PBOC gives banks $28b fresh funds via MLF

China's central bank offered banks 200 billion yuan ($28 billion) in fresh liquidity via its medium-term lending facility (MLF) on Monday, leaving enough room for a further easing of the monetary policy in the ensuing months to spur economic recovery, analysts said.

The People's Bank of China said the fund infusion was to maintain liquidity at an ample level in the banking system. The MLF is a monetary policy tool established by the PBOC in 2014 to offer collateralized loans to banks.

The interest rate of the one-year MLF was set at 2.95 percent, unchanged from its level in May. " (The liquidity offer) can fully meet the needs of financial institutions," said a statement on the PBOC website. The central bank said last week it would conduct such MLF operations to roll over the maturing liquidity this month.

The PBOC's action was "more cautious" than expectations of some analysts, who thought the central bank might have lost a chance to reduce the lending rate, as the one-year MLF rate is the basis of the benchmark Loan Prime Rate that will be reported after the next five days.

"It is a signal that the central bank is keen on preventing arbitrage in the financial sector. Too much of cheaper funds for financial institutions may boost financial asset bubbles rather than flowing into the real economy," said Wang Yifeng, chief analyst for the banking sector with Everbright Securities.

A research note from Moody's Investors Service, a global ratings agency, said that liquidity in China's banking system remains adequate at present. The PBOC has maintained adequate liquidity in the system by easing monetary policies to offset disruptions caused by the coronavirus outbreak, it said.

The MLF has become the main monetary policy instrument with its balance at the end of March 2020 up 15.1 percent on a yearly basis. Total net liquidity injections through the MLF stood at 356.1 billion yuan between February and May, Moody's research showed.

The PBOC lowered the one-year MLF interest rate by 30 basis points between February and April to the current level of 2.95 percent.

The central bank is likely to inject funds by cutting the reserve requirement ratio to avoid a liquidity crunch later this month, as more short-term bank debt and policy loans will mature, said analysts.

"The economy is far from a full recovery, the risk of a second wave of COVID-19 is rapidly on the rise and the PBOC cannot afford to tighten its policy stance yet," said Lu Ting, chief China economist with Nomura Securities.

Lu expects the PBOC to cut RRR by 100 basis points before end-September, and to deliver another 50-basis-point cut in the fourth quarter.

The PBOC lowered the RRRs by 100 basis points for regional banks on April 15. Earlier, it had cut RRR by 50 to 150 basis points for qualified banks in March, aiming to stimulate lending to small and medium-sized enterprises.

Major economic data in May and an acceleration in credit growth in recent months indicated that China is on a recovery path after a 6.8-percent drop in GDP growth during the first quarter, and that reflected monetary easing at work, Louis Kuijs, head of Asia Economics at Oxford Economics, a British think tank, said on Monday.

Kuijs expected additional supportive policies to aid economic recovery. "While no GDP growth target was set for this year, the Government Work Report presented in May provided a mandate for meaningful fiscal and monetary policy easing."

China still needs to strengthen countercyclical adjustments of monetary policy, to decrease lending rates for enterprises and accelerate production resumption, said Yan Se, chief economist with Founder Securities.

Today's Top News

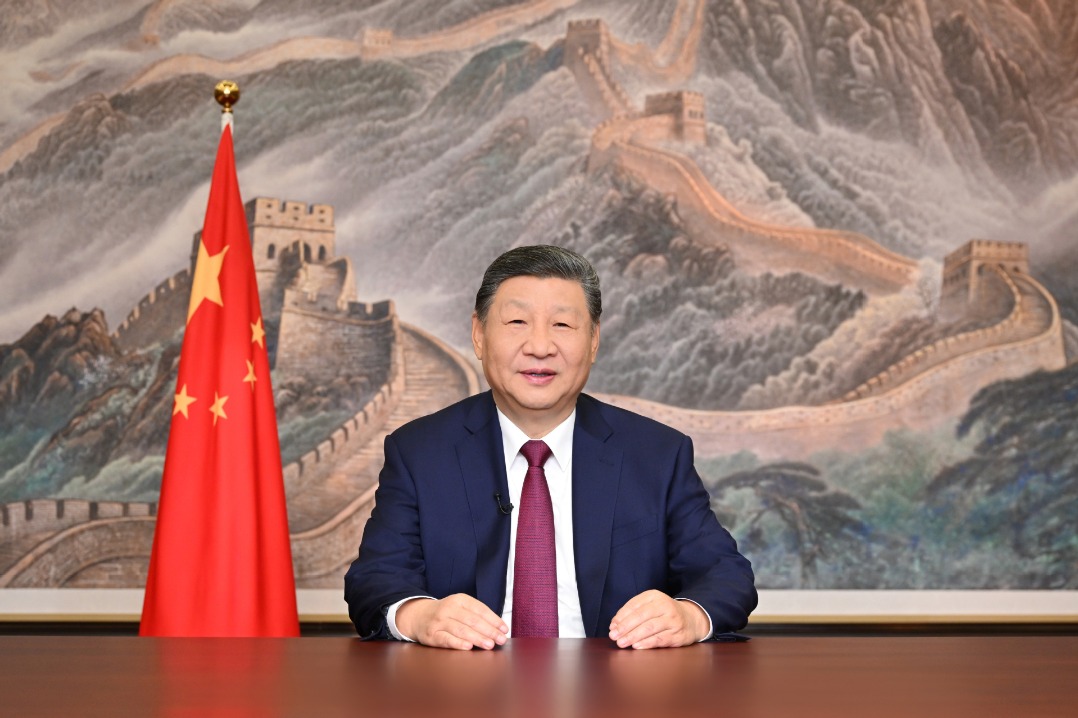

- New Year's address inspiring for all

- Xi congratulates Science and Technology Daily on its 40th anniversary

- Xi congratulates Guy Parmelin on assuming Swiss presidency

- China Daily launches 'China Bound'

- Manufacturing rebounds in December

- PLA wraps up military drills around Taiwan