Rising demand promoting innovation

Editor's note: Increasing challenges and uncertainties across the world have prompted China to improve the technology, transportation and other important sectors, as well as more actively promote innovation. China will continue to comprehensively deepen reform, intensify higher-level opening-up to achieve high-quality development. Three experts share their views on the issue with China Daily.

The fact that a middle-class shopper in a metropolis lingers over a 69,000-yuan ($9,612) filigree pendant from Laopu Gold, Gen Z crowds queue through the night for a 340-yuan Labubu blind box from Pop Mart, and young people in a small town flock to social media platforms for a 2-yuan ice cream from Mixue is evidence of the rapid development of China's consumer market.

Three groups are now driving China's consumption: the urban middle-income group, Gen Z, and youths in lower-tier markets, often referred to as the "small-town youth". The meteoric rise of brands like Pop Mart, Laopu Gold and Mixue is not a coincidence. Each is meeting the demand of distinct consumer groups, leveraging digital innovation in branding, product design, distribution and promotion to orchestrate a cycle of demand-led market growth.

Gen Z members, people who are digitally savvy and born into relative comfort, are ready to spend, and spend big, on products they love. They crave novelty, fancy products and entertainment. A Tencent report earlier this year said that 62 percent of the post-2000 consumers are willing to spend a lot of time and money on their hobbies, and that the post-1995 consumers are the main driving force behind the rising sales of designer toys.

Pop Mart has tapped into their passions with remarkable precision. As a trendsetting toy company, it has built a compelling portfolio of patented-character toys that fulfill Gen Z's quest for joy and belonging. In 2024, Pop Mart's sales touched 13 billion yuan, up 106 percent year-on-year. Importantly, its standout characters — The Monsters, Molly, Skullpanda, Crybaby, and especially Labubu — have extended their reach beyond the domestic market to reach global markets.

The allure of Pop Mart's "blind box" — a purchase that comes with an element of surprise and collectible value — feeds Gen Z's hunger to explore the "unknown", with the brand's 46 million registered members forming a thriving fan ecosystem, and reinforcing loyalty through social connection.

Pop Mart's omni-channel strategy is in tandem with Gen Z's instant, frictionless consumption. With more than 400 offline stores, 2,300 vending machines, and livestreaming-promoted e-commerce growth, the brand has become an obsession with Gen Z. Its combination of patent-induced creativity, real-time accessibility, and social engagement has invigorated the toy industry.

Lower-tier cities and towns, too, are witnessing a quiet revolution in consumption. The "small-town youth" are shifting from "volume consumption" to "quality consumption", moving away from knockoffs and embracing authentic brands, while balancing quality with affordability.

Moreover, Mixue's explosive growth shows another way to win the market. That its revenue in 2024 reached 24.8 billion yuan, up over 22 percent year-on-year, is testament to its successful strategy of offering "premium quality at ultra-low prices".

The secret of Mixue's success lies in its vertically integrated supply chain. It produces more than 60 percent of its core ingredients in-house across five manufacturing hubs, and its cost of raw materials is significantly lower than the industry average — a single lemon-based drink costs only 1.2 yuan to make, a third of premium competitors'. This makes its 4-yuan lemonade a profitable beverage.

Yet Mixue is not only about beverages. It has become a cultural icon in lower-tier cities. With over 46,000 stores — 57.4 percent of them in tier-three and tier-four cities — the brand is omnipresent in China. In some towns, three Mixue outlets line a single street. The brand's snowman mascot, "Snow King", and viral theme song have made it into a recognizable cultural symbol. And its digital reach, through WeChat and Alipay mini programs, ensures it receives direct consumer feedback.

Mixue has proved that affordability and branding are not mutually exclusive, with its "full-chain control and deep market penetration" changing consumption patterns in lower-tier cities.

China's urban middle-income group, the largest and most dynamic segment, is well-educated and discerning. With annual household disposable income ranging from 300,000 to 1 million yuan, the middle-income group now prioritizes quality.

