Telecom firms see limited impact from NYSE delisting

The planned delisting of three Chinese telecom companies by the New York Stock Exchange under a US government order will have a limited impact on their operations, but will harm global investor confidence in the United States as an important financial hub, officials and analysts said.

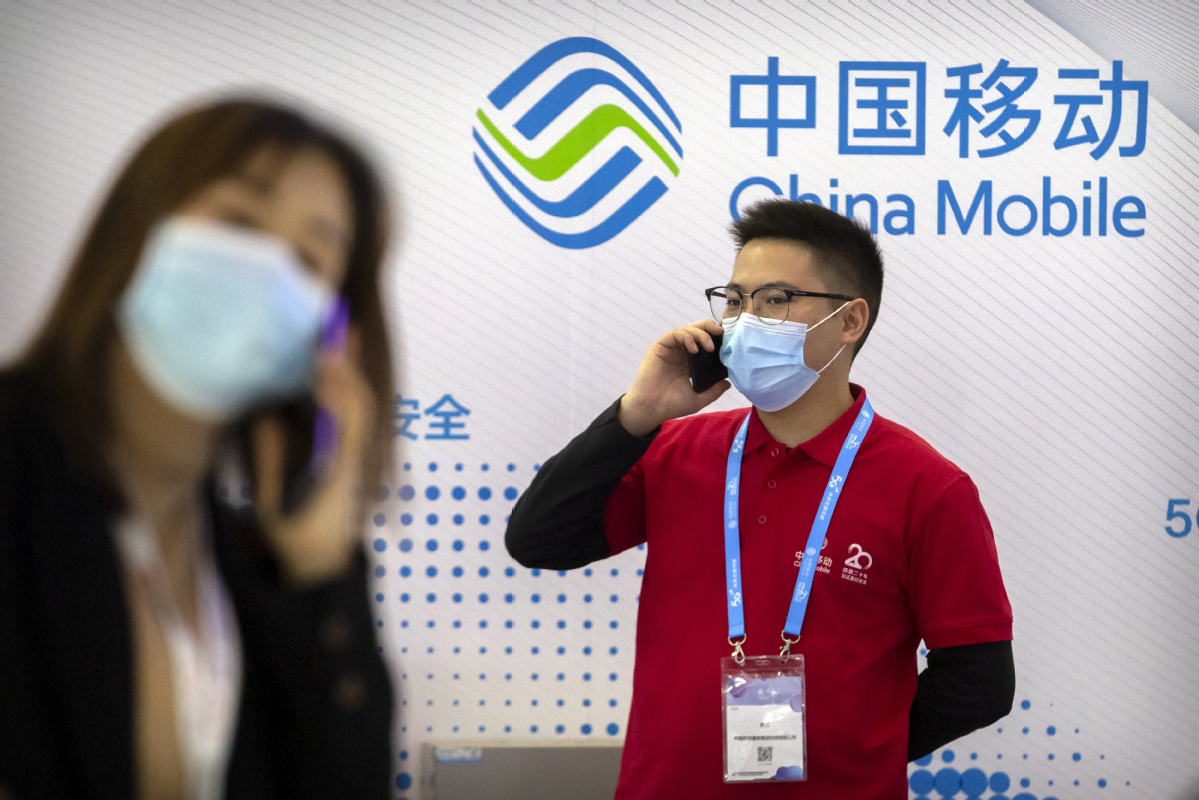

The comments came after the NYSE said on its official website on Thursday that to comply with a US government order, it planned to commence proceedings to delist China Telecom Corp Ltd, China Mobile Ltd and China Unicom (Hong Kong) Ltd.

Foreign Ministry spokeswoman Hua Chunying said on Monday that some political forces in the US have continued to suppress US-listed foreign companies for no reason.

The Chinese government will take necessary measures to resolutely safeguard the legitimate rights and interests of Chinese companies, Hua said.

The delisting of three Chinese companies under a US government order disregarded related companies' actual conditions and global investors' legitimate rights and interests and severely disrupted market order, a spokesperson for the China Securities Regulatory Commission said on Sunday.

Having issued American Depositary Receipts and being listed on the NYSE for nearly or over two decades, the three Chinese firms have complied with the rules and regulations of the US securities market, and are widely acknowledged by investors worldwide, the spokesperson said.

Some US politicians, at the cost of damaging the global status of their own capital market, have recently made moves to suppress US-listed foreign companies. These moves showed the randomness, arbitrariness and uncertainty of the country's rules and regulations, and were therefore unwise, said the spokesperson.

China Telecom, China Mobile and China Unicom said in separate comments on Monday morning that they regret the NYSE decision to delist their securities, and said that they have complied strictly with laws and regulations as well as regulatory requirements of their listing venues.

Highlighting that they have not yet received written notices from the NYSE to delist their ADRs, the three companies said that they will promptly conduct investigations and analysis and strengthen their communication and liaison with the regulatory authorities of their listing venues, to protect their lawful rights and that of holders of their securities.

The NYSE's decision and actions could increase volatility in the trading volumes and affect the prices of their securities, they said.

Fu Liang, an independent telecom analyst who has been following the telecom sector for more than a decade, said the likely delistings will not have a big impact on the three companies' operations and development.

"China Mobile, China Telecom and China Unicom have large user bases, stable operations, and significant influence on the global telecommunications service industry. ADRs only account for a very small proportion of their total shares, and they have ample resources to raise enough money for their businesses," Fu said.

Dong Dengxin, director of the Finance and Securities Institute, which is part of the Wuhan University of Science and Technology in Hubei province, said the US government is politicizing its capital markets in the hope of containing the rise of Chinese technology companies.

But such a practice would be detrimental to the international status of the US capital market, and harm the image of the US government in many countries, including its European allies, Dong said.