Dialogue has put China-UK relations on firmer ground

The 11th China-UK Economic and Financial Dialogue, which was held in Beijing on Saturday, offered a great opportunity to reset the bilateral relationship and place it on a firmer footing. The two sides agreed to expand cooperation in key areas of mutual benefit and push forward development of bilateral relations.

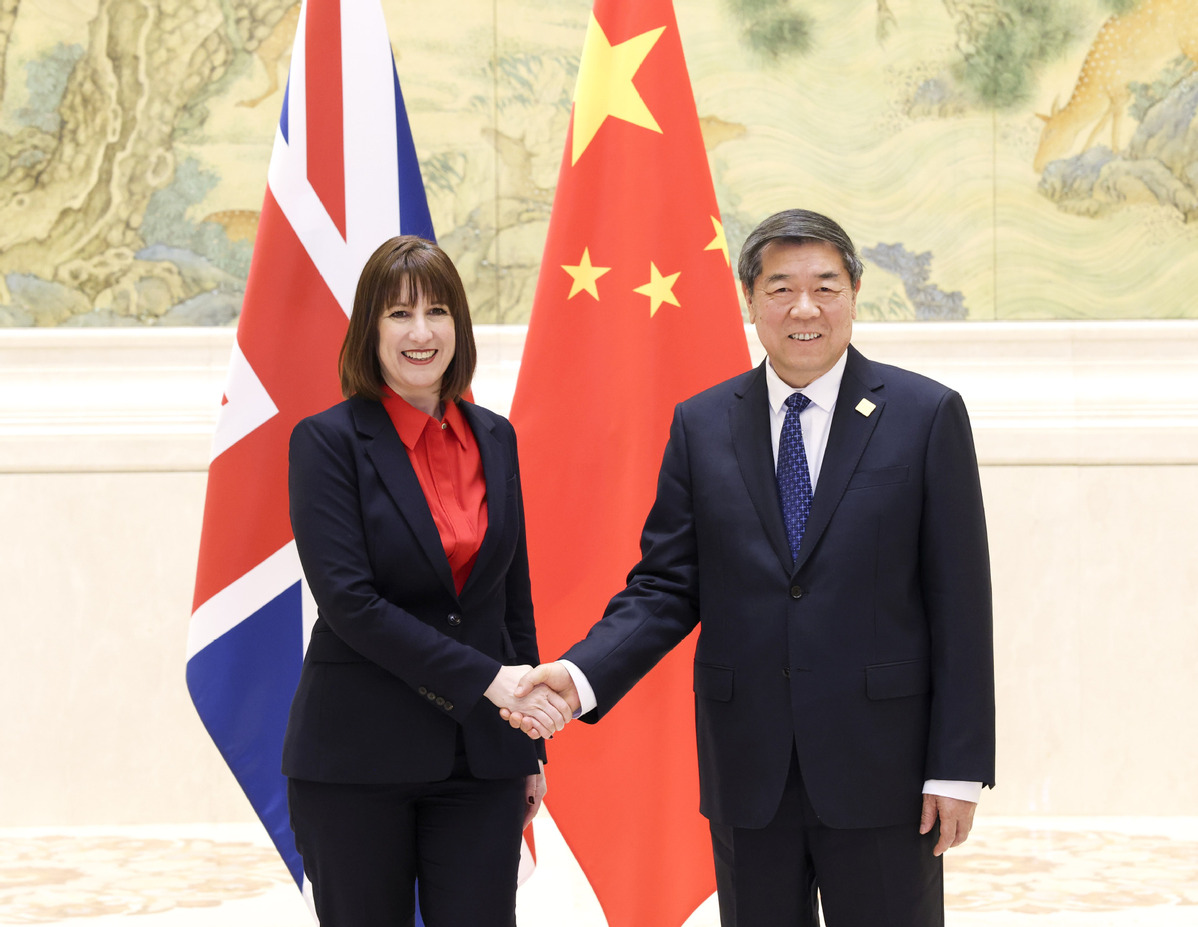

During the talks, Chinese Vice-Premier He Lifeng said that China is willing to work with the United Kingdom to implement the important consensus reached by the leaders of the two countries, uphold their positioning as strategic partners, strengthen communication and dialogue, further expand economic and financial cooperation, and provide more impetus for the development of stable and mutually beneficial China-UK relations.

