Idea to force Chinese stocks to delist in US is bad

The Luckin Coffee case of financial misreporting and misleading disclosures to its stock exchange in the United States has reopened the debate on the possibilities of some Chinese companies delisting from the US stock market so as to list or relist on Chinese bourses. Some US experts have questioned why Chinese companies get frequently caught out committing fraud, and proposed that US regulatory policies should be tightened to ensure such incidents don't recur.

On May 20, the US Senate passed a bill, which, if ratified by the House of Representatives, the other wing of the Congress, could become a new law, called the Holding Foreign Companies Accountable Act. The proposed new law would require companies listed on US stock markets to certify that "they are not owned or controlled by a foreign government", and submit their audits for inspection by the Public Company Accounting Oversight Board, the nonprofit body that oversees the audits of all US companies seeking to raise money in the local markets. It also stipulates that failure to provide the information for three consecutive years will lead to delisting.

John Kennedy, a Republican Senator and one of the sponsors of the bill, has said it targets Chinese companies. Marco Rubio, another Republican Senator, has taken the anti-Chinese business sentiment to its extreme. He said American investors face risks because of exposure to Chinese companies. His recommendation is that US-listed Chinese companies that do not comply with local regulations should all be delisted!

The US-China Economic and Security Review Commission proposed similar measures in its 2019 report to the US Congress, though limiting the scope to Chinese stocks with variable interest entity structure.

In my opinion, those threats cannot just be dismissed as idle, but rather be seen as a US ploy aimed at achieving certain outcomes by leveraging perceived advantages.

Any extreme decision or overreaction like delisting all or most Chinese stocks will cost the US stock market dearly in at least three different ways.

First and foremost, it would violate the most important principles in the legislation relating to federal securities-that is to make the US an attractive and efficient place for raising capital for business, and smoothing the path to capital. This principle reinforced US stock market's position as the world leader, and is believed to be the source of innovation, productivity, research and growth.

If Chinese stocks are all to be delisted, the economic impact will be immense, considering the total market capitalization of $1.2 trillion. Any mass delisting should be designed carefully to avoid the negative effect on the principles and reputation of the US capital market. Deliberate action will cause all the foreign companies to double-check the idea of listing in the US, including the high-quality companies which the US would not want to lose. If such prized companies choose to leave the US bourses, the country's financial center may degenerate into a castle in thin air.

Second, many Chinese companies listed in the US markets are actually top-tier private-sector players from across many sectors in China. This is especially true for Chinese high-tech companies. The US investors have benefited both from the share price appreciation and profit-sharing in the past few years. Even if there is a risk of so-called poor corporate governance at some US-listed Chinese high-tech companies, this governance structure is indeed universal, and can be found among most of the world's celebrated high-tech and internet-based companies. To wit: Facebook, Apple, Amazon, to name just a few of the mega unicorns.

Third, US investors are important shareholders of Chinese stocks and are vulnerable to any policy shock. Let's take the example of Alibaba. Jack Ma holds about 6.2 percent of the shares. The remaining shares are in the hands of foreign investors, including Canadian Joseph C. Tsai, SoftBank, Altaba (formerly known as Yahoo! Inc), BlackRock, Vanguard Group and so on.

If there is any deliberate delisting action, the Chinese stocks would be faced with two choices. One, to go private; two, to list/relist on other stock markets. In the first case, the price of repurchasing outstanding shares may not be as good as expected. In the second case, with the decline in Chinese stock liquidity, the stock price will fall accordingly. Whatever be the case, it is the US investors who will likely get hurt the most at the end of it all.

Beyond these costs, the impact on the Big Four accounting firms-Deloitte, PwC, KPMG and EY-and US companies operating in China would also cost the US heavily.

The unrecognized presumption driving the idea that Chinese stocks should be delisted from the US bourses is that the expected benefits will be so big as to outweigh all the costs discussed above. What might the potential benefits be?

The most obvious benefit is the chance to flex the US muscle, which is consistent with the developments so far in the US-China trade dispute. Such a stance may help increase US bargaining power, but it may also lead to avoidable side-effects.

Another benefit from the US perspective is the Chinese companies' credibility will be damaged and the latter may face more restraints when they seek refinancing. The higher costs associated with Chinese companies may increase the competitiveness of US rivals. Again, this logic is a bit warped.

Perhaps, one substantial impact could be that when the US stock market shuts its doors to Chinese companies, the incentive for venture capital to invest in Chinese startups will decline, which will slow down China's technological progress. But this perceived problem can be easily overcome by Chinese companies in other ways.

What's more, the "nuclear option" of the US delisting Chinese stocks and other threats will contribute to the welfare of China, producing results to the contrary in unexpected ways.

