Financing facilitates agricultural modernization

The release of the latest No 1 Central Document today marks a significant milestone in China's rural reform and comprehensive rural revitalization efforts. With a focus on key agricultural and rural development priorities, this year's document underscores the importance of ensuring food security, consolidating poverty alleviation achievements, and advancing reforms to boost agricultural productivity. By emphasizing the role of technology in driving agricultural advancements and advocating for tailored innovations, the document sets the stage for continued progress towards building a strong agricultural nation. To achieve comprehensive revitalization in rural areas, bold reforms in agricultural financing are imperative.

The comprehensive vitalization of rural areas in China requires bold reforms in agricultural financing. Since prioritizing agriculture and rural development is essential, the financial sector must play a pivotal role in driving progress. Financial institutions have been hesitant to invest in rural areas, leaving farmers struggling to repay loans as well as access financing. But recent reforms and innovations are gradually transforming the situation, unlocking new opportunities for rural growth.

Agriculture is underfunded, with financial institutions reluctant to give loans to farmers due to high costs and risks. This has left farmers with limited resources and hampered rural development. Recognizing these problems, the government has implemented systemic reforms to make the sector more efficient. By improving assessment mechanisms, policymakers have made it clear that supporting rural development is a core responsibility of financial institutions.

The results have been promising. Agricultural loans now account for a steadily increasing share of total lending, growing by more than 1 percentage point a year. Innovative approaches are fostering synergy between finance, industry and public funding, allowing the financial sector to support modern agriculture and strengthen food security. These efforts have significantly enhanced agricultural output while boosting farmers' incomes.

While financial innovation is strengthening food security, financial institutions are prioritizing high-standard farmland projects and modern agriculture infrastructure by providing long-term credit. This approach has narrowed the gap created because of limited fiscal funding, resulting in the creation of 1 billion mu (66.66 million hectares) of high-standard farmland across China. Also, advances in crop breeding, including superior corn varieties, have greatly increased yields, bringing them closer to global standards.

Financial support is also helping modernize agriculture through investments in seed technology, smart agriculture and cutting-edge research, while localized solutions are enabling the development of new agricultural productivity models, accelerating the sector's transition to a high-tech future.

Another critical area is the integration of rural industries. Financial institutions are supporting the development of agricultural processing, rural e-commerce, and agri-tourism, which are adding value to agricultural products and increasing income channels for farmers. By unlocking the cultural and ecological potential of rural areas, these initiatives are helping farmers achieve more diversified and sustainable incomes. Today, the added value of agriculture and related industries accounts for more than 15 percent of China's GDP.

While fiscal support remains vital for modernizing agriculture, it is not without limitations. Non-repayable subsidies can lead to inefficiency, rent-seeking and corruption, burdening public finances without ensuring sustainable growth. To address these shortcomings, some regions are exploring innovative partnerships between public and private funding. For example, fiscal subsidies and interest discounts are being used to incentivize financial institutions to channel resources into critical agricultural projects.

Notably, a groundbreaking initiative has extended cost and income insurance for rice, wheat and corn. This program enables farmers to pay insurance premiums with government subsidies, ensuring financial stability and minimizing systemic risks for insurance providers. Such measures represent an effective model of collaboration between public and financial sectors, directly benefiting farmers while maintaining the sustainability of financial operations.

Significant strides have also been made in reducing financing costs for rural areas. With falling interest rates and ample capital supply, agricultural loan rates have dropped from more than 10 percent to below 5 percent, making borrowing more affordable.

However, challenges remain. To address them, financial institutions need to devise differentiated financing models, such as issuing loans by using agricultural facilities or livestock as collateral and expanding credit loan availability.

In addition, improving the agricultural insurance systems is crucial. Precision-focused insurance products and streamlined claims processes will provide farmers with greater financial security, helping them weather unforeseen challenges and ensuring stable agricultural production.

Financial innovation is a cornerstone of rural vitalization. To sustain development, financial institutions should continue to align their services with the different, unique needs of rural areas. Tailored loans, robust insurance systems, and collaborative public-private funding models will remain essential to promote modernization of agriculture and improve the livelihoods of farmers.

China's journey toward rural vitalization shows that finance can be a powerful tool for transformation. By leveraging innovative financial solutions, the country is not only addressing historical challenges in agriculture but also paving the way for a prosperous, inclusive future where rural communities thrive alongside their urban counterparts.

The views don't necessarily represent those of China Daily.

The author is a researcher at the Rural Development Institute, Chinese Academy of Social Sciences.

Today's Top News

- Mainland increases entry points for Taiwan compatriots

- China notifies Japan of import ban on aquatic products

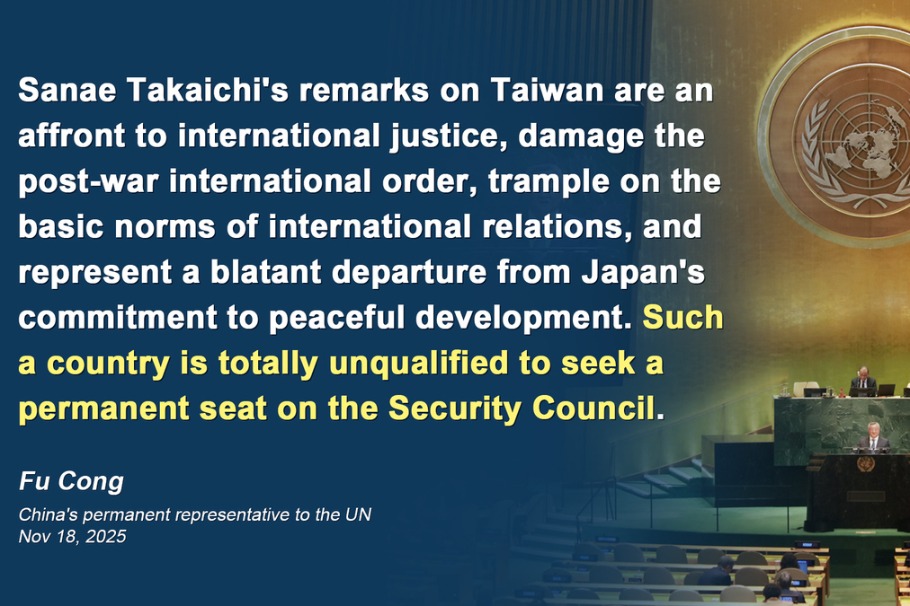

- Envoy: Japan not qualified to bid for UN seat

- Deforestation is climate action's blind spot

- Japan unqualified for UN Security Council: Chinese envoy

- China, Germany reach outcomes after discussions