First remove the log from your own eye

Americans are now blaming a host of social ills-stagnant wages, de-industrialization, inequality-even obesity and drug addiction-on globalization. More to the point, politicians and pundits of all stripes are blaming China. But most of the bad stuff that has happened in the US economy has little to do with globalization or China. Instead, it is caused by bad domestic economic policies followed over the last 30 years.

Globalization has benefited China, but the nation's spectacular long-term growth was largely made possible by systematic market and institutional reforms combined with massive investment in infrastructure, education, and productive industrial capital since the beginning of reform and opening-up in 1978. Fairly open access to international markets has facilitated this process, but the key has been the reform and investment.

Many of the benefits and problems attributed to globalization are, in fact, the result of either good or bad domestic policies.

Over the past 30 years or so, the United States has turned over much of its economy to a few large politically-connected financial companies and more and more of the economy has been taken over by monopolistic or oligopolistic firms. Of course, inequality rose as wealth flowed toward this in-group and away from average people.

As the US financial system deregulated, more than half of the local banks that had financed local companies went out of business-either by failing or by being absorbed into a few big banks. Actually, deregulation is the wrong word: the big banks were allowed to compete nationally, but many new regulations and reporting requirements were so expensive that small local banks could not cover the legal or information technology costs.

The Federal Reserve's strategy of continually goosing the economy with a very low interest rate policy (VLIRP) combined with deregulation of the market for deposits, made it impossible for banks to follow the old business model of borrowing from depositors to lend to steady companies that were investing in the real economy. Little money was to be made by lending to productive, normal companies. So, banks and other financial firms developed business models based on consumer lending, often to nearly insolvent consumers, and betting on a few internet-based superstar firms that were aiming to seize monopoly profits.

Large internet-based firms that had preferential access to capital drove the local companies, which had been the heart of the American system, out of business. For example, Amazon lost money for over 20 years. It did not pay corporate income taxes during that time. (And it also did not pay state sales taxes for many years.) No local store could compete with that.

In this era of financialization, company executives, who had previously been engineers or product experts, were largely replaced by financiers or people with political influence. It is not surprising that the Boeing 737-Max fiasco happened at a time when the company did not have a single engineer on its board of directors.

Average families were stressed by soaring costs of healthcare and education caused by a weird system of unaccountable public-private quasi-monopolistic institutions that have no incentive to control costs. For example, the student loan program, created in the late 1970s, may have been intended to help university students, but its real effect has been to create a massive pool of money that could be grabbed by the universities, allowing them to get huge increases in tuition costs. The current crisis of indebtedness of young Americans is the result.

At the same time, the federal government moved into a long period of high budget deficits-largely driven by out-of-control spending on healthcare and warfare. The government's need to borrow caused massive flows of capital into the US, raising the value of the dollar and making most US industrial exports uncompetitive.

During the same time, the federal government also almost completely stopped enforcing anti-trust laws, allowing monopolistic firms to buy out competitors or to use predatory pricing against them. The internet-based firms are the worst because they are both market platforms, which should be neutral, and competitive firms which don't hesitate to use confidential information against companies that sell or trade on their platforms.

To make matters worse, spending on lobbying in Washington (which is a legal form of corruption) made many politicians dependent on the largess of a few corporations. Do you think a politician that gets huge campaign contributions from a company will vote against that company's interests? Many politicians and regulators plan to make big bucks in retirement by working for companies they now regulate. And the unqualified family members of many politicians are getting rich working for companies that are dependent on the government. No wonder it is so hard to implement productive reforms.

It's a lot easier to blame someone else than to reform this corrupt and inefficient system.

Globalization has brought many benefits to the world. It increases competition and allows companies to achieve economies of scale. It allows producers to specialize and optimize production. According to estimates by the respected think tank Bertelsmann Stiftung in Germany, globalization increased world GDP by about 8 percent over each 10-year period.

The big winners were smaller European countries, plus Germany. Japan and South Korea also benefitted. Many of the poorest countries around the world did not see gains from globalization. However, the hopes for the future of many of them, particularly in Africa, will be stymied if they lose access to developed countries' markets.

