ChiNext IPO reform excites VC companies

Reform in the form of the registration-based initial public offering system on the ChiNext board of the Shenzhen Stock Exchange is expected to give the country's venture capital investment and entrepreneurship ecosystem a shot in the arm.

Venture capital firms and entrepreneurs were among those who bore the brunt of the coronavirus crisis.

Liu Suhua, chairman of investment firm Shenzhen HTI Group Co Ltd, said he believes both the nation's investment institutions and burgeoning firms will benefit from the reform.

He said the comprehensive reform will give full play to the market's influence on valuations and asset allocation, narrowing the gap of margins between the primary and secondary markets.

The goal of some venture capital firms in the past was a successful listing, which is like a final test, but he believes the profit margin of such a model would be remarkably contracted in the future.

"The strategy of pre-IPO focus on short-term arbitrage will be abandoned gradually by the market, while the sector ushers in a new stage of competing for the ability to evaluate firms by core and long-term development potential," he said.

Liu said he believes the reform in China's Nasdaq-style board of growth enterprises could also speed up the exit process substantially so that the financial pressure on venture capital firms could be lifted.

The registration-based system compresses the listing review period to three to six months and listing standards are much diversified, relaxing many requirements.

After the STAR Market of the Shanghai Stock Exchange first adopted the registration-based IPO system and opened in July last year, exit cases via IPO in the first quarter this year surged 57.3 percent year-on-year and accounted for more than 70 percent of all exit channels, said the latest report by Zero2IPO Research.

The impact is of additional importance as the venture capital investment market has been stagnant over the last couple of years, with the coronavirus outbreak aggravating woes.

According to Zero2IPO Research, both the number and the total size of new funds in China raised by venture capital diminished by half year-on-year in the first quarter of this year due to the epidemic.

Qiao Xudong, general manager of the research center at Shenzhen Capital Group Co Ltd, one of China's prominent venture capital firms, said the increase in the exit rate could push up the yield rate, attracting more social funds to venture capital.

Qiao said he believes the ChiNext board expands the exit channel for venture capital firms that poured their resources into companies in traditional industries that integrate novel technologies and new business models.

The unique focus distinguished itself from the STAR Market of the Shanghai Stock Exchange, which prefers applicants from emerging industries, and opens listing channels for a more diversified pool of firms, so a wider range of investment projects could choose the IPO exit channel, he said.

Ding Lieming, chairman of listed company Betta Pharmaceuticals Co Ltd, spoke from his own experience that the medical enterprises that used to be blocked due to the high standards for listing, could now land on the ChiNext board, to further their progress in research and innovation.

Today's Top News

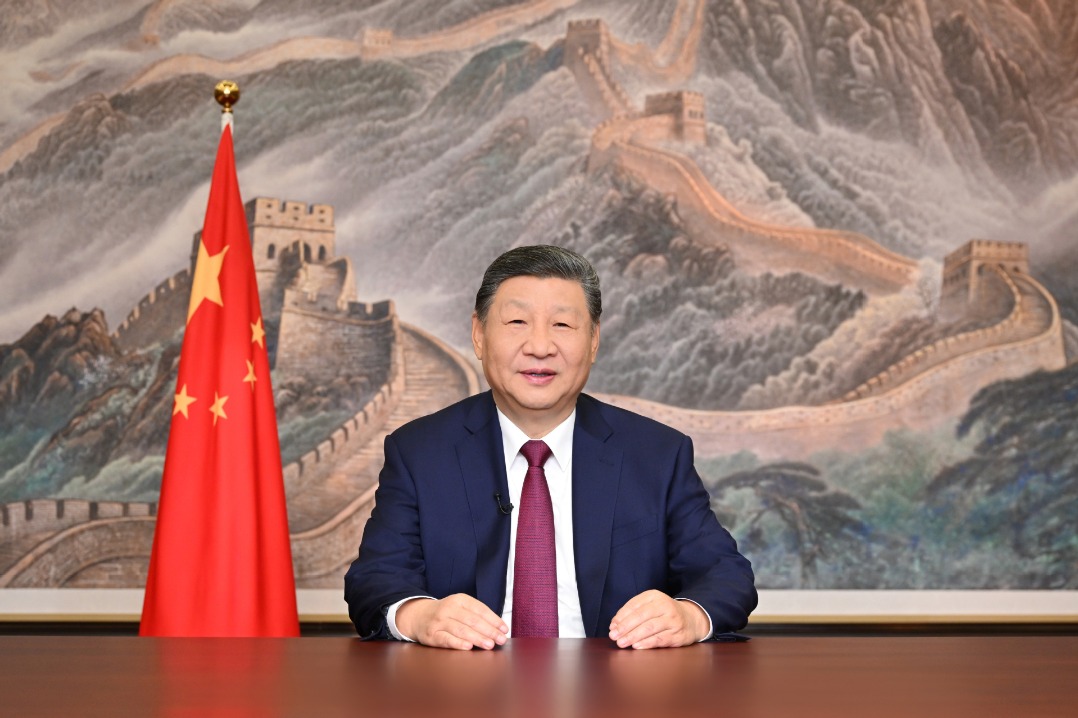

- Xi's message for New Year widely lauded

- New Year's address inspiring for all

- Xi congratulates Science and Technology Daily on its 40th anniversary

- Xi congratulates Guy Parmelin on assuming Swiss presidency

- China Daily launches 'China Bound'

- Manufacturing rebounds in December