British Chancellor of the Exchequer Rachel Reeves said the UK is willing to strengthen practical cooperation with China in the fields of economy and finance, and develop a consistent, lasting and mutually respectful relationship between the two countries.

China faces domestic challenges such as an overhang of local government and property-related debt. These may be exacerbated by tariff measures and sanctions from outside. During United States President-elect Donald Trump's first term, China sought self-sufficiency in technology, food, and energy and moved to its dual-circulation economic agenda — a new economic development pattern in which China's domestic market remains the mainstay with domestic and international markets reinforcing each other.

Now, the next stage of China's economic development points to the need to move up the value curve, with increased consumption and higher value-added growth and innovation. The third plenary session of the 20th Communist Party of China Central Committee held in July reiterated a commitment to modernization and reform. This necessitates deeper and broader capital markets.

Cooperation fields

The Sino-UK dialogue is important to China, with five interrelated financial areas having been identified as critical to future economic success: technology, green finance, digitalization, financial inclusion and pensions.

The UK has clear expectations. The UK government looks set to take a strategic, longer-term approach, citing that there are areas where both countries will challenge, compete and cooperate.

The dialogue has opened up many financial areas in which to cooperate. Also, the UK is keen to see increased inward investment and restart the UK-China Joint Economic and Trade Commission, which last took place in 2018.

As one of the largest service sector economies and home to the world's most international financial center, the UK hopes to benefit from stronger economic ties with China.

Six years ago, London's focus was on seeing the offshore renminbi market grow in London. This remains important. The global use of the renminbi is low, given China's share in world trade. But over the past year there has been a noticeable increase in China's trade invoiced in renminbi and a corresponding rise in its share of global payments. Yet there are significant regional variations in its use.

Offshore liquidity is still lacking in London, given China's overall capital account management. For the UK's offshore renminbi market to grow would necessitate more "dim sum" bond issuance, increased renminbi deposits and loans, more trading and clearing, and higher cross-border renminbi transactions. Encouragingly the infrastructure is in place in London — including a bilateral swap line and clearing bank — for this market to evolve. Promoting cross-border use of onshore renminbi bonds as eligible collateral was cited in the last dialogue, but embedding this would be another plus.

In 2014, the UK became the first Western economy to launch a renminbi-denominated sovereign bond. It was a positive signal for both the bilateral relationship and market development. Likewise, now, the Asian Infrastructure Investment Bank is deciding upon the location of its European funding and trading hub. There is a strong case for it to be in London, the success of which as a financial center reflects its regulatory environment, being the place where people and firms want to do business, and having the depth and breadth of financial markets.

London's focus is on boosting connectivity with China. The dialogue is expected to deliver on this by improving two-way capital flows, with multiple benefits.

The Shanghai-London Stock Connect program boosts dual listings. UK-based asset managers and insurance firms also see opportunities for greater access to the Chinese market. There is continuous development in China's bond market, and opening this up further should see increased foreign interest and cement UK-China ties.

Another area for cooperation is the green agenda. The UK already sees investor appetite for green assets but needs a deeper liquidity pool. More investable renminbi assets could help, with increasing renminbi bond listings in London, plus developing carbon market links, or even further innovation such as dual-currency green bonds. Indicative of improving ties, the Bank of China signed in September a renewed memorandum of understanding with the UK government on green and biodiversity finance cooperation.

There will be future work streams where both countries can collaborate. And this dialogue provided a great opportunity to reboot the UK-China economic and financial ties.

The author is an international economist based in London.