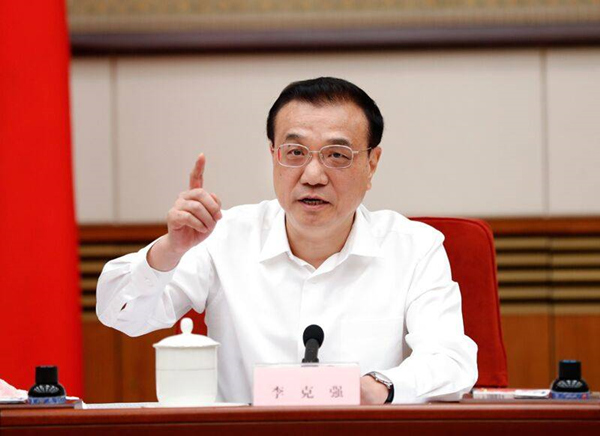

The government must maintain a tight budget to make sure that the policy of tax and fee reductions will be fully implemented, Premier Li Keqiang reaffirmed at a State Council executive meeting on Oct 16.

A report was heard on the implementation of related policies of the year, and related departments were urged to ease enterprises’ burdens to energize economic development.

Tax and fee cuts have eased the burden on enterprises, increased incomes and employment, and effectively stimulated market vitality, the Premier said. They also played a significant role in counteracting downward pressure, stabilizing the country's economy and maintaining the economy within a reasonable range.

"Tax and fee reduction policies should be implemented in full," Premier Li stressed.

According to the report, in the first eight months, tax and fee cuts exceeded 1.5 trillion yuan ($212.03 billion). It is estimated that the total figure will surpass 2 trillion yuan by the end of this year.

Larger tax and fee cuts are the key of the proactive fiscal policy, and the most direct, fair, inclusive and effective measure, the Premier said.

During his inspection tour in Shaanxi province, Premier Li chaired a symposium on the current economic situation and visited enterprises and small shops to learn about the implementation of tax and fee policies. Both local officials and business owners said they felt taxes and fees were significantly reduced.

Tax and fee cuts will reduce current fiscal revenues, but in the long run, it will stimulate the vitality of market players, expand tax bases, foster tax sources, and push enterprises to increase investment in innovation and enhance their competitiveness, thus adding to the potential for future economic development, the Premier noted.

“China has a workforce of over 900 million, of whom over 100 million have received higher education or are professionally trained – this is our greatest strength,” Premier Li said. "We must unleash the vitality and potential of the market through tax and fee cuts, so as to create social wealth, support economic and social development and improve people's lives."

Premier Li also urged local authorities to bring general expenditure under strict control, enhance budget management and be frugal.

"Illegal fees charged on enterprises should be eliminated. Never should arbitrary charges be imposed on them to relieve financial pressure," he said. "Otherwise the effect of tax and fee cuts policies will be offset and the running of the whole macro economy will be influenced."

The Premier stressed that governments should spend money on the most imperative areas to deliver in full the promise in the Government Work Report to benefit enterprises and the people.

The executive meeting decided to carry out detailed tax and fee cuts policies. Issues reported should be researched and addressed in a timely manner and taxes on industries should be reduced, especially for manufacturers and other important sectors, such as construction and transportation. Illegal charges should be cleared.

The central government will guide local authorities in budget management and control general expenditures. Provincial governments should help areas with financial difficulties in salary payments, economic operation and people's livelihoods.

The cabinet will conduct research on measures to further promote reform, development and employment, with a focus on encouraging entrepreneurship and innovation, including tax preference on manufacturers' research and development expenditures, to cultivate enterprises' inner growing force.