Internationalization of capital market gathers pace with plan

The action plan for stabilizing foreign investment in 2025, unveiled by the Ministry of Commerce and the National Development and Reform Commission on Wednesday, could play a major role in optimizing the business environment and attracting foreign direct investment.

According to the plan, China will formulate policies to allow foreign-funded enterprises to use profits earned in China for reinvestment. It will also allow foreign investors to use domestic loans for equity investment, making it convenient for multinational corporations to establish headquarters-type institutions in China.

Encouraging foreign capital to enter the domestic capital market will help stabilize international capital flows. Several economists have pointed out that China's listed enterprises, such as those in high-end manufacturing, new energy, and e-commerce, are globally attractive. The new regulations will accelerate the process of foreign capital "discovering" them, and promote the internationalization of shareholder structures of these companies.

Equity investment is characterized by long-term holding and strategic cooperation. With their interests linked to Chinese enterprises, these foreign investors will pay more attention to the development of Chinese enterprises.

At a deeper level, long-term shareholding by foreign capital will promote the improvement of listed company governance by introducing international management experience, technological standards, and market resources, thereby driving the internationalization of the capital market.

In January, China's actual use of foreign investment amounted to 97.59 billion yuan ($13.43 billion), a month-on-month increase of 27.5 percent. During the same period, actual investments in China by the United Kingdom, the Republic of Korea, the Netherlands and Japan increased markedly.

Those foreign investors coming to China more than a decade ago were lured by its market size. What attracts them more now should be the innovation potential.

Today's Top News

- Japan PM's blatant remarks delay China-Japan-ROK meeting

- CPC holds symposium to commemorate 110th birth anniversary of Hu Yaobang

- Economy seen on steady track

- Trade-in program likely to continue next year

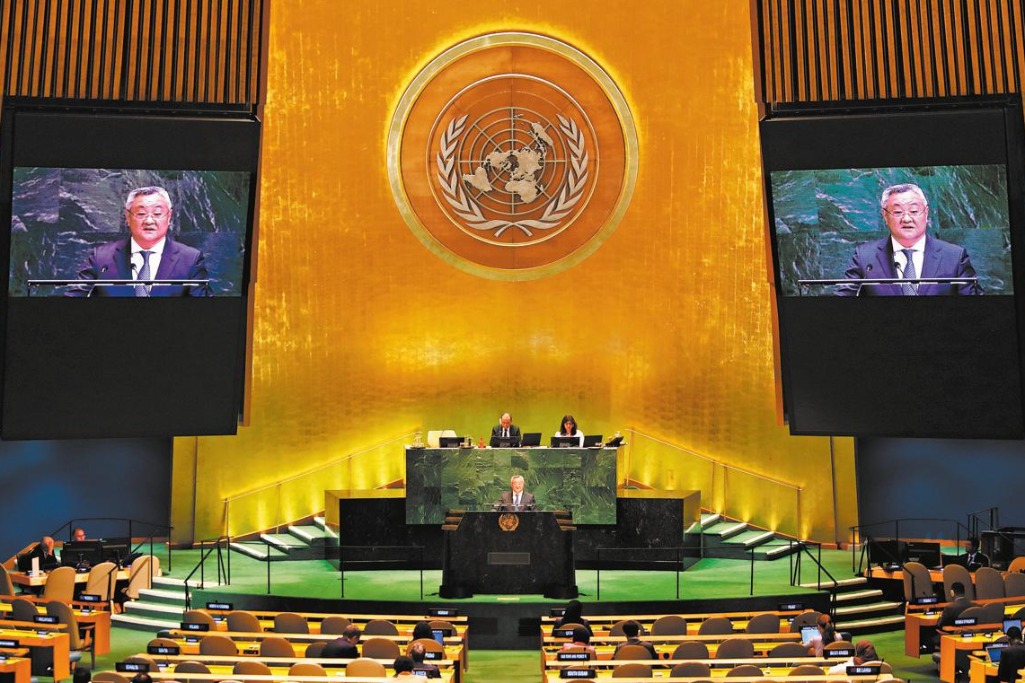

- Li: SCO can play bigger role in governance

- Huangyan Island protection lifeline for coral ecosystem