PBOC to maintain flexible policy stance, say experts

China's central bank may focus on maintaining ample liquidity in the financial system and curb financial arbitrage by pursuing a more flexible monetary policy stance and keeping the benchmark lending rates adaptive, as it did for three months in a row, analysts said on Monday.

The People's Bank of China, the central bank, did not make any changes to the existing loan prime rates and maintained them at 3.85 percent for loans with a tenor of one year and 4.65 percent for five-year loans.

The central bank has also strengthened the regulations on arbitrage activities in the financial system. The availability of cheaper funds in the financial system may encourage investors to chase higher returns by trading financial assets rather than investments in the real economy, said analysts.

"The central bank's monetary policy tends to be more flexible, and its use of policy tools is more cautious. The monetary easing expectation of the market is somewhat convergent," said Wen Bin, chief analyst of China Minsheng Bank.

Since the LPR reform in August 2019, the average lending rate has fallen. As a result, banks' short-term interest rate spreads-the gap between the lending and deposit rates, have narrowed, leading to a decline in profits. "In the long run, the pricing ability of banks may face new challenges," said Steven Xu, a financial services partner at EY.

The central bank said it would continue to deepen the LPR reform, and improve the monetary policy transmission mechanism, to further lower the lending rates and support the development of real economy. "The reform, to transfer all the outstanding loans' benchmark to the LPR, has been progressing smoothly," said Xu.

Although the major interest rates have remained unchanged, market participants expect further cuts in the reserve requirement ratio (RRR), as early as this week, to inject more long-term capital and tame the surging interbank interest rates and bond yields. In the past weeks, the higher interbank financial costs have fanned market concerns of a reversal in the central bank's easing stance.

The RRR cuts could be targeted for some smaller banks that mainly issue small and medium-sized enterprises' loans, as a response to the top-level policymakers' call to lower financing costs and spur the real economy, analysts said.

The PBOC has made 10 cuts to the RRR since 2018 and brought down the average ratio to 9 percent from 15 percent, thereby releasing some 8 trillion yuan ($1.13 trillion) of liquidity into the financial sector.

The RRR cut led to a "monetary expansionary effect", which resulted in the rising loans from commercial banks, said Yi Gang, governor of the central bank, at a forum last week. Yi said that after an executive meeting of the State Council, which mentioned the need to lower the RRR and use the relending scheme to maintain ample liquidity in the system.

The central government signaled, during the recently concluded annual meeting of the National People's Congress, "a more flexible approach toward macroeconomic policy in 2020 than in the recent past", as it scrapped an explicit growth target and developed a stimulus package that relies more on fiscal measures than large-scale credit loosening, according to Andrew Fennell, an analyst with Fitch Ratings, a global credit ratings agency.

The monetary policy response as a result of the growth shock has included liquidity injections, targeted cuts to banks' reserve requirement ratios, reductions in the policy rate, such as the medium-term lending facility interest rate, and measured financial sector regulatory forbearance, Fennell said.

Economists expect the economic recovery path may be filled with uncertainty, as China is caught between domestic policy stimulus, continuing social distancing rules and slumping external demand. Also, the headwinds from overseas markets continue.

"As the economy is still far from a full recovery, it's too early for the PBOC to reverse its easing stance," said a research note of Nomura Securities.

Today's Top News

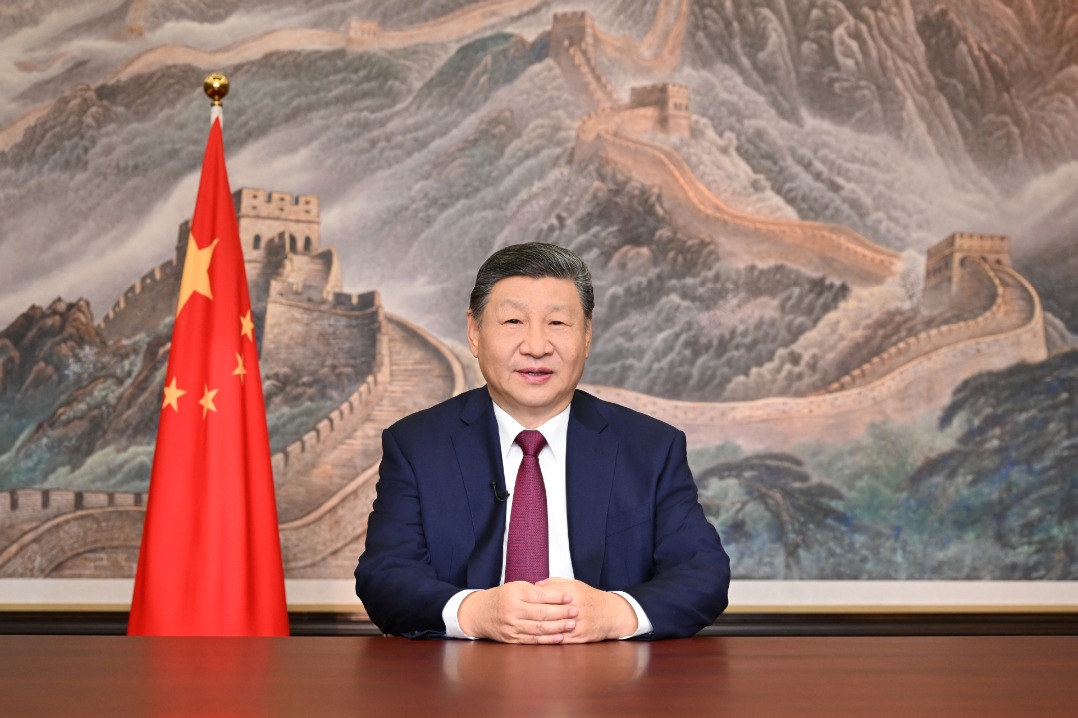

- New Year's address inspiring for all

- Xi congratulates Science and Technology Daily on its 40th anniversary

- Xi congratulates Guy Parmelin on assuming Swiss presidency

- China Daily launches 'China Bound'

- Manufacturing rebounds in December

- PLA wraps up military drills around Taiwan