Japan ends era of negative interest rates

The Bank of Japan announced its decision to end negative interest rates on Tuesday, marking a major shift from years of unprecedented monetary easing.

At a two-day monetary policy meeting starting on Monday, the central bank announced its first benchmark rate hike in 17 years, guiding overnight lending rates to 0 percent to 0.1 percent, up a fraction from minus 0.1 percent to 0 percent.

The bank also decided to end its yield curve control policy, which aims to suppress long-term interest rates alongside short-term interest rates, and to scrap purchases of exchange-traded funds and Japanese real estate investment trusts.

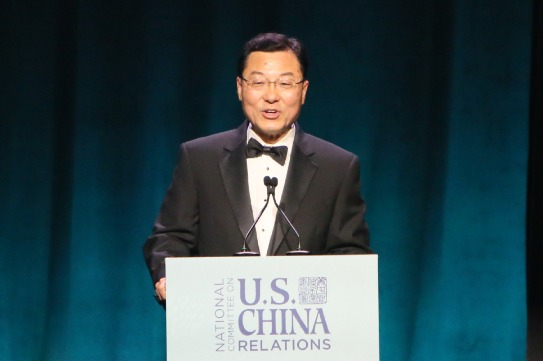

"The BOJ's exit from the negative interest rate policy will give us a signal that a virtuous cycle between wages and prices is gradually embedded in the Japanese economy. That kind of a signal effect will outweigh an impact arising from a 10-basis-point rate hike," said Kyohei Morita, chief Japan economist at Nomura Securities.

Economists at Nomura expected the BOJ to leave all the measures "invented" during yield curve control, such as fixed-rate Japanese government bond purchasing operations and common collateral operations, in its toolbox so that the bank can make use of them whenever necessary. Thus, the bank will remain engaged in the Japanese government bond market going forward, Morita said.

Nomura economists believe the BOJ will make an additional rate hike to 0.25 percent in October, assuming the economy will continue to recover and that core consumer price index inflation will remain at or above 2 percent year-on-year.

'Symbolic move'

"The BOJ's end of negative rates would be largely a symbolic move, as we think it does not wish to signal the start of an aggressive rate-hiking cycle similar to what has transpired with developed market central banks," said Park Chonghoon, head of South Korea and Japan economic research at Standard Chartered Bank.

He was of the view that the BOJ wants to close the chapter on its ultra-accommodative monetary policy, which has set it apart from other central banks such as the European Central Bank and the United States Federal Reserve.

Moreover, the BOJ has also indicated that Japan is slowly but steadily moving out of a deflationary environment amid growing economic resilience, fueled by sizable wage increases negotiated by Japan's largest labor confederation.

The 7-million-member Japanese Trade Union Confederation, known as Rengo, announced on Friday that its member unions achieved an average wage increase of 5.28 percent this year, the most substantial rise since 1991.

The wage hikes occurred in the backdrop of increasing labor shortage, ongoing inflation, and a weakened yen. The overall wage increase exceeded last year's figure by 1.48 percentage points, according to Rengo's initial tally of the results, and provided the BOJ with another reason to increase interest rates.

Park said the indirect impact of Japan's move to end negative rates will be more salient in the foreign exchange market, as a weak yen has translated into higher corporate margins, and imported inflation for products sourced from overseas. "We think Japan's rate differential versus the US will stay wide for the foreseeable future, as we do not expect the BOJ to hike aggressively."