Japan's military and security moves

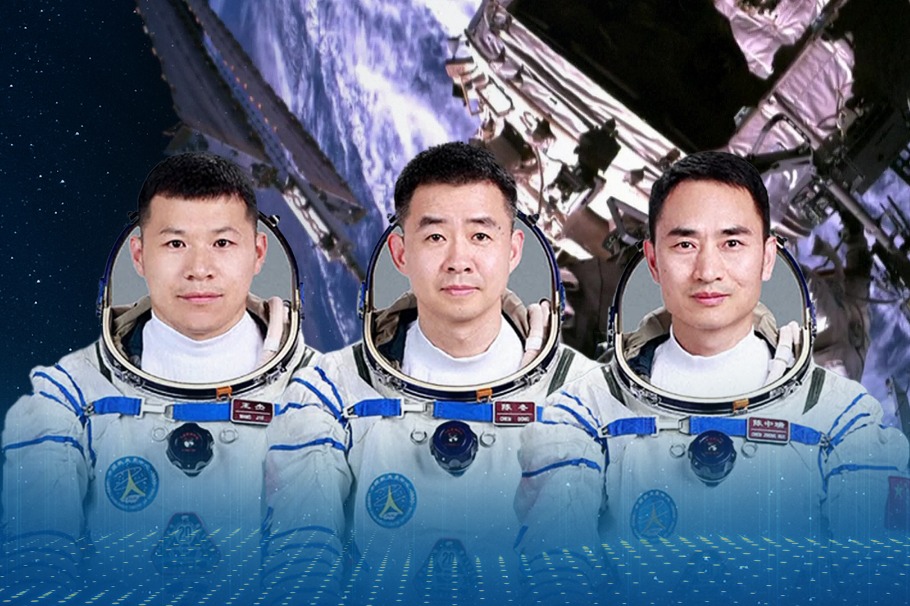

- Shenzhou XX mission crew returns after debris delays landing

- China warns Japan of 'heavy price' for any military interference in Taiwan

- Japan will only suffer a crushing defeat should it dare to take a risk: Defense spokesperson

- Tokyo must stop playing with fire: Editorial flash

- China's Shenzhou XX crew en route back to Earth