Two sessions to focus on development safety

At the upcoming two sessions, the 14th Five-Year Plan, the blueprint of China's social and economic development for the next five years, and the long-range objectives through the year 2035 are expected to be finalized, becoming key highlights of the meetings.

Kang Yong, chief economist at KPMG China, said risk prevention as a topic to be discussed at the two sessions, is expected to cover a wide range of areas: the financial system, supply chain, infrastructure, energy, and food.

As for financial risks, asset prices have become expensive across global financial markets, after central banks of major countries rolled out large stimulus packages last year to counter the pandemic-induced economic damages, Kang said.

"But given China's stimulus package last year, which was relatively small by global standards, the country's risk of asset bubbles should be less serious than that in most other economies," he said.

The risk of loan defaults should be controllable in general as banks have set aside more capital to cushion the potential rise in defaults, he said.

The two sessions are expected to assure more policy supports to manage the risk of defaults, like allowing some hard-hit small businesses to further delay loan repayments, he said.

The focus on safeguarding the safety of development is closely correlated to another priority-advancing technological innovation. This, economists believe, will be a key economic issue during the two sessions.

"Indigenous innovation, especially in basic sciences and also key technology areas, is very important to China's high-quality development and the dual-circulation strategy," Kang said.

China is expected to invest heavily in technology segments such as artificial intelligence, quantum computing, life sciences, and semiconductors, he said.

Wang Tao, chief China economist at global investment bank UBS, said she expects the country to continue to increase spending on "new infrastructure", including those that can facilitate further digitalization and innovation.

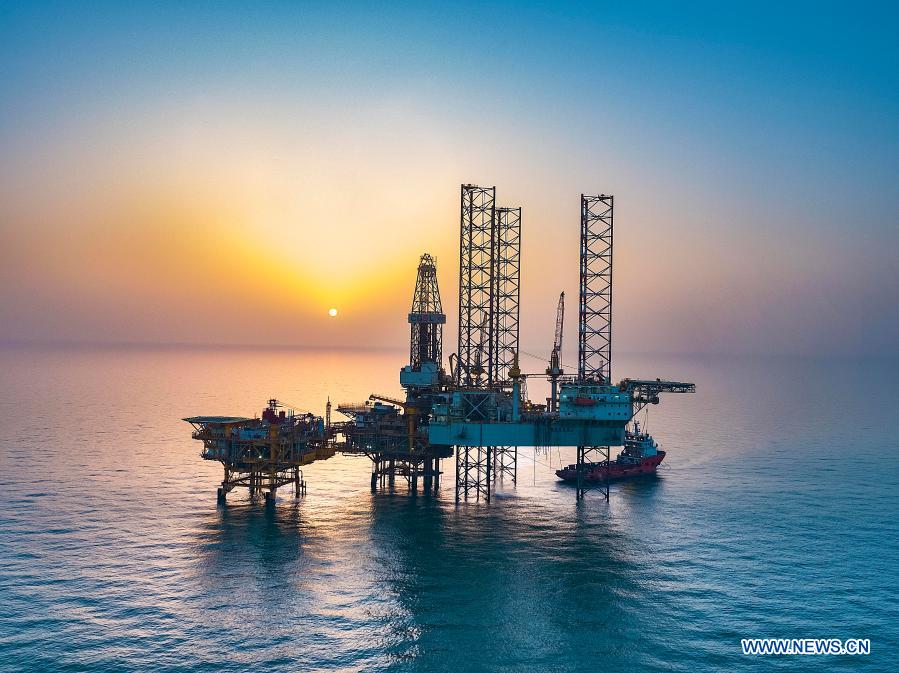

The investment in infrastructure related to renewable energies and other projects that will help reduce carbon emissions-for example, public transport-is also expected to gather pace, Wang said.

Green development would be another key topic during the two sessions as China has pledged to achieve carbon neutrality by 2060, while the path to achieving this goal could be challenging, said En from CIFM.

Fiscal subsidy for green economy will continue, and carbon emission trading will enter the phase of implementation this year, En said.

The government has approved the establishment of the Guangzhou futures exchange in January, which, industry experts said, is expected to pioneer China's green finance efforts by launching the country's first carbon emissions futures contract.

As China attaches greater emphasis to high-quality development agenda such as technological innovation, green economy, and development safety, economists said the two sessions may continue to forgo a specific GDP growth target for the year but focus on employment targets.

For the first time in years, last year's two sessions did not set a GDP growth target due to the huge uncertainty engendered by COVID-19 but set employment and other policy priorities.

Despite giving less importance to the GDP growth figure, the government is expected to maintain supportive macro policies to sustain China's economic recovery and avoid any sharp policy shifts in the process of policy normalization, they said.

The Central Economic Work Conference held in December had pledged to maintain the consistency, stability and sustainability of macro policies this year, continuing to adopt a proactive fiscal policy and prudent monetary policy.

Pang from ING said she expects no changes in China's benchmark lending rates this year, which would be a result of balancing the need for stabilizing the macro leverage level with the need to boost economic recovery amid the still volatile external demand and the ups and downs of global COVID-19 cases.

Fiscal stimulus may be around the same number as that of last year, Pang said, while the spending focus could be changed to achieving technology self-sufficiency.

"While UBS expects this year's (China) GDP growth to recover strongly at 8 percent to 9 percent, we don't think the country will set a specific growth target," said Wang.

Given the strong rebound, macro policies are expected to normalize from the anti-crisis easing mode, which means the budgeted fiscal deficit, to be announced at the two sessions, could decline to 3 percent of GDP or even lower, versus more than 3.6 percent last year.