ESG an 'investment culture' for businesses

Companies in the Asia-Pacific need to go the extra mile in their sustainable development goals to ensure long-term growth. Wang Yuke reports from Hong Kong.

Environmental, social and corporate governance factors are becoming all the more important for the performance of companies on the Chinese mainland, not only in the long term, but also in the short term as well.

This is driven and necessitated by regulations to ensure that these non-financial factors can be sustained, says Thomas Kwan Chi-wang, CEO of Harvest Global Investments — the Hong Kong-based international arm of Chinese asset-management giant Harvest Fund Management.

To no small extent, the mainland's tightened environmental policies and enforcement have prodded enterprises to jump on the sustainable-growth bandwagon, he said. If a company fails to comply with or double down on sustainable practices, it will slide into a predicament and a disadvantageous situation in which investors will turn their backs on the company. And these companies "won't survive at the end of the day," Kwan said.

Companies with a record of high carbon intensity are compelled to "find a way to convert their products and operational procedures to low-carbon alternatives," Kwan said. Otherwise, they will lose out, he added.

Despite the frisson of excitement and vibrancy of ESG investing in China, this investment concept is still in a nascent stage in the country and across Asia, Kwan said.

A recent survey by BNP Paribas — the largest French banking group and the largest bank in the eurozone, — found that asset owners and institutional investors in the Asia-Pacific were lagging far behind in incorporating ESG into their strategic decision-making processes, compared with North America and Europe. Hong Kong and the mainland were way back, with 75 percent of investors incorporating less than a quarter of their assets into ESG investments.

Kwan said the Asia-Pacific's slow ESG performance is due to the late start and lack of investor interest in the region in recent years. In Europe, ESG investments are primarily driven by demand from asset owners, such as family offices and pension funds for long-term sustainable growth. The European approach is in contrast to a top-down, policy-driven approach in Asia despite increased ESG awareness among Asian asset owners.

Kwan has more than 20 years' experience in investment management. Before joining Harvest Global Investments, he had worked at Baring Asset Management as head of Asian debt; with First Sentier Investors in Hong Kong as portfolio manager; with Prudential Asset Management as investment director in Singapore; and in Beijing as director of Asian fixed income and currency.

Kwan has witnessed the paradigm shift in ESG investments or, in a broader sense, sustainable investments, in Hong Kong and Asia over the past two decades.

"Corporate governance, or the 'G' factor, has long been part of the financial analysis," he recalled. "But the 'E' and 'S' factors have only begun to be put on the table in China since 2016 when the nation started pursuing quality growth. Stringent environmental policies have had a direct impact on some high-polluting companies through fines and penalties." China's carbon neutrality pledge last year has further prompted high emitters to reconsider their business development strategies for the next few decades.

There was little reckoning of responsible investment and the importance of sustainability in ensuring a company's long-term returns in China until in recent years when the country set its ambitious goal of achieving carbon neutrality by 2060. Under the 13th Five-Year Plan (2016-20), sustainable development goals were explicitly outlined. The China Securities Regulatory Commission in June published information-disclosure rules for all listed companies, making it mandatory for them to disclose any administrative penalties relating to environmental issues in their annual and semiannual reports. The regulatory body has galvanized domestic companies into doubling down on their environmental sustainability management. For domestic corporations, the progressive policies have served as a wake-up call on ESG operations and strategic planning, Kwan said.

- Guangdong reaffirms easing process to boost innovation and entrepreneurship

- Taiwan and mainland united by goddess Mazu, common ancestral roots

- First robotics debate competition holds semifinals in Beijing

- Top court seeks to ensure quality of construction projects

- Shanghai Disney Resort reaches 100 million visitors

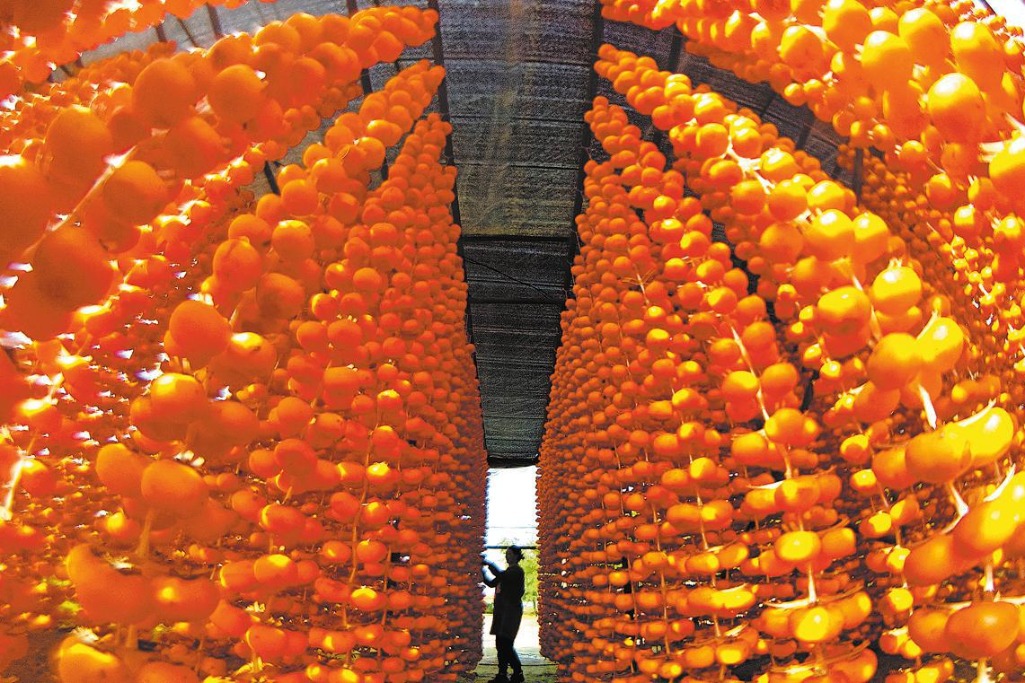

- Xinjiang's desert poplar forests shine with autumn tourism