Rio Tinto banks on nation's energy shift

China's ambitious shift toward green energy is set to fuel significant demand for commodities like copper, aluminum and lithium, creating substantial opportunities for multinational mining giants such as Rio Tinto, its top executive said on Monday.

Speaking in Beijing, Jakob Stausholm, CEO of Rio Tinto, underscored China's indispensable role as the world's major manufacturing powerhouse and a cornerstone market for the Anglo-Australian miner.

"China, the manufacturing hub of the world, is fundamental for us and accounts for a commanding 57 percent of our total revenue, solidifying its position as our largest customer," said Stausholm.

Beyond just a market for the company, China has been rapidly evolving into a crucial sourcing partner, with procurement from the country exceeding $4.2 billion in the past year alone, reflecting a deepening economic interdependence, Stausholm said.

He emphasized the country's resolute drive toward a sustainable future through massive investments in solar and wind energy infrastructure, the expansion of sophisticated grid networks, cutting-edge battery production facilities, and the burgeoning electric vehicle industry.

"China is amazing in terms of energy transition, starting from rollouts of solar energy and onshore wind, expanding the grid network, and EVs. It all leads to more demand for our commodities, providing massive opportunities for multinational corporations like Rio Tinto," he said.

Industry experts believe China's rapidly expanding green energy sector represents an unprecedented market opportunity for international energy companies.

China's dual drivers of ambitious carbon neutrality targets and massive renewable energy investments make it a highly compelling destination for global firms, said Wang Lining, director of the oil market department under the economics and technology research institute of China National Petroleum Corp.

Participation in this dynamic market allows companies to tap into the world's largest energy consumer base, diversify their global operations away from traditional fossil fuels and secure a strategic foothold in the vanguard of the global energy transformation, he said.

Stausholm articulated strong confidence in China's economic trajectory, citing the government's recent reaffirmation of its ambitious 5 percent growth target for the current year amidst a complex global economic landscape.

"China is growing strongly and has just reconfirmed a 5 percent growth target for this year. I see increased confidence from the government in its growth target," he said.

"I do think that there is a tremendous number of opportunities for innovative growth in China and beyond. It seems that the growth in innovation seems to accelerate."

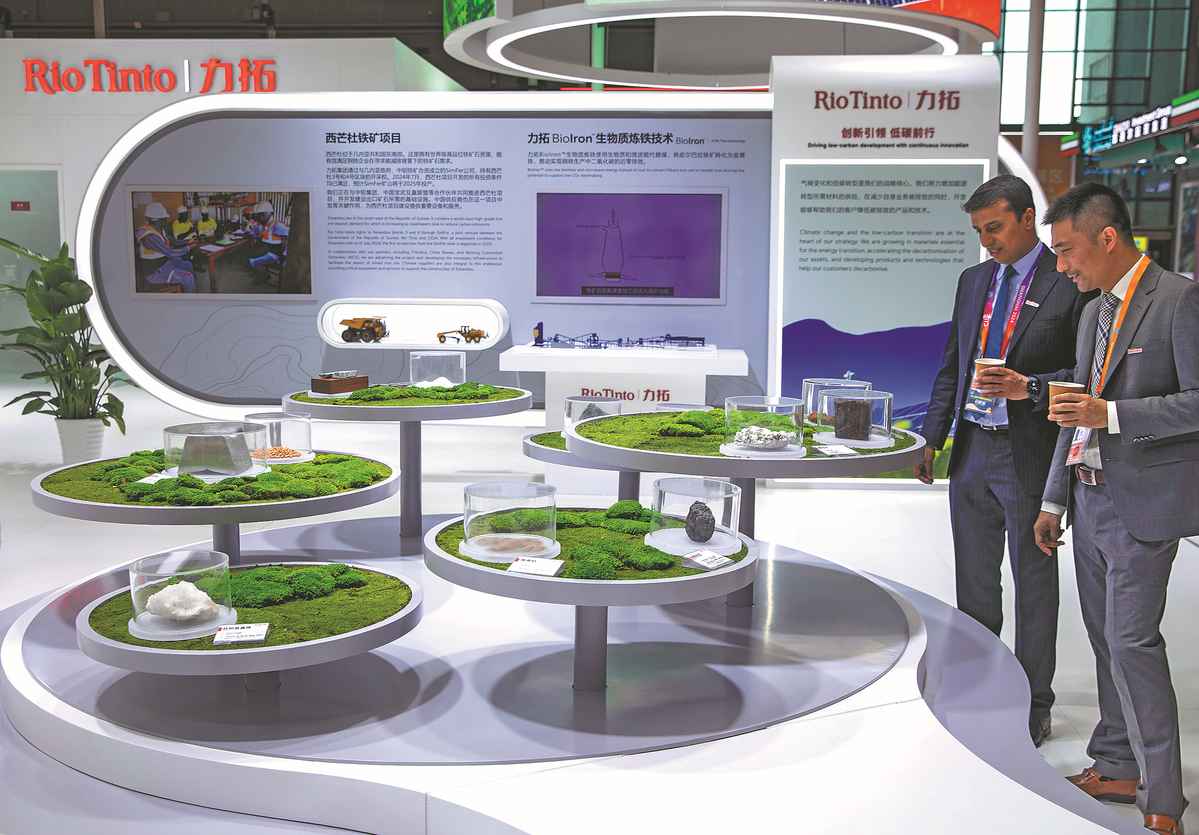

To effectively meet this anticipated surge in commodity demand, Rio Tinto is strategically ramping up its global production capabilities.

A cornerstone of this strategy, according to Stausholm, is the imminent commencement of production at two major projects, the world-class Simandou iron ore project in Guinea and the strategically vital Western Range project in Australia, both slated to begin operations this year.

These projects are crucial for ensuring a consistent and reliable supply of high-quality iron ore to China's steel industry and the superior grade of iron ore from Simandou will be particularly beneficial for Chinese steelmakers as they intensify their efforts to reduce carbon emissions within their energy-intensive operations, he said.

Beyond the critical role of iron ore, Rio Tinto is strategically positioned to become a key supplier of a broader spectrum of essential materials vital for China's ambitious energy transition, including lithium, a critical component in batteries powering EVs and energy storage solutions; copper, indispensable for expanding and upgrading electricity grids and renewable energy infrastructure; and aluminum, crucial for light-weighting vehicles and constructing renewable energy systems.

"We are excited to support this innovative growth in China and supplying lithium, copper and aluminum to Chinese industry," Stausholm said.

While acknowledging the prevailing global economic uncertainties and simmering trade tensions that cast a shadow over international commerce, Stausholm emphatically reiterated Rio Tinto's unwavering long-term investment strategy and steadfast commitment to the Chinese market.

China's ambitious energy transition is not merely a regional phenomenon but a global megatrend, said Stausholm.

This will act as a significant and sustained growth driver for Rio Tinto and the broader commodities sector in the foreseeable years to come, positioning the company to benefit from the evolving global economic order, he said.

- Top foreign CEOs head to China for meeting

- UK business leaders praise China supply chain efforts amid US tariffs

- China will deliver broad-based growth

- US' dirty geopolitics again on display exposing its idea of 'fair competition': China Daily editorial

- Icebreaking spirit highlighted at Chinese New Year gathering in London