Somewhat surprisingly, the US and China were only mildly affected by globalization. According to Bertelsmann's calculations, over the past 30 years, globalization caused an increase in China's annual GDP per person of roughly $250. As a percentage of per capita GDP, that's not negligible, but it is not overwhelming. China's great increases in GDP from the last two decades are primarily based on its willingness to take advantage of globalization by instituting systemic economic reforms and making large investments.

Globalization drove an increase of annual US GDP per person of about $450. This is a positive number, but many Americans focus on the social negatives. Yet, America's problems were caused by its own negative "reforms" and its unwillingness to invest in the real economy.

The great lesson of the last few decades is that globalization offers an opportunity, but that opportunity is available only to countries that are willing to make the painful and politically-difficult choices needed to improve efficiency by opening markets and making large productivity-enhancing real investments.

There is an old western saying: "Your hypocrite! Why do you look at the speck of sawdust in your brother's eye and pay no attention to the log in your own eye? How can you say to your brother, 'Let me take the speck out of your eye,' when all the time there is a log in your own eye?"

That's great advice.

Today's Top News

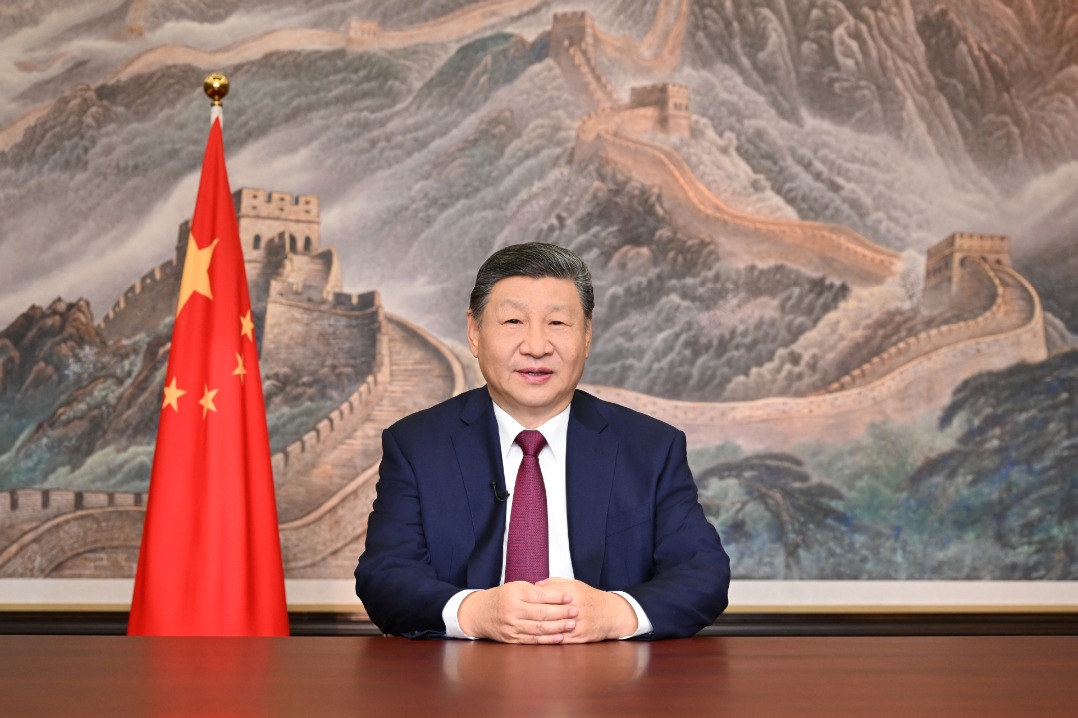

- New Year's address inspiring for all

- Xi congratulates Science and Technology Daily on its 40th anniversary

- Xi congratulates Guy Parmelin on assuming Swiss presidency

- China Daily launches 'China Bound'

- Manufacturing rebounds in December

- PLA wraps up military drills around Taiwan