Rising gold sign of growing dollar doubts

Ever since the novel coronavirus spread to the United States in March, the global financial market has seen drastic fluctuations, with the dollar index continuing to fall and gold prices continuing to rise, hitting a record high of $1,975.7 per ounce on Tuesday.

As the bubbles in the US stock market become increasingly obvious, gold has become a preferred haven for capital flows. Investment banks have raised their bullish forecast for gold, with the Bank of America pricing gold at $3,000 per ounce over the next 18 months.

Pessimism about the US economy and the dollar has spurred further fund flows to the gold market, with inflows of gold exchange-traded fund hitting a record $40 billion in the first half of this year, eight times higher year-on-year.

As global central banks' rescue policies push market interest rates lower, more funds are expected to flow into the gold market. Recent fast rises in gold prices are largely related to capital continuing to short the dollar, due to mounting uncertainties such as the US' intensifying conflict with China, increasing concerns over the US' inability to contain the pandemic, uncertainties over its presidential election in November, and growing expectations that the Federal Reserve will cut interests.

While the US is failing to effectively control the spread of the pandemic, the US Treasury Department is planning new financial relief measures, which means that while production and imports are heavily affected, excessive liquidity is being injected into the market, increasing the possibility of inflation and even stagflation.

For a long time, US government bonds have been viewed as a haven for funds during an economic downturn, and the US dollar maintained a strong position globally. But this time, the market has made a non-dollar choice, proof that a weak dollar is perhaps not a short-term phenomenon.

Compared with China and Europe which have largely contained the pandemic and are gradually restoring their economies, there is no sign that the US will follow suit. The World Bank and the International Monetary Fund both predict that China will be the only large economy to realize economic growth this year.

And with continuous interest rate cuts by the Federal Reserve and the decline in US government bond yields, the bond yield gap between the US and the European Union has narrowed.

As the EU launches an enormous fiscal program for economic recovery in the eurozone, the European economy is expected to accelerate recovery, which will enrich the choice of safe assets and investors around the world for major central banks.

This, coupled with the increased flow of overseas funds into Chinese bonds and equities, means safer European and Chinese assets could perpetuate the dollar's weak status.

21ST CENTURY BUSINESS HERALD

Today's Top News

- Shameful betrayal of commitments the real threat: China Daily editorial

- Japan PM's remarks delay China-Japan-ROK meeting

- CPC holds symposium to commemorate 110th birth anniversary of Hu Yaobang

- Economy seen on steady track

- Trade-in program likely to continue next year

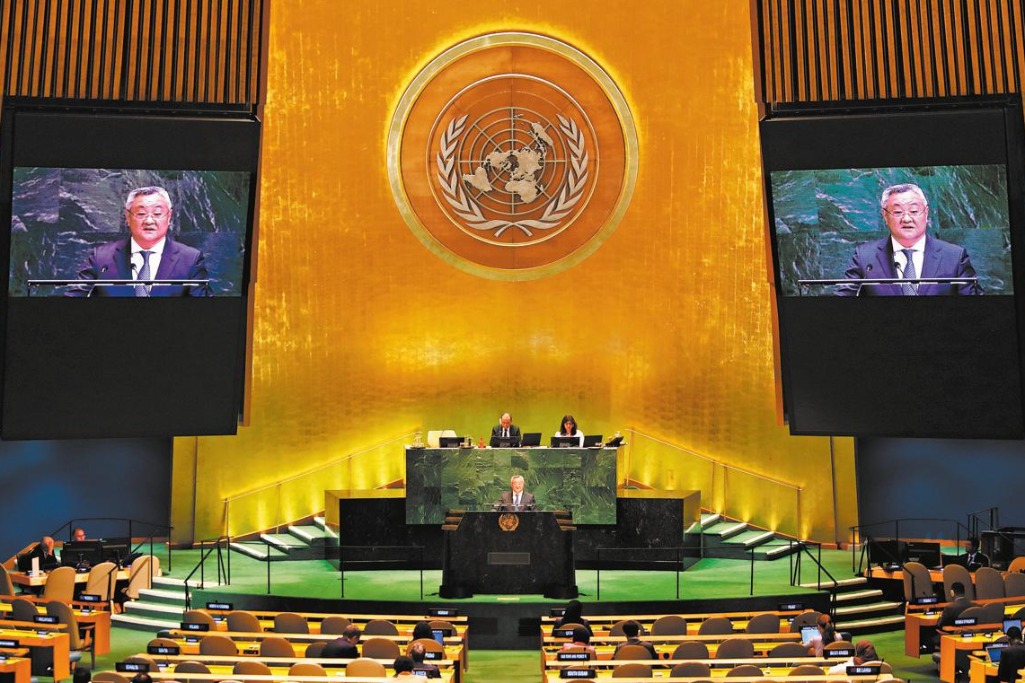

- Li: SCO can play bigger role in governance