Furthermore, Laopu Gold has emerged as a breakout player in the market, by combining ancient craftsmanship with modern sensibility. In 2024, its sales reached 9.8 billion yuan, up 166 percent year-on-year. Rooted in the "royal Chinese goldsmith" tradition, Laopu Gold fuses intangible heritage craftsmanship like filigree inlay and enameling with contemporary aesthetics. Its collaboration with the Palace Museum (Forbidden City) has yielded culturally rich designs, such as pendants with auspicious symbols and celestial dragons.

Laopu Gold has opened 36 flagship boutiques in 15 major cities, often in luxury malls, which occupy the pride of place alongside Cartier and Bulgari.

Brands like Pop Mart, Laopu Gold and Mixue demonstrate that meeting consumers' demand for special innovative products is the best way to boost business. These brands are not only benefitting from the market; they are helping shape it as well. While Pop Mart has turned designer toys from niche to mainstream products, Mixue has spread brand consciousness in smaller cities, and Laopu Gold has redefined the role of culture in premium retail.

This is China's new consumption era, when people are boosting consumption but also promoting smarter, deeper, and more meaningful consumption.

The views don't necessarily reflect those of China Daily.

Today's Top News

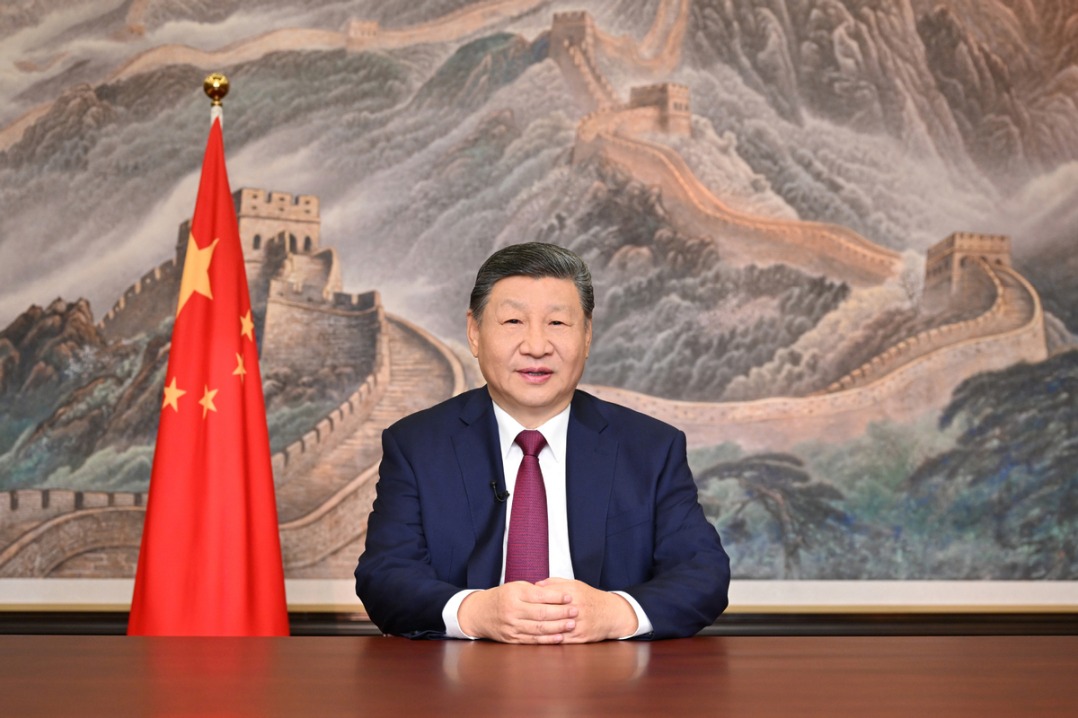

- Confidence, resolve mark China's New Year outlook: China Daily editorial

- Key quotes from President Xi's 2026 New Year Address

- Full text: Chinese President Xi Jinping's 2026 New Year message

- Poll findings indicate Taiwan people's 'strong dissatisfaction' with DPP authorities

- Xi emphasizes strong start for 15th Five-Year Plan period

- PLA drills a stern warning to 'Taiwan independence' separatist forces, external interference: spokesperson