Jabs for cats and dogs turn into thriving sector

Protecting furry family friends creates booming market for players

With China's pet market constantly expanding, a subcategory-pet vaccinations-is gradually taking root, and more vaccine providers are emerging, becoming a new focus of investment.

On Feb 9, Shanghai-based Aichong Biotechnology announced that its inactivated feline triple vaccine had entered its clinical trial stage. Seven months earlier, the company received investment from Yingke PE. The capital inflow targets the research and development of pet vaccines.

In September, Kanghua Animal Health-a wholly owned subsidiary of Kanghua Biotech Co Ltd-held an opening ceremony in Chengdu, Sichuan province, officially entering the high-end pet rabies vaccine segment.

Also last year, Zhang Chongyu, chairman of Jinyu Bio-Technology, another biopharmaceutical company in the animal vaccine field, said during a news conference that the company's short-term goal was to become among the world's top 10 companies in the field of animal vaccines.

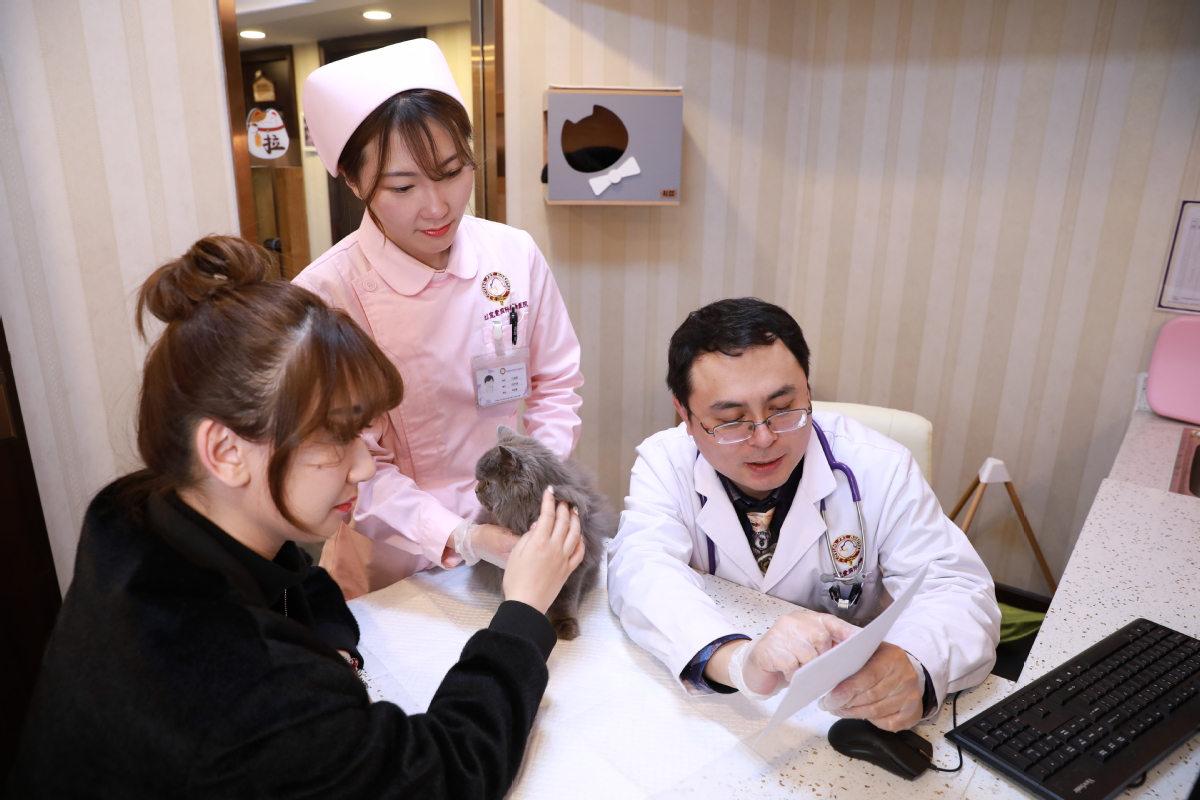

Demand for pet vaccinations has been rising in China in recent years. Expenditures on pet vaccinations are taking an increasingly large share of overall pet-related healthcare services.

According to a report jointly released by the China Animal Agriculture Association and Shandong province-based pet information platform Pethadoop, in 2021, pet inoculations topped the reasons for pets' visits to veterinarians, with 70.3 percent of owners taking their pets to animal hospitals at least once last year.

The 2021 Pet Industry White Paper further illustrated that cat vaccination rates are usually higher than those of dogs. Feline and canine vaccination rates in the entire pet vaccination sector stood at 44.6 percent and 30.8 percent, respectively.

However, in contrast to skyrocketing demand, the paper said China's R&D of veterinary vaccines has long been focused on animals raised for their meat, rather than house pets. Chinese companies that develop pet vaccines are significantly underdeveloped in terms of both scale and maturity to meet rising needs from the pet sector.

Currently, foreign companies dominate the market, with animal health heavyweights-such as United States-based Zoetis and French-based Merial and Virbac-taking nearly 90 percent of the market share. The rest of the market is shared by homegrown enterprises, including Jinyu Biotechnology Co Ltd, Wuhan Keqian Biology Co Ltd and Pulike Biological Engineering Inc.

Industry experts said that the present market pattern leaves limited space for Chinese brands to develop.

Li Xue, millennial founder of Loving Care International Pet Medical Center, a high-end Beijing-based pet care chain brand, said that her hospital doesn't offer domestic-brand pet vaccines to consumers, as there is hardly any demand.

"Consumers prefer imported products, especially those related to their pets' health and safety, such as vaccines," she said.

Muzapaer, a college student and owner of two cats in the Xinjiang Uygur autonomous region, said that the still-raging COVID-19 pandemic is impeding the vaccination of pets. Foreign vaccine prices nearly doubled compared with that before the pandemic, and they have been in short supply for a long time.

"Without prompt replenishment, we have to book for vaccinations at least a month in advance," said Muzapaer.

Although there are alternatives produced by local pet vaccine companies, most pet owners in China choose to wait.

"Nearly 95 percent of pet owners will choose overseas vaccines, having expectations that imported ones have a higher immunization rate. Even if the vaccines are running out, they will wait, as they see pets as members of their family," Muzapaer said.

But actually, most consumers don't know that there are available domestic vaccines.

"They just want to give their pets, or to put it more precisely, their 'kids', the best care they could ever give," said Li of Loving Care International, who also has five dogs of her own.

"They think pet vaccines developed by foreign companies contain more advanced technology and maturer production procedures, which they expect will be better for their pets. This explains why imported vaccines are preferred. Once people establish emotional bonds with pets, they can hardly ignore them, and are more likely to make every decision about pets very cautiously," she said.