For example, short-selling and class action litigation are highly developed mechanisms in the US. The profit-pursuing behavior among greedy market players will press Chinese companies to calibrate their corporate governance according to the international standard. This would improve the information disclosures of listed companies. After all, accounting frauds will not be allowed both in China and the US.

And the elimination of fraudulent companies from the market will improve the overall quality of Chinese listed companies. Consequently, stock prices may increase owing to the lower risk perception associated with Chinese companies.

It is not difficult to foresee the development of the Chinese stock market in the event of the US opting for the nuclear option of delisting all Chinese stocks from its bourses. A larger number of delistings would encourage more companies to return to the mainland or the Hong Kong stock exchange.

In fact, on April 30, the China Securities Regulatory Commission issued regulations to encourage domestic listing of red chips (companies operating on the mainland but registered in Hong Kong and listed on the local stock market, so as to attract overseas investors). This can be seen as one good example of promoting financial reforms through opening-up.

To sum up, delisting Chinese stocks from the US bourses is an option that would entail minor benefits with huge costs for the US. It is hard to imagine any reasonable regulator will initiate market war at this juncture.

Even if the benefits of delisting Chinese stocks outweigh costs for the US, China will stick to its own authority over regulatory issues. This is a matter of national sovereignty. Any move by the US Securities and Exchange Commission to get involved in Chinese companies must be carefully examined on the ground of China national security or public interest consideration. In fact, in addition to China, some other countries, including Belgium, have banned the US regulator from inspecting companies based in their countries.

On the contrary, it is the US that needs to adjust its understanding of this issue, if it is to reap the benefits that foreign companies bring to its stock market, local investors, and the American economy.

In practice, the Sarbanes-Oxley Act could be amended to remove the requirement that the US stock-market regulator can inspect foreign accounting firms, and instead begin to accept the work of Chinese regulators as that of its own. Other developed economies such as the European Union have granted this kind of regulatory equivalency to China.

Today's Top News

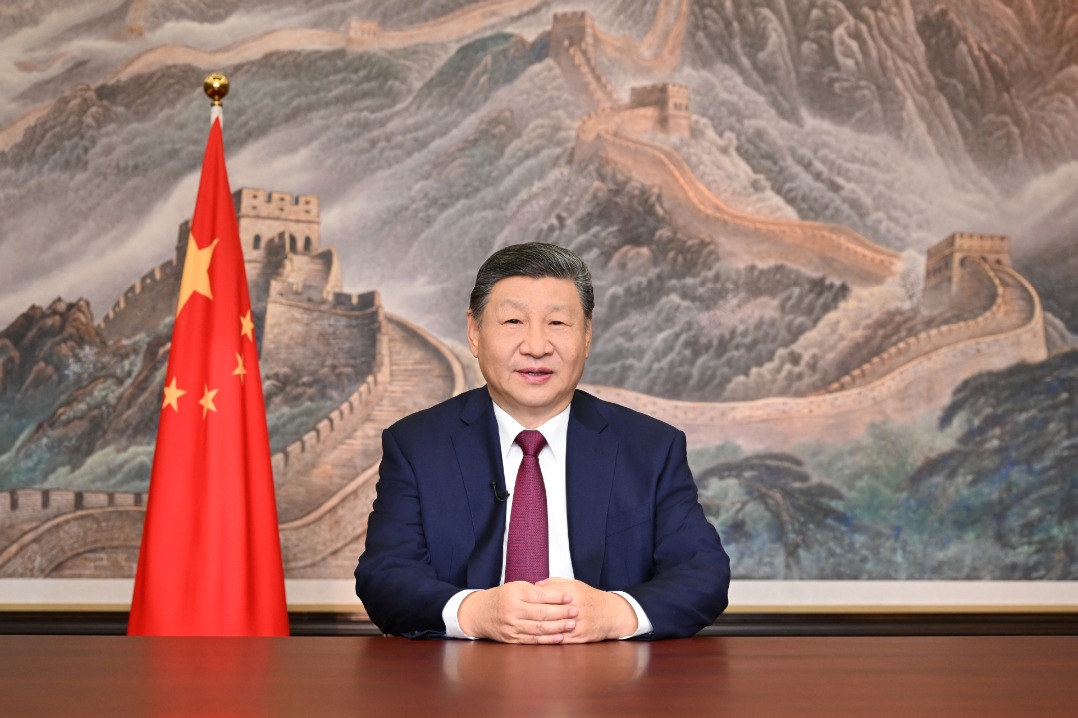

- New Year's address inspiring for all

- Xi congratulates Science and Technology Daily on its 40th anniversary

- Xi congratulates Guy Parmelin on assuming Swiss presidency

- China Daily launches 'China Bound'

- Manufacturing rebounds in December

- PLA wraps up military drills around Taiwan